Amani’s Kebigada gold resource increases to 4.1Moz

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Shares in Amani Gold Limited (ASX:ANL) doubled on Thursday morning after the company announced a substantial upgrade of the Kebigada gold deposit, part of the Giro Gold Project located in the Democratic Republic of the Congo (DRC).

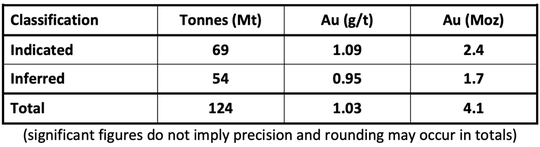

The Mineral Resource now stands at 124 million tonnes at 1.03g/t gold for 4.1 million ounces of gold at a cut-off grade of 0.5g/t.

The new MRE represents a 28% or 800,000 ounces increase in contained gold over the previous estimate of 75 million tonnes at 1.18g/t gold, for 2.9 million ounces gold at a cut-off grade of 0.6g/t.

Consistent gold exploration by the Klaus Eckhof chaired Amani at its Giro Gold Project at Kebigada and Douze Match continues to provide ongoing success in terms of gold exploration results and project scale.

Commenting on this development, Amani’s technical director Grant Thomas said, “The new MRE upgrade for Kebigada at over 4.1 million ounces gold is a milestone for Amani and confirms our strategy of targeted deeper drilling.

‘’Kebigada, even now, remains open at depth along the entire strike of the orebody. ’We believe we have a major gold deposit here at Giro, and Amani now has a very solid resource base to move to our aim of significant gold production from a new African gold mine.”

Underexplored but host to Randgold’s 17 million ounce deposits

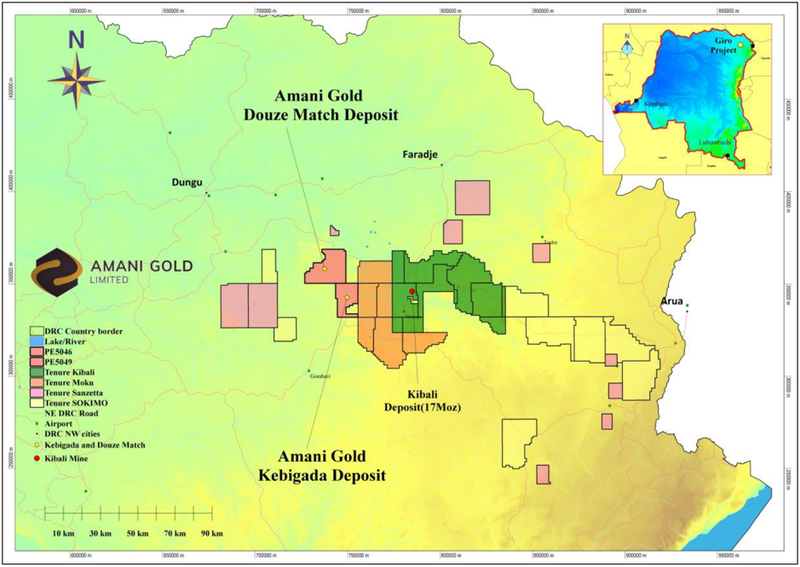

The Giro Gold Project comprises two exploration permits covering a surface area of nearly 500 square kilometres and lies within the Kilo-Moto Belt of the DRC, a significant under-explored greenstone belt which is shown below hosts Randgold Resources’ 17 million-ounce Kibali group of deposits within 35 kilometres of Giro.

The nearby Kibali Gold Project produces in excess of 600,000 ounces of gold per annum.

The Giro Gold Project area is underlain by highly prospective volcano-sedimentary lithologies in a similar structural and lithological setting as the Kibali gold deposits.

The Giro Gold Project including both the Kebigada and Douze Match deposits now exceeds 4.4 million ounces of contained gold.

Strike length of 1.4 kilometres

There has been limited mining of the upper part of the Kebigada deposit.

This is reflected in “No Sample” intervals in the drilling, which were used to generate an indicator model that identified the proportion and location of voids in the model.

Tonnage and grade in the model were then depleted assuming that the highest-grade material was preferentially removed.

The Kebigada MRE at a gold cut-off grade of 0.5 g/t has a strike length of approximately 1.4 kilometres and a horizontal width up to 400 metres.

The MRE starts at surface and is reported to a maximum depth of 300 metres.

The resource estimates at a gold cut-off of 0.5 g/t are shown below.

The preferred gold cut-off grade of 0.5 g/t assumes that mineralisation can be mined economically at this grade in an open pit, based on the current metal price.

The resource estimate was validated in several ways, including visual and statistical comparison of block and drill hole grades, examination of grade-tonnage data, and comparison with the previous model.

The new model indicates several areas where mineralisation is not closed-off and may continue, including at depth along the entire strike of the orebody and the western edge of the deposit.

Limited metallurgical testwork demonstrates that higher grade mineralisation from Kebigada is amenable to CIL only or combined CIL and gravity recovery.

Exploration strategy involves deeper drilling

Diamond drill holes GRDD034 and GRDD035 which are 240 metres apart have both outlined high-grade gold mineralisation deeper than previously intersected at the Kebigada deposit.

These gold assay results and the current Kebigada MRE indicate the potential for the Kebigada deposit to substantially grow via targeted deeper drilling along the entire strike of the orebody.

Amani plans to complete 200 metre spaced drilling north and south of drill holes GRDD034 and GRDD035, as well as similar spaced drill holes along the western edge of the deposit.

The much anticipated drilling campaign planned to commence in May/June will involve 12 core holes, each nominally 500 metres in length for a total of 6,000 metres.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.