AngloGold Ashanti takes significant stake in LCL in exchange for JV interest

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

In a development that underlines the strategic significance of Los Cerros Limited’s (ASX:LCL) Quinchia Project in Colombia, global mining group AngloGold Ashanti has entered into a binding terms sheet, exchanging its Chuscal joint-venture interest for Los Cerros securities, effectively making it a 4.3% shareholder in the group.

Under the terms of the agreement, AngloGold Ashanti will have the right to increase its interest to 10%.

Los Cerros stands to benefit from agreed access to the group’s regional geophysics data, as well as unlimited use of its IP equipment for the next 18 months.

Managing director of Los Cerros Jason Stirbinskis pointed to AngloGold’s extensive experience in the region saying, “We welcome AGA to the share registry.

“They have proved to be supportive JV partners at Chuscal and we look forward to their ongoing support as a shareholder of Los Cerros.

‘’In addition to their vast knowledge of Colombian geology and gold discoveries, they have direct experience in the Quinchia region and some of our highest priority targets in the extensive Andes portfolio were also once AGA assets”.

Los Cerros to gain 100% ownership of Chuscal

The Agreement will take Los Cerros’ ownership of Chuscal to 100% and results in the company holding 100% of the entire Quinchia Project of which Chuscal is a part.

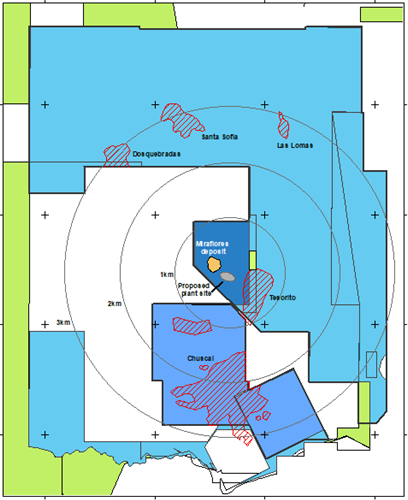

The Quinchia Gold Project hosts four discoveries (Miraflores, Tesorito, Dosquebradas and Chuscal) within a 3 kilometre radius of the proposed Miraflores plant site with potential for more discoveries.

As indicated below, Chuscal is in a central position just to the south of the proposed Miraflores plant site.

The recently completed maiden drilling program at Chuscal has sharpened the company’s belief that Chuscal is a critical element in the regional scale Quinchia Gold Project which already hosts three other discoveries in Miraflores, Tesorito and Dosquebradas, all within a 3 kilometre radius.

Consequently, management holds the view that controlling Chuscal and having discretion over how the larger opportunity presented is explored and developed is of substantial strategic importance and benefit.

In a similar vein, AngloGold Ashanti now has exposure to the larger Quinchia Project and the enormous greenfield potential of the Andes Project, 70 kilometres to the north.

All of these projects are located within the highly prospective mid-Cauca porphyry belt that hosts many multi-million ounce discoveries, some owned and discovered by AngloGold such as the Nuevo Chaquiro and La Colosa projects which have a combined gold equivalent resource of 55 million ounces.

From a broader perspective, AngloGold Ashanti has notched up more than 100 million ounces of gold resource discoveries, making it a very attractive shareholder to have on the register.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.