Auroch’s Leinster drilling could see it provide BHP with feedstock

Published 25-MAR-2021 09:24 A.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Shares in Auroch Minerals Limited (ASX: AOU) have soared roughly 300% in the last six months, but there could be more upside to come company announcing today that it has commenced diamond drilling at the Leinster Nickel Project in Western Australia, and assays from the maiden drilling program at the Nepean Nickel Project are imminent.

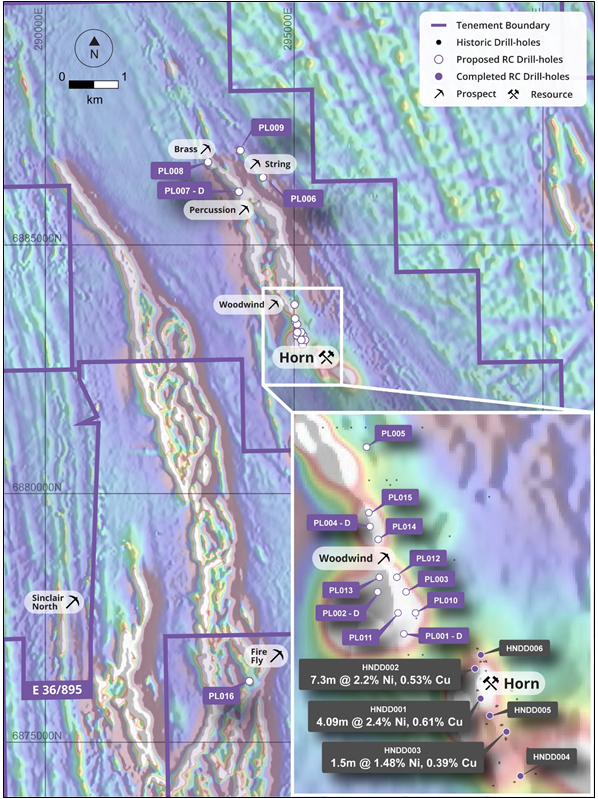

The drill programmes follow promising diamond drilling at the Horn in late 2020, which successfully intersected thick high-grade nickel-copper sulphide mineralisation at shallow depths.

High-grade nickel is a feature of the Leinster region and the second hole (HNDD002) confirmed thick shallow high-grade nickel-copper-PGE sulphide mineralisation, with the logged massive sulphides interval reporting 7.3 metres at 2.2% nickel, 0.53% copper from 143 metres.

The first hole accepted 4.1 metres of high-grade nickel-copper sulphide mineralisation grading 2.4% nickel and 0.61% copper from 119 metres.

Both the quality of the grades and the near-surface nature of the mineralisation suggest that this could be a highly economical project.

The drill programme will begin with four diamond drill-holes, designed to test high-priority magnetic targets directly along strike from the shallow high-grade nickel sulphide mineralisation at the Horn Prospect.

Following diamond drilling the company will conduct reverse-circulation (RC) drilling to further test the strike potential along from the Horn, as well as some of the more-advanced regional targets across the Leinster tenure.

The combined diamond and RC drill programmes will consist of approximately 1200 metres of diamond drilling and 1800 metres of RC drilling.

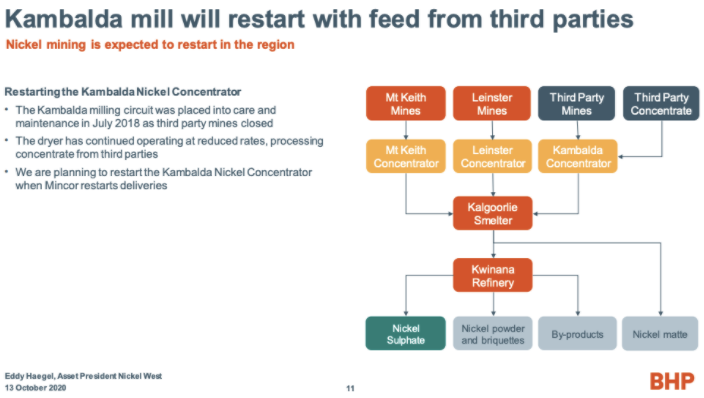

Drilling success at Leinster would be highly material given that BHP has expressed a desire to ramp up its nickel production to meet growing global demand fuelled by the shift to electric vehicles.

