Armadale closes Mahenge graphite deal

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Finfeed presents this information for the use of readers in their decision to engage with this product. Please be aware that this is a very high-risk product. Getting mining projects up and running in countries such as Tanzania is no simple feat, and there may be challenges ahead. Seek professional financial advice.

Armadale Capital (AIM:ACP) has formally completed its acquisition of the Mahenge graphite project, and is targeting a maiden resource before the year is out.

Having previously conducted due diligence work at the Tanzanian graphite project, it has decided to move ahead with the acquisition of the project from Graphite Advancement Tanzania – having signed a heads of agreement to do so in June.

ACP said that it chose to move ahead with the acquisition on the back of positive rock chip results, reported in late June.

ACP told its investors at that stage that some rock chips had come back at up to 33.8%. The positive results led the company to declare that it would more than likely move ahead with the acquisition.

“Graphite has been identified and prioritised by the Armadale team as a high demand commodity with significant strategic value as an essential component of the modern lithium-ion battery,” chairman Peter Marks said earlier this week.

“The Liandu project provides Armadale with ground-floor access to this rapidly growing market whilst limiting exploration risk, due to the project’s location in a premier graphite bearing region, which includes being contiguous to well established high grade graphite projects.”

Marks also said that the company would aim to start drilling in the coming weeks with an eye towards a maiden resource by the end of the year.

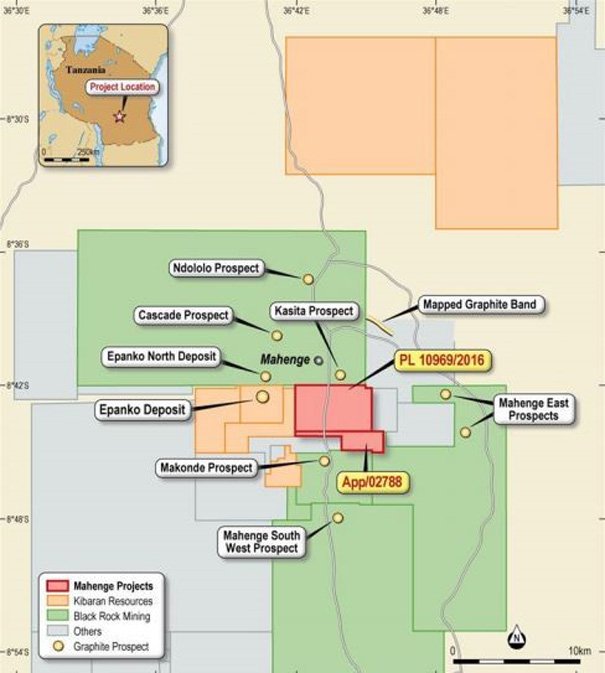

The project itself is next door to Black Rock Mining’s (ASX:BKT) Mahenge project, which has a resource of 131 million tonnes @ 7.9% TGC.

It is also next to Kibaran Resources’ (ASX:KLN) Epanko Project, with a bankable feasibility study done in 2015 finding the project had proven and probable ore reserves of 10.9Mt @ 8.6% TGC.

On Armadale Capital and Liandu

Mahenge Liandu Project, which consists of two tenements covering 29.9 km2, adjacent to the town of Mahenge.

A map showing ACP’s project

Reconnaissance mapping done late last year defined a mineralized trend at the project of more than 1.5 km in strike length and up to 500m in width.

From this initial mapping, ACP has been able to obtain some initial drill hole data as an indicator of future potential.

Three RC drill holes drilled late last year by the previous vendors showed intercepts of 24m @ 12.9% TGC, 5m @ 21.5% TGC and 10m @ 6.54% TGC.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.