American Pacific sparks off lithium power play in California

Published 04-OCT-2017 12:41 P.M.

|

2 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

The struggle for lithium market dominance is intensifying with growing numbers of lithium explorers attempting to satiate the growing demand for battery-grade lithium carbonate.

However, close to the scene of Tesla’s highly-acclaimed Gigafactory in Nevada, a lithium power play is in the offing for American Pacific Borate & Lithium (ASX:ABR).

Listed on the ASX in July, ABR, which is a junior borates explorer, yesterday announced substantiated results indicating the genuine likelihood of lithium being viably produced from ‘lithium-enriched brines’, known as ‘colemanite’.

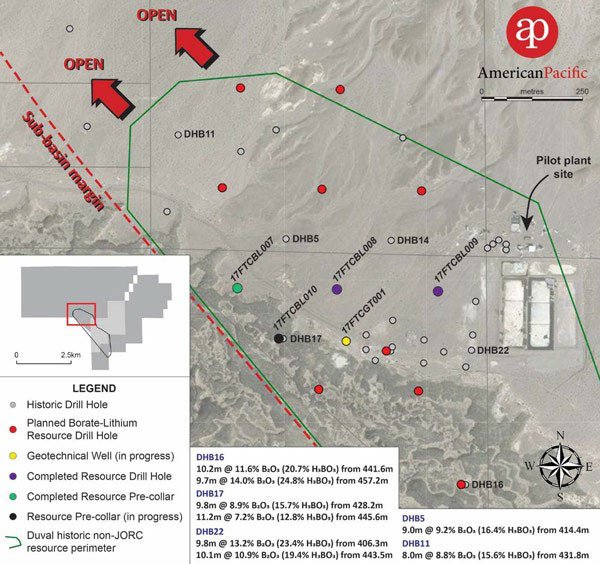

As a priority, ABR has completed two initial drill-holes at its flagship Fort Cady Project and reports it detected ‘elevated levels of both boron and lithium’. Three drill rigs are operating on site at Fort Cady, with a fourth expected to be brought online in early October.

Following the discovery, ABR is now prioritising metallurgical testwork to be fast-tracked, to determine optimal and most cost-friendly extraction options.

ABR says that the preliminary results it has collated so far, will be crucial for a considerably larger test work program, leading into pilot-scale test works in the first quarter of 2018.

However it is an early stage of this company’s development and if considering this stock for your portfolio you should take all public information into account and seek professional financial advice.

ABR Managing Director and CEO Michael Schlumpberger said, “We are excited with visual identification of mineralisation and the LIBS results from the first two drill holes. We appear to have encountered higher levels of lithium than initially anticipated, which has given us the confidence to fast track metallurgical test work.”

As it stands, the Fort Cady Project hosts a historical non-JORC mineral estimate of 115Mt at 7.4% B2O3 or 13.2% H3BO3 (boric acid), including 69Mt at 9% B2O3 and 16% H3BO3.

ABR is confident it can progress Fort Cady to ‘construction-ready status’ given the extensive amount of historical drilling already one and in excess of $10 million being spent on the project since the 1980’s, for the purpose of feasibility studies. According to ABR, 33 resource drill holes and 17 injection and production wells were previously completed. The aim is to produce both high-grade boric acid and high-grade lithium from the same ore body.

More about borates...

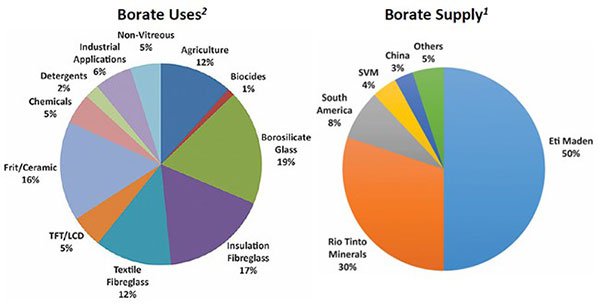

Borates are used in more than 300 applications with 75% going into borosilicate glass, fibreglass, frits/ceramics, agriculture & detergents

Borates market is a de-facto duopoly, dominated by two major mining companies accounting for around 75% of global production — Rio Tinto Minerals and Eti Maden.

Current market size is around 2.2Mtpa3 B2O3 with an expected five year compound annual growth rate of greater than five per cent.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.