Adriatic spikes 20% on release of scoping study

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Adriatic Metals PLC (ASX:ADT FSE:3FN) has released the results of a Scoping Study on its 100% owned Vareš Project in Bosnia and Herzegovina.

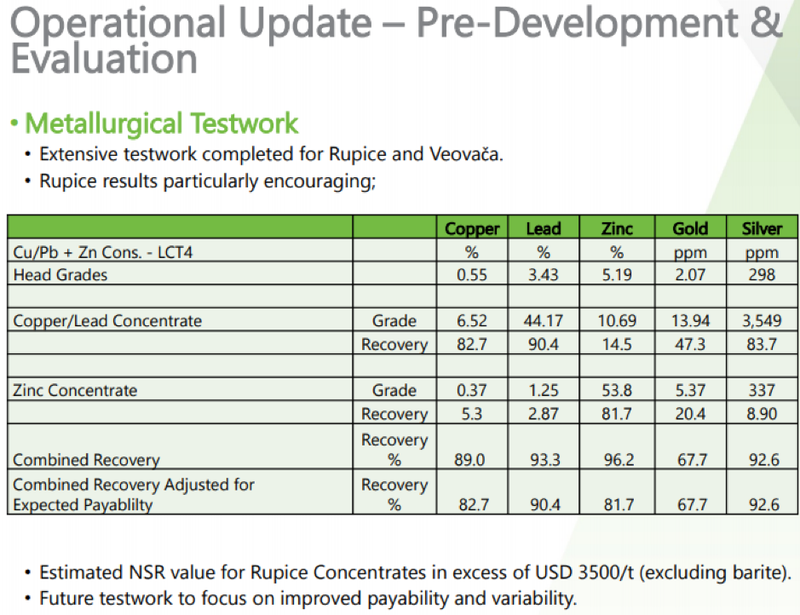

In determining the potential viability of an underground mine at Rupice and an open-pit mine at Veovača with a conventional milling and flotation circuit to produce multiple metal concentrates, the scoping study has revealed some promising findings.

The positive nature of the scoping study hasn’t been lost on the investment community with the company’s shares up more than 20% in mid-morning trading yesterday.

It is important to note that the scoping study is an early stage assessment representing a preliminary technical and economic study of the potential viability of those projects based on low level technical and economic assessments (+/- 40% accuracy) that are not sufficient to support the estimation of Ore Reserves.

Adriatic will be undertaking further evaluation work and appropriate studies in order to estimate any Ore Reserves or to provide any assurance of an economic development case.

However, a JORC-compliant Mineral Resource Estimate was released in July and this forms the basis for the Scoping Study.

Over the life of mine considered in the scoping study, 83% of the processed Mineral Resource originates from Indicated Mineral Resources and 17% from Inferred Mineral Resources.

During the payback period, 87% of the processed Mineral Resource would be from Indicated Mineral Resources.

Consequently, the viability of the development scenario envisaged in the Scoping Study isn’t dependent on Inferred Mineral Resources.

Targeting prefeasibility study by early 2020

The project development schedule assumes the completion of a prefeasibility study (PFS) by early 2020 and a feasibility study by the December quarter of 2020.

Provided there aren’t any delays in permitting, first production should occur in the June quarter of 2022.

To achieve the range of outcomes indicated in the Vareš Project Scoping Study, funding of approximately US$180 million will likely be required in capital expenditure to construct the mine, grinding mill, project infrastructure and processing plant.

It is anticipated that the finance will be sourced through a combination of equity and debt instruments from existing shareholders, new equity investment and debt providers from Australia and overseas.

In October 2019, Adriatic completed a $25 million placement of ordinary shares, with strong participation from institutional investors.

The Board considers that the company has sufficient cash on hand to undertake the next stage of planned work programs, including the completion of a DFS, continued metallurgical testing and the commencement of other technical studies.

Crunching the numbers

The scoping study assessed the potential viability of running an underground mining operation at Rupice followed by an open pit operation at Veovača, with all mined material being centrally processed on the site of the derelict processing plant at Veovača, which will be cleared for construction of a new processing plant.

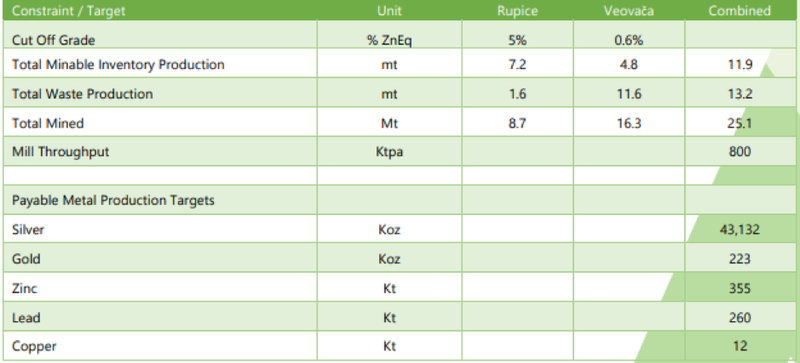

Recoveries from Rupice are expected to be in the vicinity of 715,000 tonnes per annum for 10 years.

Adriatic will then move to mining Veovača at an estimated annual average rate of 679,000 tonnes per annum for 7 years.

The flotation plant at Veovača which will be processing material from both Rupice and Veovača will be designed to produce three concentrates, being lead/copper, zinc and barite.

The following lays out the payable metal production targets.

Total operating costs are forecast to be US$56.70 per tonne.

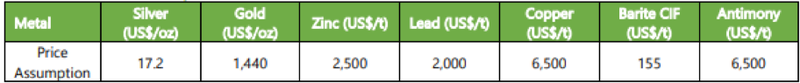

Based on the following commodity price assumptions the project has a net present value taking into account an 8% discount of US$916.6 million.

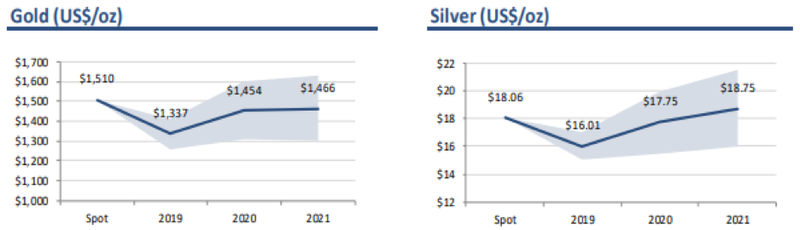

Assumptions for the precious metal components of production appear reasonable with gold currently trading in the vicinity of US$1470 per ounce, and silver having recently retraced from about US$18.00 per ounce to US$17.00 per ounce.

Research house, PCF Capital Group released its November 2019 addition of ‘’Resources Thermometer’’ last week.

As you can see, gold has mainly traded at the top end of its average assumptions for 2019, and PCF is forecasting an average gold price of around US$1460 per ounce over the next two years.

PCF is tipping a gradual uplift in the copper price throughout 2020 and 2021, which would see it fetching in the vicinity of US$6900 per tonne, implying upside of about 8% relative to Adriatic’s assumptions.

PCF is forecasting a 10% increase in the zinc price over the next two years which would imply a price of approximately US$2670 per tonne compared with Adriatic’s assumptions of US$2500 per tonne.

Consequently, it would appear that Adriatic has been measured with its commodity price assumptions, as it has in detailing contingencies that can arise as further studies are undertaken and the project moves closer to production.

On the upside though, there is the potential for Adriatic to expand its resource base as management undertakes further regional exploration in underexplored areas.

Under such a scenario, the company would benefit from economies of scale.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.