Armadale Capital Plc making quick ground at Mahenge graphite project

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

AIM listed Armadale Capital Plc has informed the market that geological mapping conducted at the company’s recently acquired Mahenge Liandu graphite project located in a highly prospective region in Tanzania has confirmed extensive areas of graphite mineralisation.

This is a significant development for the company as the results coincide with conductive targets identified by recent electromagnetic surveying, indicating the potential for Armadale to join the list of successful graphite plays in that region.

ASX listed Kibaran Resources which is currently in a trading halt pending the release of an announcement concerning a material capital raising is one of Armadale’s closest neighbours. The decision to raise funds comes just after the company negotiated a binding agreement with Japanese commodities trading giant Sojitz Corporation for sales of a minimum of 14,000 tonnes per year of natural flake graphite.

This brings the company’s current binding agreements to 30,000 tonnes, demonstrating the commercial viability of the resource traditionally found in the Mahenge region.

As Kibaran established proven and probable ore reserves at its Epanko project and subsequently negotiated offtake agreements, the company’s share price increased by nearly 150% just in the last four months.

However, it should be noted that share prices are subject to fluctuation and investors should take a cautious approach to any investment in TKF and not base that decision solely on historical price movements.

This not only demonstrates the quality of the resource in that region, but it is an indication of how quickly a company such as Armadale could rerate following the commencement of drilling in early September.

Of course the underlying supply/demand fundamentals for graphite have been well documented with demand expected to surge due to its applications in the manufacture of lithium ion batteries for electric vehicles, smart phones and developments in the energy storage industry.

Looking at specific exploration results at Mahenge Liandu, management highlighted that numerous areas of extensive surface outcrop had been mapped and that the mineralisation is well correlated with anomalies identified in the electromagnetic survey. Importantly within the zones, incremental exploration targets were shown to have extensive areas of outcrop.

Making Armadale and even more compelling story is the fact that the primary prospect has an extensive strike length of 2.6 kilometres which remains open and a further mineralised zone identified to the west of this project has a 3.7 kilometre strike length which also remains open.

In terms of grade, rock chip samples taken in June 2016 returned high grade graphite mineralisation of up to 33.8% total graphite content (TGC). Previous drilling has confirmed high-grade mineralisation from the surface with results including 60 metres grading 10.7% TGC.

The bankable feasibility study undertaken by Kibaran at its Epanko project established proven and probable ore reserves of 10.9 million tonnes grading 8.6% TGC which was assessed as supporting a 15 year mine life, generating annual EBITDA of US$33.6 million.

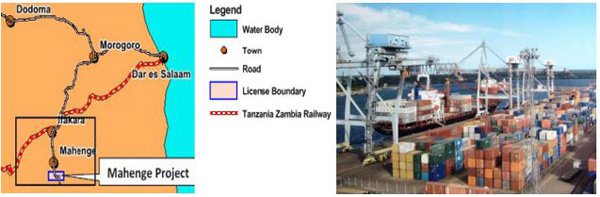

One of the impressive features of the Mahenge Liandu project is its proximity to essential infrastructure including port facilities. Regardless of the resource being mined, a project without supporting infrastructure can provide significant challenges as well as reducing profit margins as production and transport to end markets becomes extremely costly.

Should Armadale bring the Mahenge Liandu project into production it will benefit from both proximity of rail transport and access to a major port in Dar es Salam which will facilitate export of its product to markets in Europe and Asia.

The most significant near-term catalyst is drilling results which should be released in the fourth quarter. Management is targeting the establishment of a maiden resource by late 2016.

It should be noted that projected milestones may or may not be met. Furthermore, the share price movements of Armadale Capital or peers such as Kibaran Resources should not be used as a guide to future performance, and as such should not be used as the basis for an investment decision.

The other factor to bear in mind is that Armadale is a relatively small company with an asset that is at the very early stages of exploration. As part of the broader African continent, Tanzania is deemed to carry sovereign risk and this needs to be taken into account when making an investment decision.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.