Amani commences Gold exploration of 'highly prospective' territory in DRC

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Amani Gold Ltd (ASX:ANL) announced on Monday that it had commenced exploration at the highly prospective Gada Gold Project in the Democratic Republic of Congo (DRC).

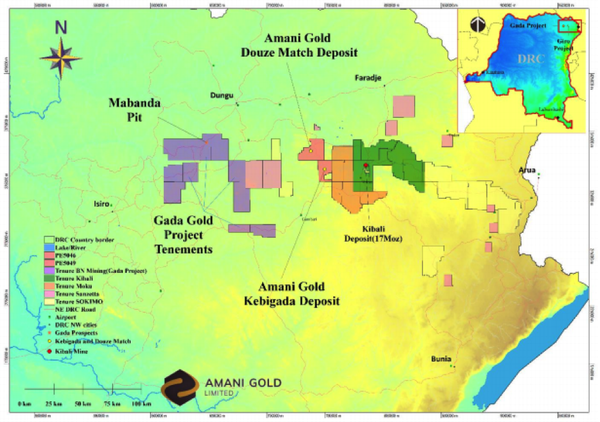

The Gada Gold Project is located approximately 80km west of Amani‘s Giro Gold Project with similar geology and mineralisation and approximately 100km from Barrick Gold and AngloGold Ashanti’s 17Moz Kibali joint venture project.

In May, Amani signed a Memorandum of Understanding (MOU) to acquire the Gada Gold Project. That MOU has now been substituted with a new MOU over the Gada Gold Project with project owner Société Miniére de Kilo-Moto (SOKIMO), following due diligence, to acquire six highly prospective gold Exploration Permits in the DRC.

The board and management today confirmed their view that the Gada Gold Project offers a significant opportunity for value enhancement. Given the location, geology and scale of the tenement package, as well as the early stage assessment carried out across the project, it is clear that the package is highly prospective for gold mineralisation.

Local artisanal gold mining has been undertaken for many years within shallow pits of depth to generally less than 10 metres.

Amani is conducting a modern exploration program to determine potential target areas for systematic exploration work.

Amani’s field teams have commenced exploration with prospect visits and rock chip and channel sampling of selected Gada targets.

Best results from initial due diligence include:

- Mbugo Pit - 8.99g/t Au (Rock Chip), 2m @ 10.6g/t Au and 1.6m @ 32.1g/t Au (Channel Samples).

- Mabanda Pit (Dubai) - 0.5m @ 47.7g/t Au and 0.5m @ 13.4g/t Au (Channel Samples).

- Mabanda Pit (Dix Huit 18) - 3.2m @ 5.91g/t Au (Channel Sample).

- Munguba Pit - 1.14g/t Au (Rock Chip), 1.5m @ 7.57g/t Au, 1.2m @ 2.14g/t Au and 1m @ 1.44g/t Au (Channel Samples).

- Arikazi Pit - 2m @ 11.16g/t Au (Channel Sample).

- Mangbetu Pit - 5.12m @ 1.27g/t Au, incl. 1m @ 3.8g/t Au (Channel Samples).

Underlining the importance of collaborating with the group’s existing partner at Giro, Amani’s managing director Jacky Chan said, “Amani has completed due diligence on the Gada Gold Project and we now look forward to aggressively exploring the ground under a new MoU with project owner SOKIMO, our JV partner for Giro.

‘’We have already planned extensive soil sampling and RC drilling programs over several of the best prospects at Gada. Field teams have already completed channel and rock sampling of several actively worked artisanal pits, returning exceptional gold assay results.”

The proximity of the two projects is illustrated in the following map.

Cash and equity for Gada acquisition

On signing the MoU, Amani has agreed to settle outstanding Surface Rights payments due to DRC Cadastre Minier (CAMI) of approximately US$315,000.

In addition, Amani has agreed to pay SOKIMO the sum of US$300,000 for exploration data, the rights to explore, prospecting authorisations and administrative expenses during the MoU period.

Further to the agreement with SOKIMO, Amani has also agreed, subject to shareholder approval, to issue 30,000,000 shares as an introduction fee to Mark Gasson and a further 10,000,000 shares to Mazoka Resources (PTY) Limited for assistance in concluding the MoU on the Gada Gold Project.

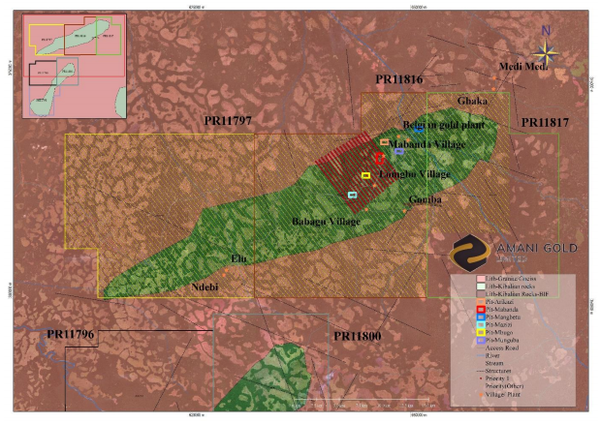

As part of the initial technical due diligence of the Gada tenements site visits and rock chip and channel sampling of known gold occurrences, artisanal pits and mineralised outcrops were completed within tenement PR11816.

The following summarises some of the rock chip and channel samples that were identified in the prospects and the artisanal pits that the group examined.

Exploration to include 23,000 soil samples

Initial exploration activities have been planned for Gada tenements PR11816, PR11817 and PR11797 to cover the known prospects from Mazizi Pit in the south, through Mbugo, Mabanda, Munguba, Arakaki and Mundial to Mangbetu Pits in the north as indicated below.

Conventional soil sampling will be carried out over the prospect areas on a nominal 400 X 100 metre grid for a planned total of 22,904 samples.

Priority soil sampling will target gold mineralisation at Mazizi, Mbugo and Mabanda areas and will be completed first, for a planned total of 1,193 samples.

The priority soil sampling program is anticipated to take up to eight weeks to complete, with final multi-element laboratory assay results available shortly thereafter.

Reverse Circulation (RC) drilling operations over Mazizi, Mbugo, Mabanda, Munguba, Arakaki and Mangbetu Pit prospect areas will comprise a planned total of 92 holes for approximately 5,060 metres.

Mabanda represents a key target

Initial priority RC drilling will target near surface gold mineralisation at Mabanda Pits for a planned total of 21 holes for approximately 1,150 metres.

Mabanda Pit (Dubai) delivered standout sampling results, including 0.5 metres at 47.7 g/t gold.

Also, Mabanda Pit (Dix Huit 18) returned 3.2 metres at 6.4 g/t gold from a channel sample.

This area consists of a number of several open pits across a strike length of approximately 900 metres.

The Mabanda (Dubai) open pit is actively mined by artisanal miners.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.