Mining giant BHP could boost production on commercially viable terms and has commenced trying to source contracts with Nickel Sulphide deposits to feed into its Nickel West refineries.

It has also been in talks with Tesla to increase supply.

‘The Big Australian’ has fleshed out how it could restart the Kambalda Nickel Concentrator, and as you can see in the group’s October presentation Leinster has the potential to be a key source of feedstock.

Targeting unexplored territory coincident with aeromagnetic anomaly

A detailed review of the project’s geochemistry and geophysics identified that the high-grade nickel-sulphide mineralisation at the Horn was strongly coincident with an aeromagnetic anomaly, and that further similar aeromagnetic high anomalies exist directly along strike from Horn which have never previously been drill-tested.

The highest priority of these aeromagnetic target areas that can be seen below is the magnetic anomaly directly north-west of the Horn.

This target has been named the Woodwind Prospect, and management has planned three diamond holes and a further eight RC holes to test this prospect’s potential to host significant nickel sulphide mineralisation.

Further to the north-west are the String and Brass Prospects which are also defined by untested magnetic highs.

Commenting on the upcoming drilling program and underlining the significance of recent drilling at Nepean, managing director Aidan Platel said, “We are excited to be back on the ground at Leinster and drilling such high-potential exploration targets.

"Our drilling last year confirmed thick high-grade nickel and copper sulphide mineralisation at very shallow depths at the Horn Prospect, but importantly it also showed how well this mineralisation is 'mapped' by the aeromagnetic anomaly there.

"We have very similar aeromagnetic anomalies along strike to the north-west of the Horn which basically have never been drilled, so we are eager to test these anomalies and see if the relationship between the aeromagnetic highs and the nickel sulphide mineralisation continues along strike.

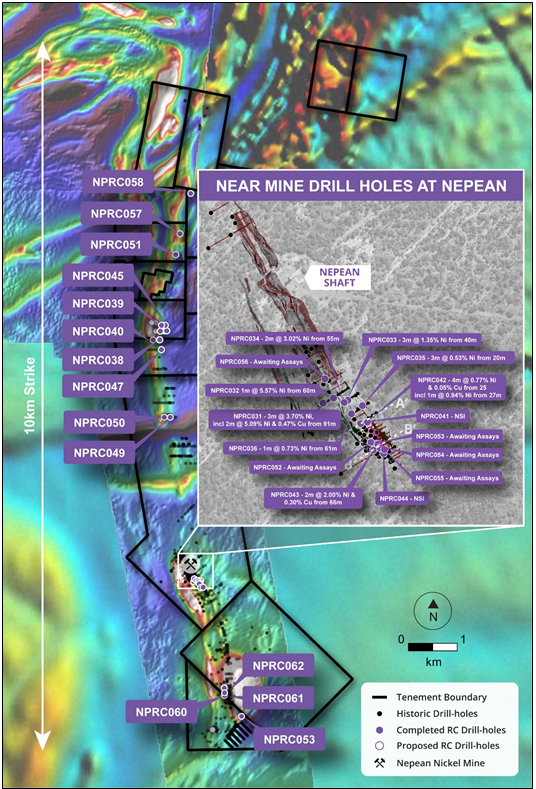

"Our maiden RC programme at Nepean has been completed, which tested both near-mine shallow drill targets as well as more regional greenfields targets along the full 10 kilometres of prospective strike.

"We are awaiting assay and DHEM results which we expect to receive over the coming weeks.”

In total, 32 holes for 3,397 metres were drilled, testing both shallow targets near the historic high-grade Nepean Nickel Mine and regional aeromagnetic targets along strike.

All samples have been delivered to the laboratory and DHEM surveys are underway.

The results from this programme will be modelled and used to define targets for the next phase of drilling at Nepean.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.