Amani raises $2.5M for gold exploration at Giro and Gada Projects

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

The Klaus Eckhof chaired Amani Gold Limited (ASX:ANL) has completed a bookbuild for a two tranche placement to sophisticated and professional investors to raise up to $2.55 million. The placement will fund ongoing exploration activities at the company's Giro and Gada gold projects in the Democratic Republic of Congo (DRC), as well as meeting ongoing working capital requirements.

Up to 2,550 million fully paid ordinary shares will be issued at a price of 0.1 cents per share (placement shares), raising up to $2.55 million before costs.

Subject to receipt of shareholder approval, each placement share will include 1.5 free attaching listed options, with each having an exercise price of 15 cents and an expiry date three years from date of issue.

Commenting on how the funds will be applied, managing director Jacky Chan said, “This drilling program is a significant step forward for Amani and with it we aim to establish a significant transition stage for the company.

‘’Amani welcomes the support demonstrated for the Placement by existing shareholders and new investors of the company.

‘’The funds will enable Amani to continue to grow the Kebigada deposit over the current 4.1 million ounces gold (0.5g/t gold cut-off grade) and rapidly progress targets to drill stage at Gada”.

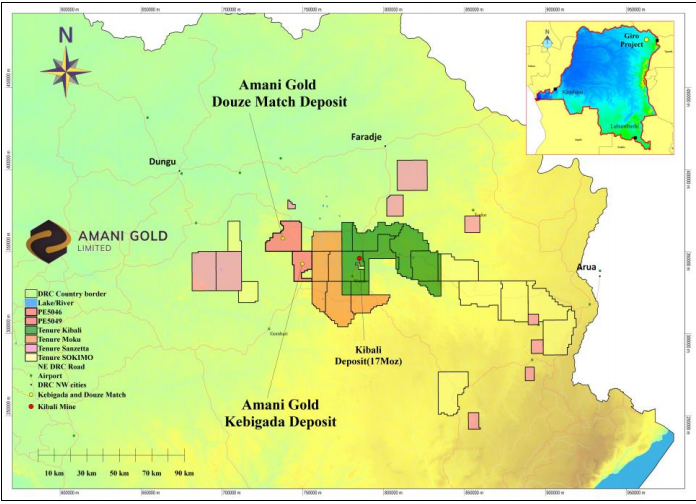

As a backdrop, the Giro Gold Project’s (see map for location) global resource for Kebigada and Douze Match deposits exceeds 4.4 million ounces contained gold with a total Indicated and Inferred Mineral Resource Estimate of 132 million tonnes at 1.04g/t gold, for 4.4 million ounces gold.

Deeper drilling to target higher grade mineralisation

The Giro Gold Project is located in proven territory, and the significantly underexplored greenstone belt which Amani will be targeting hosts Randgold Resources’ 17 million-ounce Kibali group of deposits within 35 kilometres of Giro.

The nearby Kibali Gold Project produces more than 600,000 ounces of gold per annum.

The Kebigada resource follows diamond core drilling results which successfully targeted deeper high-grade sulphide associated gold mineralisation within the central core of the Kebigada deposit.

Drillholes GRDD034 and GRDD035 are 240 metres apart and both outlined high-grade gold mineralisation deeper than previously intersected at the Kebigada deposit.

These gold assay results indicate the potential for the Kebigada deposit to substantially grow via targeted deeper and along strike drilling.

Amani plans to complete 200 metre spaced drilling north and south of drillholes GRDD034 and GRDD035.

The planned drilling campaign will involve four core holes, each nominally 500 metres in length for a total of 2,000 metres and is expected to commence in August 2020.

Gada has history of high grade gold mining

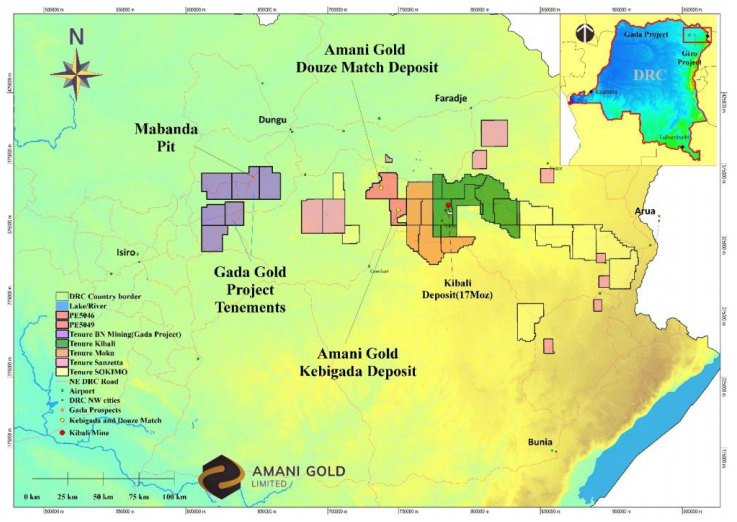

The Gada Gold Project consists of six Exploration Permits namely 11796, 11797, 11798, 11800, 11816 and 11817, totaling of 1,831 square kilometres, located in the north-east of the Democratic Republic of Congo within the Niangara, Dungu and Rungu Territories of the Haute Uele Province with Isiro as the Provincial Capital.

As indicated below, the Gada permits lie approximately 80 kilometres to the west of Giro.

The Gada Project area has complex transfer faults that could host gold deposits at the intersections.

The porphyritic granites also show some micro-folding and faulting which gives an indication of the general structural setting within the area.

Mineralisation is hosted in quartz veins and structures which are believed to be open at depth.

Artisanal miners have mined quartz veins and associated structures at many places within the Gada Project area.

Typically, high gold grades are mined by the artisanal miners, but they have been unable to carry out mining below approximately 40 metres due to flooding and the inability to dig through hard fresh rock.

Initial exploration of the Gada tenements included site visits and rock chip and channel sampling of known gold occurrences, artisanal pits and mineralised outcrops were completed within tenement PR11816.

Amani plans to rapidly progress exploration at Gada with Phase 1 soil sampling over previously identified priority targets.

Phase 1 Sampling is expected to start in early July 2020, and Phase 2 sampling will infill the priority area.

Soil sampling results at Gada will determine the location of an initial 5000 metre reverse circulation drilling campaign which is expected to commence in October 2020.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.