Aldoro prepares to drill after ratifying Altilium acquisition

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Aldoro Resources Limited (ASX:ARN) advised on Wednesday that conditions precedent to the acquisition of all outstanding shares of Altilium Metals Limited have now been satisfied.

The company has also completed the placement of $650,000 at 15 cents per share which was carried out in conjunction with the acquisition.

Completion of the acquisition has been well received by investors with the company’s shares rallying more than 10%.

However, there could be more upside to come given the quality of Altilium’s assets and the potential to add shareholder value through exploration.

Aldoro’s new managing director is Caedmon Marriott who highlighted the revitalised company’s focus in saying, “We plan to hit the ground running and have completed initial exploration and targeting work at the Penny South Gold Project.

‘’I look forward to updating shareholders on plans for a maiden drilling program at the project shortly.”

Indeed the Penny South Gold Project is shaping up as one of the company’s prime opportunities following the acquisition.

Following in Spectrum’s footsteps

Altilium held a series of advanced exploration projects in the Murchison Region of Western Australia including the Penny South Gold Project in the Youanmi Gold Mining District and the multi-commodity Narndee Project Area.

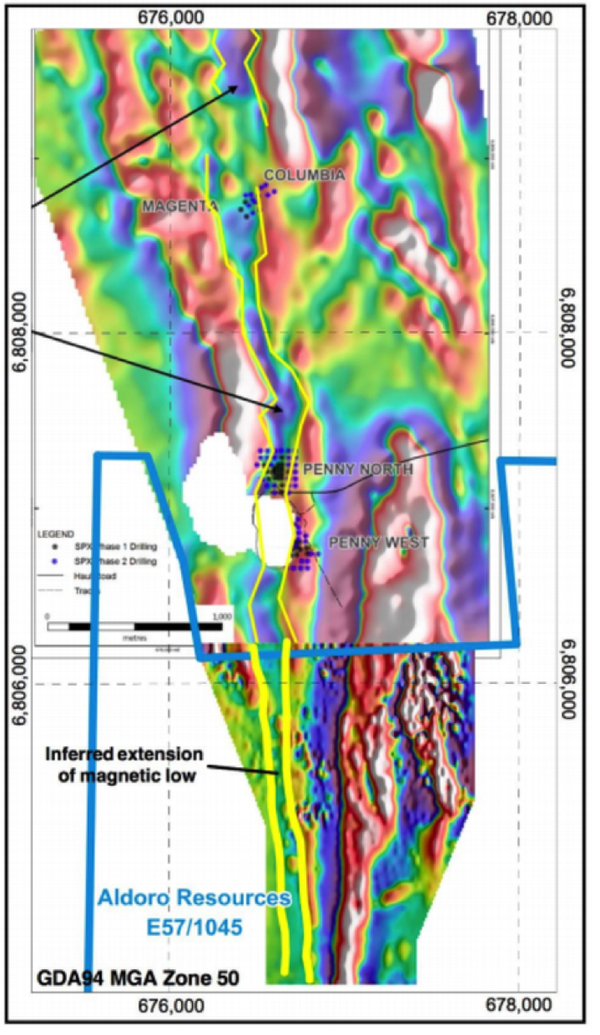

The Penny South Gold Project lies directly to the south of the Penny West Gold Project owned by Spectrum Metals (ASX:SPX) and as indicated below contains over 2.5 kilometres strike extension of the Penny West Shear that hosts the historic high-grade Penny West Gold Mine.

Courtesy of the acquisition, Aldoro now has the opportunity to capitalise on this asset.

Historic drilling within tenement E57/1045 (southern extent of the above map) encountered various significantly anomalous intersections of gold mineralisation including 2 metres at 34 g/t gold and 6 metres at 1.3 grams per tonne gold.

Like the Penny West area, tenement E57/1045 contains limited outcrop and is overlain by up to 30 metres of sand and sedimentary cover.

The average depth of historic drilling within the Penny South Gold Project is less than 40 metres down hole.

