Navarre Minerals extends mineralised footprint at Glenlyle

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Navarre Minerals Limited (ASX:NML) has announced encouraging new reconnaissance air-core (AC) drilling results from its Glenlyle Project (EL 5497) in western Victoria, Australia.

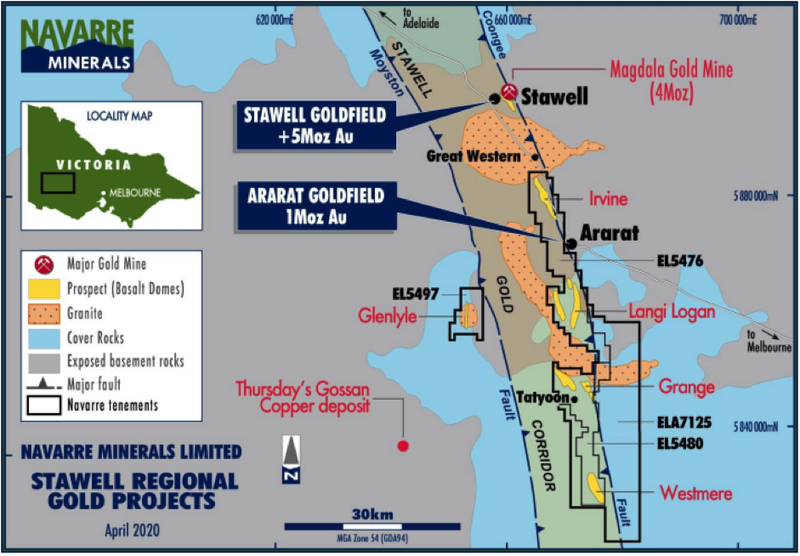

The Glenlyle Project is 25 kilometres south-west of Ararat, under between 10 metres and 40 metres of Newer Volcanics cover, and approximately 25 kilometres north-east, on-strike, of Stavely Minerals Limited’s (ASX:SVY) recent Cayley Lode copper discovery at its Thursdays Gossan project.

The close proximity of the two projects as indicated below brings the aspect of nearology into play, potentially providing support for lookalike exploration results to signal the prospect of another Thursdays Gossan.

For the moment though, it is important to note that the new results have significantly expanded the mineralised footprint and the potential of the Glenlyle Project.

These follow two earlier phases of reconnaissance AC drilling which also demonstrated strong silver-gold mineralisation.

Gold grades of up to 3.6 g/t and silver up to 12.4 g/t were recorded in the latest round of drilling, with several holes finishing in mineralisation at AC refusal.

The new results complement those delineated in recent drilling including 23 metres at 30.3 g/t silver and 47 metres at 11.8 g/t silver.

McDermott notes evidence of large poly-metallic system

Navarre Minerals has completed its third phase of AC drilling, totalling 2,150 metres across 26 holes at the Glenlyle Project.

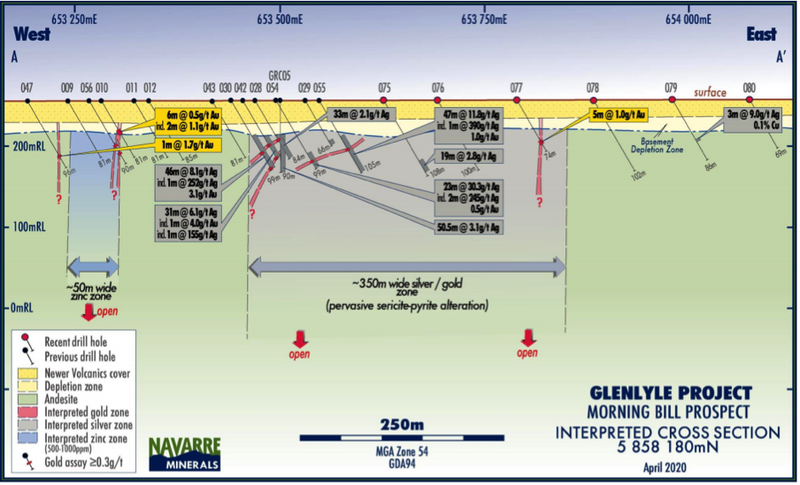

The drilling program was designed to expand and scope the shallow lateral expanses of the gold and silver mineralisation discovered in 2018, now referred to as the Morning Bill prospect.

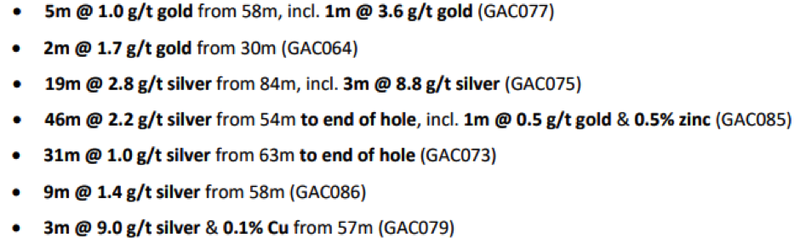

The following drill intercepts were returned in this round of drilling.

Commenting on these recent developments and casting an eye to the future, Navarre Minerals' managing director Geoff McDermott said, “The new air-core drilling results continue to provide evidence for a large poly-metallic mineral system at Glenlyle in the emerging Stavely Arc volcanics of western Victoria.

“The mineralised footprint at Glenlyle has now been expanded to approximately 350 metres by 300 metres and remains open to the south and at depth (as indicated below).

‘’Given the tenor of results being generated at this early stage of exploration, the proximity to a magnetic low and IP anomaly, a favourable geological setting and proximity to an existing large copper discovery, we believe there is potential to discover a large poly-metallic mineral system at depth at Glenlyle.

“We look forward to completing the targeting of potential mineralisation under cover and to plan our next phases of drilling.”

Planning for follow-up diamond drilling at the Morning Bill prospect is underway, potentially to be undertaken during the coming quarter, subject to cropping activity, Autumn weather conditions and any health and safety considerations and government restrictions arising from the COVID-19 global pandemic.

Follow-up regional reconnaissance AC drilling will be planned on receipt and integration of final VTEM data with previous IP, magnetics and gravity geophysical surveys.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.