Artemis copper gold project yields commercially viable cobalt mineralisation

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

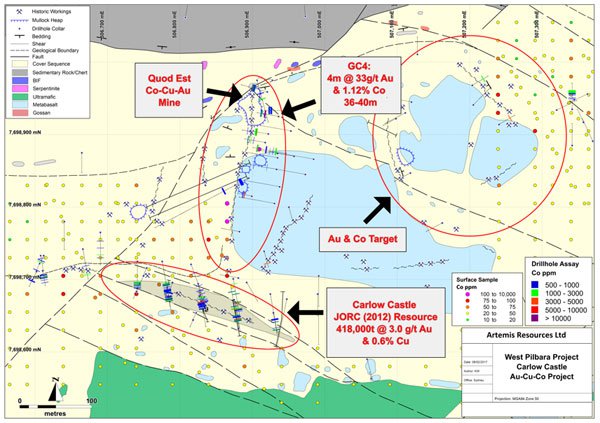

In the course of delineating high grade gold at its Carlow Castle copper gold project located near Karratha, Artemis Resources has identified cobalt mineralisation.

Importantly, the grades of more than 1% are robust in terms of sale to end users, being predominantly manufacturers of electric vehicles and batteries for use in electronic devices such as tablets and smart phones.

This is an extremely important development as some analysts are predicting that cobalt will overtake lithium as the high profile new age commodity of 2017.

Commenting on this development, Artemis’s Chairman David Lenigas said, “The Carlow Castle area holds significant potential for primary cobalt mineralisation associated with high grades of copper and gold”.

There is certainly plenty of hype around cobalt at the moment with Korab Resources’ share price soaring on Friday simply on the back of a first stage review of a project that could be prospective for cobalt.

Although, it should be noted that historical data in terms of earnings performance and/or share trading patterns should not be used as the basis for an investment as they may not be replicated. Those considering this stock should seek independent financial advice.

Despite the project being located in the relatively remote Rum Jungle area of the Northern Territory and the fact that it does not have any potential guide as to whether there is a measured resource or whether there are commercially viable grades, the company’s share price spiked from the previous day’s closing price of 1.8 cents to close at 4.1 cents, representing a gain of approximately 125%.

Again, past performance is no indication of future performance and investors should take a cautious approach to their investment decision if considering this stock for their portfolio.

By comparison, ARV has the benefit of historic underground mining data which provides some indication of grades and the extent of mineralisation, as well as being situated near Karratha. This data will be used to assist in re-evaluating the resource.

Potential to expand gold resource with cobalt upside

The company has released some exceptional drilling results today with one drill hole having intersected 4 metres grading 33.6 grams per tonne gold. Geological records demonstrate there is generally a strong correlation between gold, copper and cobalt mineralisation. Furthermore, past drilling in this area identified robust grade gold, copper and cobalt mineralisation.

Importantly, previous mining and exploration efforts in the area were primarily focused on gold and copper exploration and mining, with only cursory historic efforts made to understand the area’s significant cobalt potential.

Artemis is progressing a drilling campaign with a view to upgrading the existing JORC 2012 Inferred Mineral Resource of 418,000 tonnes grading 3% grams per tonne gold and 0.6% copper for total contained metal of 40,000 ounces of gold and 2500 tonnes of copper at the Carlow Castle project.

However, with the cobalt price pushing up towards US$40,000 per tonne, Lenigas said, “We believe that cobalt, copper and gold now need to be considered integrated at Carlow Castle and Artemis is undertaking a complete re-evaluation of this very exciting 100% owned project”.

Macquarie says 2017 may be cobalt’s year

It was only last week that Macquarie came out with an extensive paper on the prospects for cobalt in 2017, saying, “If last year was lithium’s time, for 2017 its battery peer cobalt may be the one receiving more attention”.

The broker went on to highlight the fact that prices have accelerated to levels last seen in 2011, and with demand from the portable electronics sector recovering and supply growth relatively stagnant this can be fundamentally justified.

Macquarie pointed out that China has next to no domestic mine supply and it is highly reliant on the Democratic Republic of the Congo (DRC) for its cobalt units. The prioritisation of higher quality battery development by the Chinese government could even open up the coveted new energy vehicle market to greater cobalt penetration according to Macquarie.

This is certainly reflected in price movements which have increased about 70% from circa US$10 per pound to approximately US$17 per pound, a level that Macquarie only expected the metal to reach in the medium term. The closing cobalt price as at February 7, 2017 was US$17.35 per pound or US$38,250 per tonne

The broker also noted that this move has been slightly exceeded by an increase in cobalt chemical prices, the raw material crucial for the global rechargeable battery industry. On this note, Cobalt Tetroxide prices in China have roughly doubled in RMB terms since mid-2016.

Smartphones to drive growth as demand outstrips supply

Looking at the demand picture Macquarie highlighted that lithium-cobalt batteries are the staple of consumer electronics, and have suffered as core areas have declined with both laptop and tablet shipments dropping over 10% year-on-year in 2016.

However, the broker noted that demand picked up strongly in the second half of 2016 as a result of increased sales for smartphones. Stressing the much improved demand picture, Macquarie said, “This is highly beneficial for cobalt, while LCO batteries also continue to gain penetration in other areas, notably power tools”.

Macquarie’s projections regarding the supply demand balance out to 2021 indicates supply falling short of demand initially in 2018 with increasingly large deficits of between 3200 tonnes and 7200 tonnes between 2019 and 2021 inclusive.

It should be noted that broker projections and price targets are only estimates and may not be met. Furthermore, commodity prices do fluctuate and caution should be applied to any investment decision here and not be based on spot prices alone.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.