Spectrum quick to establish maiden resource estimate

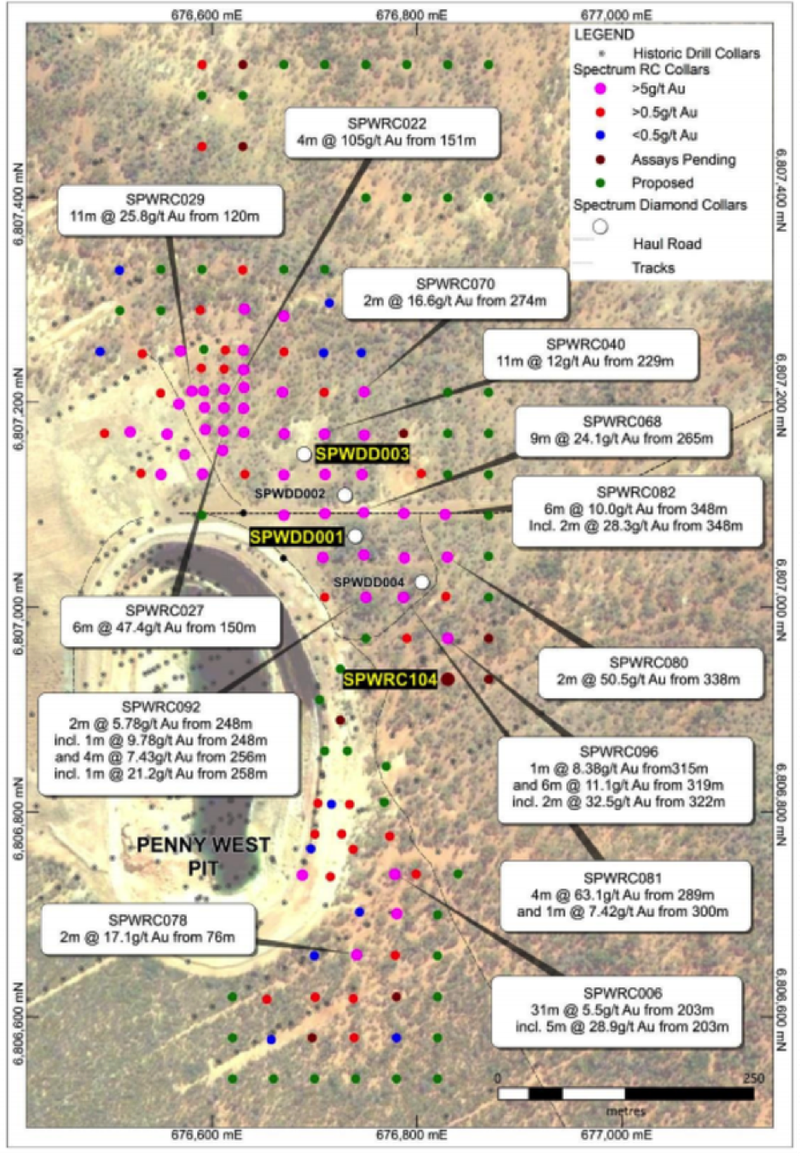

Spectrum has reported outstanding recent exploration success at Penny North and at the southern end of the Penny West pit within deeper drill holes beneath cover.

In mid-October the company announced drill results at Penny West of 6 metres at 11 g/t gold from 320 metres, including 2 metres at 32 g/t gold from 322 metres.

The following map shows the consistently outstanding grades returned from numerous drill holes in the Penny West area where Spectrum has been drilling at depths between about 200 metres and 350 metres.

Just last month Spectrum declared a maiden Mineral Resource Estimate for the Penny West project of 799,000 tonnes at 13.8 g/t gold for 355,500 ounces.

It is important to note that Spectrum has been able to quickly establish a maiden resource at a very economical cost of $10 per ounce, as this indicates the potential near-term upside for Aldoro which intends to utilise a similar exploration strategy to test surface anomalies at depth.

Penny South has the potential to drive Aldoro’s shares higher once the company starts to deliver drilling results, particularly given that investors will see the correlation between Spectrum’s landholding and Penny South.

Upcoming activity at Cathedrals Belt

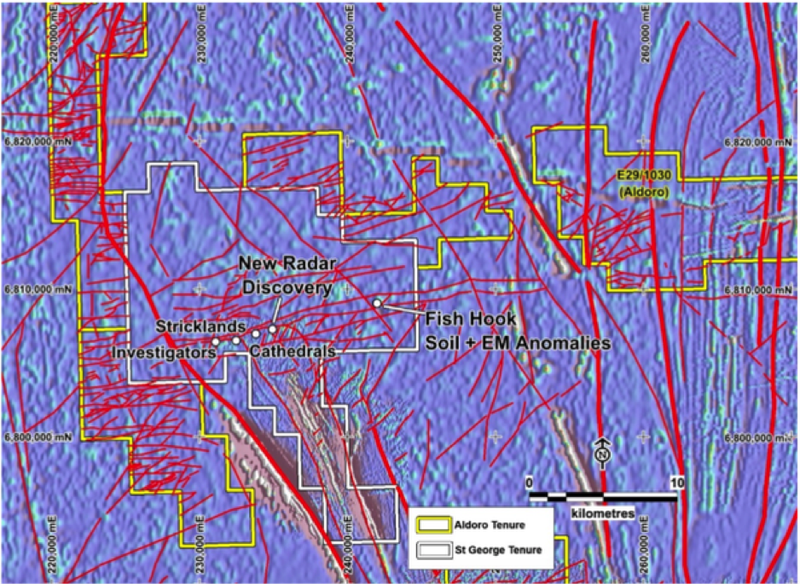

Aldoro also has the potential to benefit from exploration activity at its established operations with the E29/1030 section of the Cathedrals Belt Project being surveyed in order to identify follow-up drill targets.

This should be completed by the end of November with results due in December.

Once again, there is a hint of nearology that could work in Aldoro’s favour.

Cathedrals’ Belt lies to the east and west of the $60 million capped St George Mining’s (ASX:SGQ) Mt Alexander Project.

Aldoro’s tenement E29/1030 is interpreted to lie directly along trend from the ultramafic units hosting the nickel-sulphide mineralisation at the Cathedrals, Strickland and Investigators Prospects as seen below.

St George plans to drill its new Fish Hook Prospect in November, and Aldoro is hoping that this significantly increases the strike length of nickel-copper mineralisation identified across the Cathedrals Belt.

Previous images obtained in November 2018 when Aldoro completed a high resolution aeromagnetic survey over its Cathedrals Belt tenure show a discrete east-west magnetic feature in the south-west portion of E29/1030.

The current MLTEM survey will attempt to identify whether any conductive zones (potentially indicative of accumulations of sulphide minerals) are associated with this identified feature.

Such conductors would form high priority follow-up drill targets for Aldoro.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.