Amani Gold completes Phase One drilling at Giro’s Kebigada Deposit

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Amani Gold Limited (ASX:ANL) has completed Phase One diamond core drilling operations at the Kebigada gold deposit, Giro Gold Project.

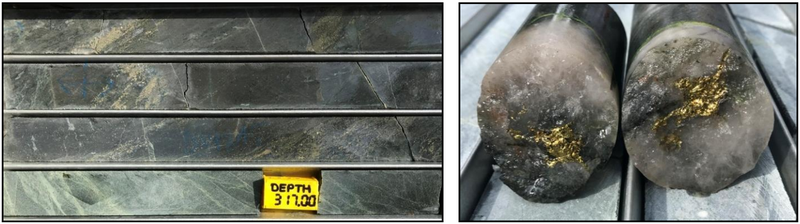

While assay results are pending, drill core indicates broad visual intervals of rock type and sulphide mineralisation which is similar to adjacent drillholes which intersected significant gold mineralisation.

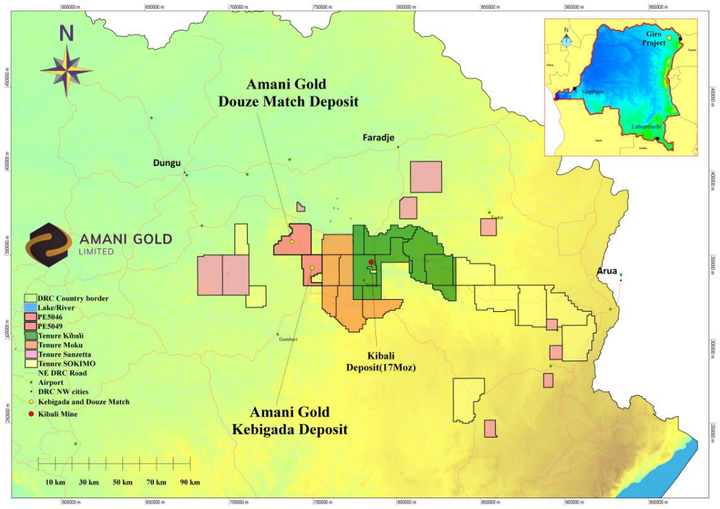

The Kebigada deposit is one of two exploration permits at the Giro Gold Project — with Douze Match — that covers 497km2 and lies within the Kilo-Moto Belt of the Democratic Republic of Congo (DRC).

This is a significant under-explored greenstone belt which hosts Barrick Gold/Randgold Resources’ 16 million-ounce Kibali group of deposits located 35km from Giro. The project area is underlain by highly prospective volcano-sedimentary lithologies in a similar structural and lithological setting as the Kibali gold deposits.

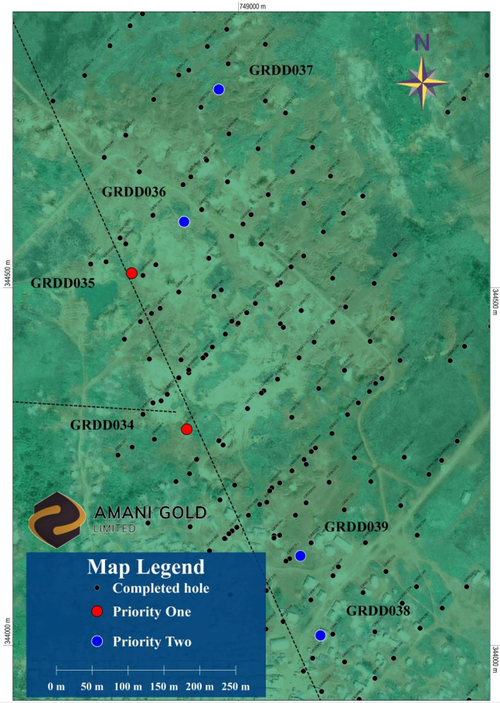

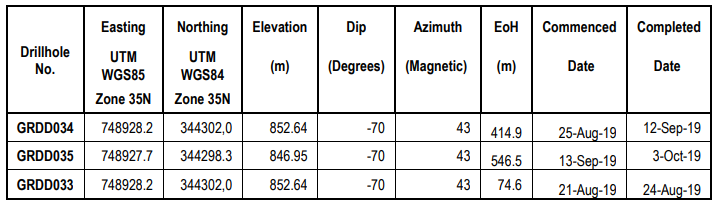

Drilling of three holes (GRDD033, GRDD034, GRDD035) targeted deeper high-grade gold mineralisation within the central core of Kebigada deposit.

Review of GRDD034 and GRDD035 drill core indicates broad visual intervals of rock type and sulphide mineralisation, which is similar to adjacent drillholes GRDD025 and GRDD032 which intersected significant gold mineralisation.

The total drilling completed in this Phase One was 1,036m. Drillhole GRDD034 was completed at 414.9m with core samples submitted to SGS Mwanza laboratory in Tanzania. Drillhole GRDD035 completed at 546.5m with core samples also selected for submission to SGS Mwanza. The initial Phase One diamond core drillhole GRDD033 was abandoned at a depth of 74.6m due to significant deflection after crossing a fracture zone.

Assay results are expected late-October and mid-November, respectively.

If Amani determines that significant gold mineralisation has been intersected in Priority One holes, Phase Two drilling may comprise a further four core holes, each 500m in length.

Amani has previously outlined a gold resource at Kebigada within the Giro Gold Project of 45.62Mt @ 1.46g/t Au, for 2.14Moz gold at a cut-off grade of 0.9g/t Au.

The Giro Gold Project global resource now exceeds 3Moz gold. Combined Indicated and Inferred Mineral Resource estimates for the Kebigada and Douze Match deposits is 81.77Mt @ 1.2g/t Au, for 3.14Moz Au, at a cut-off grade of 0.6g/t Au, while at a 0.9g/t Au cutoff, it is 49.62Mt @ 1.49g/t Au, for 2.37Moz Au.

GRDD034

GRDD034 intersected broad intervals of pyrite mineralisation from 204.00m to 263.50m (59.5m interval containing 2-3% pyrite), from 286.9m to 322.5m (35.6m interval containing 1% pyrite) and from 334.0m to 373.0m (39.0m interval containing 1-2% pyrite).

Also typical of the Kebigada gold deposit is that consistently mineralised intervals are separated by narrow non-mineralised zones with weak sulphidation and/or barren mafic dykes varying in width between 0.2m and 4.0m. This is based on a visual review and interpretation and the actual assessment may vary from initial interpretation.

GRDD035

Drillhole GRDD035 was collared on section L950N and drilled with an inclination of 70° and an azimuth of 43° and targeted deeper sulphide associated gold mineralisation previously delineated in hole GRDD032 (10m at 4.36g/t Au from 102m; including 4.05m at 9.30g/t Au from 103.75m, 88.1m at 2.13g/t Au from 221.4m; including 3m at 35.86g/t Au from 238m).

Review of cut core of GRDD032 and GRDD035 indicate lithological continuity and style of mineralisation.

Drillhole GRDD035 has intersected sulphide mineralisation in the form of dissemination, quartz/pyrite and pyrite veins and thin pyrite stringers all of which may be associated with gold mineralisation.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.