Adriatic Metals unearths high-grade extension in Balkans

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Finfeed presents this information for the use of readers in their decision to engage with this stock. Please be aware that this is a very high risk stock. We stress that this article should only be used as one part of this decision making process. You need to fully inform yourself of all factors and information relating to this product before engaging with it.

Adriatic Metals PLC (ASX:ADT) this morning revealed it has received assay results from the first hole completed in its 15,000 metre drilling program at Rupice in Bosnia.

Rupice is an advanced exploration project that displays exceptionally high grades of base and precious metals.

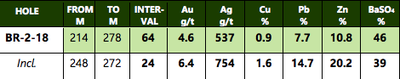

Encouragingly, the first hole in ADT’s 2018 campaign has returned a combination of the highest grade and thickest intercept to date — 64m at 4.6g/t gold, 537g/t silver, 0.9% copper, 7.7% lead, 10.8% zinc, 46% barite.

These initial results confirm the consistency of the previously drilled, high-grade northern zone at Rupice, suggesting exceptional growth potential.

Drill hole BR-2-18 was drilled in a westerly direction at -60 ̊ to test the down dip and down plunge extension of high-grade mineralisation intersected in ADT’s 2017 drilling program — specifically, hole BR-1-17. The intersection represents an 80 metre down dip extension and a 50 metre down plunge extension from BR-1-17.

The mineralisation is very visible and consists of galena, sphalerite, chalcopyrite and barite hosted within brecciated sediments which are typically strata bound and dipping at 50 ̊ to the east.

The results include:

Of course, as with all minerals exploration, success is not guaranteed — consider your own personal circumstances before investing, and seek professional financial advice.

Previously, ADT also undertook a sampling program at the dumps of Juresvac Brestic (JB Zone) — the site of an historic exploration adit. Assays have now been received, and these confirm a significant gold grade in these samples.

Compellingly, the tenor of this mineralisation is similar to that observed at Rupice, providing confidence that the source of mineralisation may be related in both zones. ADT will undertake further exploration to determine the potential continuity of these zones within the geological corridor between them.

ADT CEO, Geraint Harris, said: “The results from BR-2-18 are exciting in a number of respects: firstly, we have revealed the continuation of thick mineralisation on an 80m step out hole, which has the potential to add significant tonnes to any future resource. Secondly, we have assays confirming that this extension has grade continuity in excess of the exceptionally high grade precious and base metals content of BR-1-17, which make these some of the highest grade polymetallic results on the ASX.”

“The presence of high grade gold in the dumps at Jurasevac gives us further confidence in the JB Zone as a high grade polymetallic deposit in a style similar to Rupice. Our first holes at the JB Zone are currently underway and the drilling target coincides with a strong geochemical soil anomaly and a significant gradient array IP (GAIP) signature,” Harris added.

Notably, ADT is one of the few independent near-term zinc development companies on the ASX and the first and only company on the ASX with exposure to Bosnia and Herzegovina.

This seems to be reflected in its upwardly moving share price, which is currently up 14.7 per cent at 19.5 cents.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.