American Pacific Borate enhances DFS to deliver low capex starter project

Published 01-FEB-2019 11:28 A.M.

|

2 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

American Pacific Borate (ASX:ABR) has enhanced its Fort Cady Borate Project DFS released on 17 December 2018 to include a low capex starter project.

The starter project is likely to change the game for ABR and was achieved by splitting Phase One into Phase One A and Phase One B, with Phase One A targeting the production of 40k stpa of SOP (potassium sulphate or K2SO4) and 6k stpa of boric acid (H3BO3).

Phase One B will increase boric acid production to 90k stpa.

The benefits of doing this are many and varied, however importantly the project substantially reduces pre-production capex from US$138 million to only US$36.8 million. That is an initial capital reduction of over $100 million.

Furthermore, pre-production capex has been reduced by around 75% whilst total capex has only increased by around 7%.

Overall, the project delivers exceptional financial metrics and is financeable on a standalone basis.

Also important to note is that this enhancement is likely to mean lower share dilution whilst preserving the targeted larger project and valuation.

“We are delighted with the enhancements of the DFS to include a low capex starter project that works on a standalone basis,” said ABR CEO Michael Schlumpberger.

“We now have pre-production capex of only US$36.8 million and a pathway to Phase Three that has an annual EBITDA in the first full year of production of over US$340 million.

“We have made the Fort Cady Project easier to finance, whilst limiting likely share dilution and preserving a massive EBITDA target in full production.

“Our ability to include such a low capex starter project emphasizes how unique the Fort Cady project is in the world of mining.”

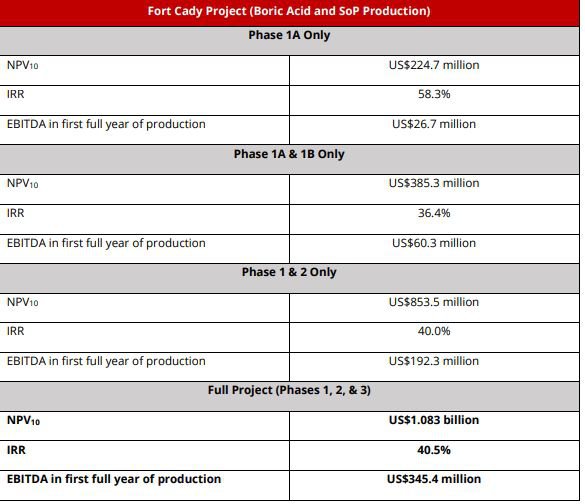

The following table highlights the positive financial metrics for the Fort Cady Project.

The Phase One A financial metrics means ABR can target financing this project in isolation, whilst creating a sensible pathway to full production and an EBITDA target in the first full year of production of US$345 million.

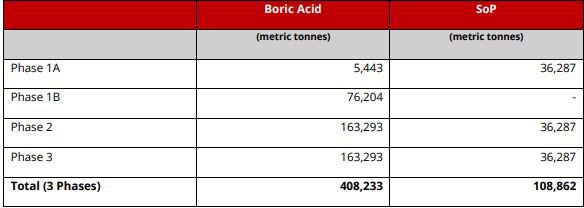

The table below summarises the production targets by each construction Phase. The targets have not changed from the initial DFS.

The numbers couldn’t come at a better time for ABR, with Grand View Research estimating the global lithium-ion battery market is projected to reach US$93.1 billion by 2025 while growing at a CAGR of 17% during the forecasted period.

Furthermore, borate producers should continue to benefit from increasing demand for glass and ceramics across Asian countries where there is an absence of boron resources.

Given the location of the project near America's lithium hub in Nevada, which includes Tesla's Gigafactory, it could be an interesting 2019 for ABR.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.