Alligator Energy Appoints New CEO to Oversee Energy Projects

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Having appointed Greg Hall as Acting CEO effective 1 April 2018, Alligator Energy (ASX:AGE) is now primed to push forward with its exploration work at its cobalt nickel play in Northern Italy, whilst maintaining its uranium projects in the Alligator Rivers Uranium Province.

Hall is currently a non-executive director of Alligator Energy and has agreed to assume the role as CEO on a part-time basis.

The former Mining Engineer has 35 years’ experience in the resources sector, holding executive roles in projects in uranium (Olympic Dam, Ranger, Toro Energy), nickel (Leinster and Kambalda Nickel Operations) and copper (Olympic Dam, Hillgrove Resources).

Hall was also Marketing Manager for Rio Tinto Uranium and Director Sales (Bauxite & Alumina) at Rio Tinto Aluminium.

“The Company is excited to be able to secure Greg’s services in an executive capacity given his extensive knowledge and experience in both the uranium sector as well as energy minerals including nickel,” Alligator Executive Chairman, John Main commented.

“Greg was actively involved in the investor presentations associated with the Company’s recent share placement and we look forward to him being able to build and extend the relationships formed with key shareholders and investors.”

Hall will be tasked with early on-ground exploration and drilling at the Company’s newly acquired tenements in Piedmont, northern Italy and will oversee preparation for near term work on AGE’s two high quality and advanced uranium targets in the Alligator Rivers Uranium Province (ARUP) in the Northern Territory.

The Northern Italy deal

In February, AGE announced it had signed a binding Heads of Agreement with Chris Reindler and Partners (CRP) to earn up to a 70% interest in the Piedmont cobalt nickel copper project in Northern Italy.

The acquisition plays into AGE’s overall business plan to discover large, high grade energy related metal deposits including uranium, nickel and cobalt with clear pathways for approval and development.

The company is in its early stages and investors should seek professional financial advice if considering this stock for their portfolio.

The company sees the Piedmont acquisition as an outstanding opportunity that contains walk-up geophysical targets in close proximity to historical mines at a time when energy minerals are in high demand. Ford is spending US$11 billion on electrified vehicles through to 2022, as Telsa continues to change public attitudes towards energy management.

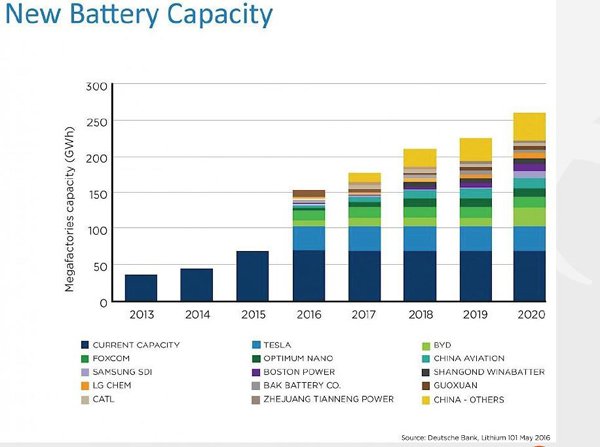

The following Deutsche Bank table indicates market demand for cobalt:

Uranium also on the march

AGE’s uranium project is also highly prospective, with drill ready uranium targets and a dominant land holding in a premier uranium exploration district.

Hall will be tasked with preparing for near term work on AGE’s two high quality, advanced uranium targets within ARUP, as well as consolidating and enhancing the high quality landholdings.

He will also continue ongoing relationships with indigenous groups in Arnhem Land with whom AGE has had longstanding and beneficial relationships.

The ARUP is an under-explored, high grade uranium province which hosts several world class, high grade uranium deposits, including the Ranger No 1 and No 3 deposits which have to date produced over 300Mlb of U3O8 for export and the Jabiluka deposit, which is one of the world’s largest uranium deposits, having a resource in excess of 300Mlb U3O8 at grades of 0.5% U3O8.

The Province has benefited from uranium mining for over 30 years and has an established regulatory framework which offers a high degree of certainty for business and stakeholders.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.