Amani Gold spikes ahead of extensive drilling campaign

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Shares in Amani Gold Ltd (ASX:ANL) surged 20% on Wednesday under all-time record volumes, arguably in anticipation of the group’s imminent drilling campaign in the Democratic Republic of Congo (DRC).

In May, the company raised $3 million through the issue of 1.5 billion fully paid ordinary shares at $0.002 per share, and the company is now trading at a 50% premium to the placement price.

The funds raised will be used to advance the Giro Gold Project in the DRC which will include diamond drilling.

Funds from the placement will also cover regional exploration and field costs and geophysics and mining studies, as well as financing due diligence on the potential Gada acquisition which we will discuss in more detail later.

Importantly though, this is a transformational period for Amani as it plans to accelerate drilling and exploration programmes across its highly attractive gold project portfolio, particularly given that its assets are in the heart of DRC gold territory.

On this note, chairman Klaus Eckhof said, ‘’We know the geology and mineralisation have been proven at Giro, and we know how to explore and discover gold deposits in this part of the DRC.

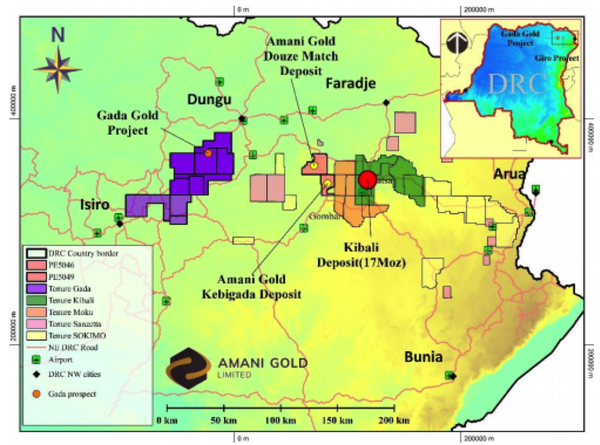

‘’The acquisition of this package would see Amani as one of the major gold tenement holders in DRC in a proven gold producing region nearby to the 600,000 ounce per annum gold mine at Kibali.”

This year Amani will principally test for deeper high-grade mineralisation at Kebigada, complete infill drilling at Kebigada and reconnaissance drilling north of Douze Match using a combination of reverse circulation (RC) and diamond core drilling.

The location of these two prospects is indicated below.

Drilling at the Giro Gold Project is expected to commence in shortly and consist of approximately 3500 metres.

If the Gada Gold Project is added to the potfolio, Amani expects to carry out an initial 1500 metre exploration drilling program commencing in August.

Amani is considering purchasing and operating a combined RC/diamond core rig to carry out the majority of planned 2019 drilling.

It is anticipated that an owner operated drill in the DRC will significantly reduce drill costs and aid logistical flexibility in relation to exploration programs.

High grades on offer at Gada Project

Amani has signed a Memorandum of Understanding with Bon Génie N. Mining (BN Mining) Sarl, to acquire ten highly prospective gold Exploration Permits in the DRC through an 85.7% interest in BN Mining.

The Gada Project lies approximately 100 kilometres to the west of Amani’s Giro Gold Project.

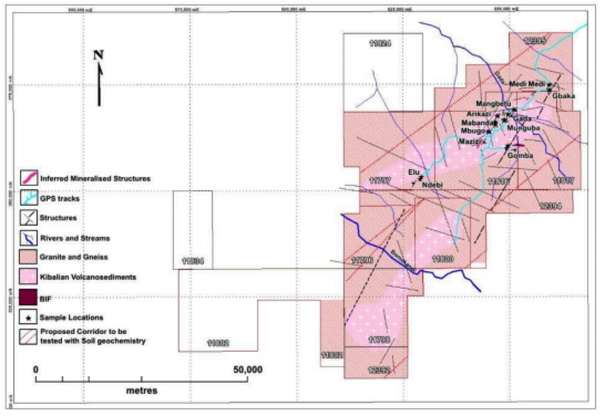

Given the location, geology and scale of the tenement package, as well as the early stage scouting carried out across the project, in management’s view it is clear that the package is highly prospective for large gold mineralisation.

Mineralisation is hosted in quartz veins and structures which are believed to be open at depth.

Local artisanal gold mining has been undertaken for many years within shallow pits of depth to generally less than 10 metres, and miners have identified quartz veins and associated structures at many places within the Gada Project area.

Typically high gold grades are mined by the artisanal miners, but they have been unable to carry out mining below approximately 40 metres due to flooding and inability to dig through hard fresh rock.

Conventional diamond core and/or RC drilling will adequately determine depth extensions and widths of mineralised veins and structures within fresh rock.

Consequently, Amani has several strings to its bow, and with drilling occurring across a number of sites over the next six months there is scope for further share price momentum.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.