Archer to develop new battery tech with Uni of NSW

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

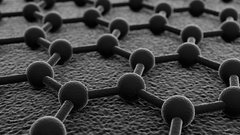

Archer Exploration Limited (ASX:AXE) has today announced the signing of a Collaboration Agreement and a complementary Research Service Agreement with The University of New South Wales (UNSW) to develop and implement AXE’s graphite and graphene materials for use in lithium-ion battery energy storage systems. The aim of the research will be to achieve technological advances through AXE’s graphite and graphene materials and the research and development capability of UNSW.

UNSW ranks in the top 3% globally in terms of Engineering and Technology, according to the 2018QS World University Rankings. Importantly, it has world-class facilities for battery materials testing and development at the Mark Wainwright Analytical Centre.

The research potentially generates technologies and patents that have commercial applications in reliable energy. This research fits within AXE’s broader vision of developing and integrating advanced materials towards creating reliable energy systems for a greener future. The global lithium-ion battery market is forecast to increase to US$130 billion by 2028 with growth concentrated in the Asia Pacific region. The following expanding market segments all share a growing interest in high-power and long-life lithium batteries:

- Transportation and mobility (electric vehicles)

- Mobile devices and computing

- Intermittent renewable energy sources

The primary focus of the collaboration is on the rational design of high-performance electrodes for lithium-ion batteries using graphite and graphene sourced from AXE’s Campoona deposit; this is expected to result in the development of electrodes for lithium-ion batteries and the implementation of these electrodes in a number of advanced application full-cell and half-cell configurations.

The resulting materials developed would be tailored electronically, chemically and structurally for mobile and stationary device applications with specific performance requirements.

Commenting on the new agreements, AXE CEO Mohammad Choucair stated: “Archer now enjoys a unique relationship with UNSW and facilities within the University including those in the Mark Wainwright Analytical Centre. This Centre, unique in its diversity in Australia, comprises AUD$100 million of state-of-the-art characterisation equipment, managed by over 80 instrument scientists ready to engage and drive research projects within Archer.

“The Centre has a broad range of capabilities that fulfil our aims to participate in the integration of advanced materials in battery technologies that will provide future opportunities and new markets to underpin the development of Archer’s substantial graphite resources.”

It should be noted that AXE is an early stage play and anything can happen, so seek professional financial advice if considering this stock for your portfolio.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.