Aguia poised to progress Tres Estradas phosphate deposit

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Brazilian fertiliser developer, Aguia Resources (ASX: AGR) released updated data regarding its Tres Estradas phosphate deposit on Monday, which drew a positive response with the company’s shares spiking from Friday’s close of 8.9 cents to hit an intraday high of 9.7 cents, representing an increase of nearly 10%.

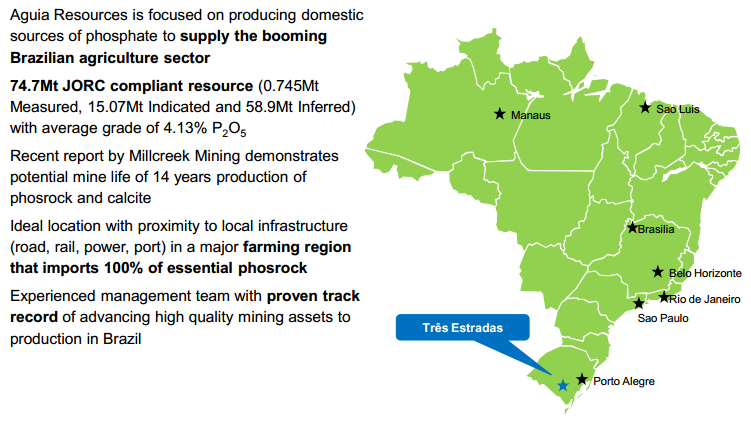

Tres Estradas has a 74.7 million tonnes resource grading 4.13% P205. Management highlighted the fact that one of the key project development milestones had been met with the submission of an Environmental Impact Assessment (EIA).

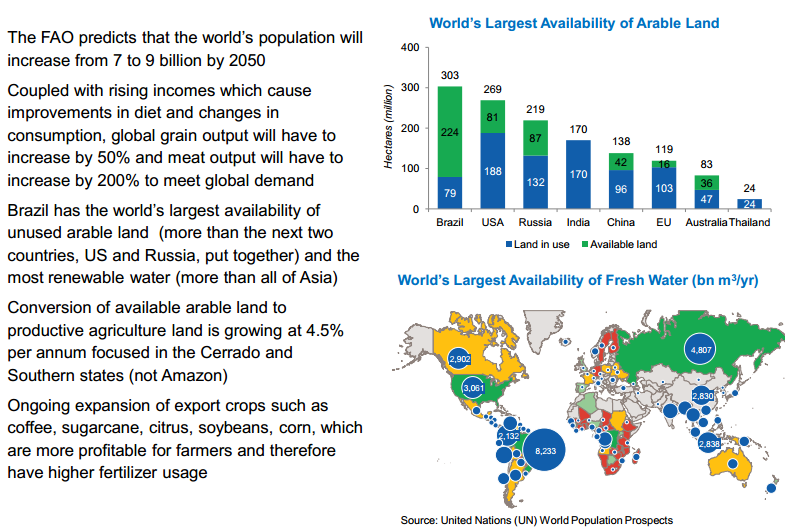

As can be seen below, the project dynamics are compelling with a potential mine life of 14 years and anticipated strong demand from the domestic agricultural sector.

Forward-looking statements regarding potential production and cost metrics may not come to fruition and investors should not use this information as the basis for an investment decision. AGR is an early stage mining company, and investors considering this stock should seek independent financial advice.

Environmental Impact Study crucial to de-risking project

The next steps include discussions with the Rio Grande State Environmental Agency, and within 6 to 12 months the agency is expected to approve the EIA and issue the Preliminary License for the project.

Issue of the license would significantly de-risk the prospect of taking the project from exploration to production, and can also be an important factor in gaining investor support through capital raisings and/or debt financing.

On the score of financing though, AGR is currently well-placed having recently raised $8.5 million through a private placement. Importantly, this will provide the funds required to complete a Bankable Feasibility Study (BFS) which will provide important data on the commercial viability of the project.

Plant optimisation points to lower cost production

Significant ground has been made in recent months with the finalisation of an optimisation study conducted by Millcreek Mining Group indicating earlier results that point to the substantial upside which could potentially be gained from making improvements to the processing facility compared to those previously considered.

By improving the processing facility it was established that the production of high quality calcite is viable and that this by-product could create a secondary source of revenue. Also, the decision to produce phosrock only instead of the more capital intense SSP production previously considered will result in project versatility and lower capital costs.

As can be seen from the table below, any products that can be utilised in the agricultural industry have a ready market where AGR intends to produce.

Drilling results and BFS potential share price catalysts

With regard to the execution of a Bankable Feasibility Study (BFS), the upcoming months will be important as AGR conducts a drilling program aimed at converting the current Inferred Mineral Resource to the Measured and Indicated category, which should provide much more attractive economic and production forecasts.

AGR’s technical director, Fernando Tallarico, also highlighted the benefits in terms of providing more precision in mine design and costing, which should in turn increase the value of the project.

Over the coming weeks and months there is the potential for a number of share price catalysts to emerge and Managing Director, Justin Reid alluded to these developments in summing up AGR’s position as he said, “With four drill rigs turning, we will be providing regular updates to the market as to our progress and we will also drill test certain priority exploration targets adjacent to Tres Estradas to identify future optimal development opportunities”.

The delineation of further nearby mineralisation could prove to be a vital development for the company as it has the potential to possibly increase production from the proposed plant and/or extend the mine life of Tres Estradas, as well as having a positive impact on the valuation of the group’s assets.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.