Angolan government approves long-term mining title for Minbos

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Shares in Minbos Resources Limited (ASX:MNB) increased more than three-fold at the start of year, and despite a retracement in the last month they are still up 300% since August last year.

Important news has come to hand today regarding support from the Angolan government, and this is also likely to see strong support for the stock.

MNB today announced that it has received approval for the exploitation of the Cabinda Phosphate Project, located in Angola.

Minbos won an international tender for the Cabinda Phosphate Project in 2020 based on producing Enhanced Phosphate Rock (EPR) as a substitute for fertilisers currently imported by the Angolan Government for distribution to wholesalers and farmers.

The company's goal is to build a nutrient supply and distribution business, that stimulates agricultural production and promotes food security in Angola and the broader Middle Africa region.

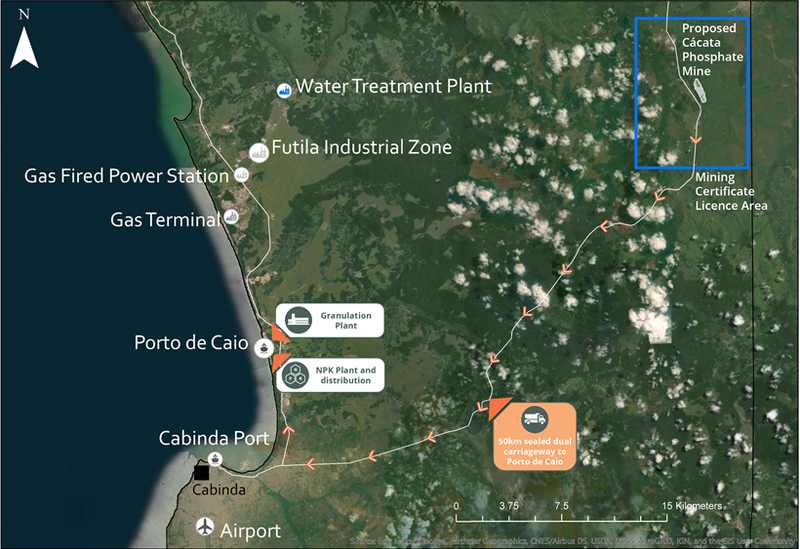

As an indication of the Angolan government’s understandably strong support for the project, the Ministry of Mineral Resources and Petroleum has approved the company's Mining Title, renewable up to 35 years, for the mining of phosphate at the Cácata Deposit as indicated below.

The exclusive mining rights have been granted over an 85 square kilometre area, including the designated project area, encompassing the Cácata high-grade phosphate deposit, proposed open-pit mine, waste and ore stockpiles, and all associated infrastructure required for the mining operations.

Commenting on the significance of this development, Chief Executive Lindsay Reed said, "To receive our Mining Licence less than two months after executing a Mining Investment Contract, usually a 3-5 year process, is a stunning confirmation by the Government of Angola of their commitment to support and accelerate our project.

"The company is now positioned to develop Angola’s first locally mined and manufactured fertiliser for sale into one of the most prospective growing regions globally."

Minbos ticking all ESG boxes

Making Minbos even more attractive for both government and investor support is its adherence to environmental, social and governance principles (ESG), a factor that is becoming increasingly important in the investment decision-making process.

The Cácata deposit is a uniquely low-impact mining project with a relatively small environmental footprint and long operational life.

From a social perspective, production from the project will assist in addressing vital food supply issues in Angola and other Middle African regions.

The project's planned small open-pit operation measures less than 2 kilometres in length with the mining amenities positioned around the pit and close to a local workforce.

The mine is adjacent to the sealed dual carriage highway which is 50 kilometres from the proposed granulation plant at Port de Caio.

Another potential share price catalyst is imminent as the company’s environmental consultants Grupos Simples in Angola, HCV from South Africa mobilise to Cabinda in early April to complete a wet season base line environmental survey in the Mining License area.

Meanwhile, the DFS is the next of the key studies to be released, and management expects this to be completed by November.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.