Adriatic Metals lists on ASX, chases high-grade zinc discovery in mining-friendly Balkans

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

This stock is classified as ‘very high risk’ in nature due to its location and geopolitical situation of the region. Finfeed advises that extra caution should be taken when deciding whether to engage in this product, however if you are not sure whether it is suitable for you we suggest you seek independent financial advice.

Adriatic Metals (ASX:ADT) makes its ASX debut today and is already drawing considerable attention as a noteworthy zinc contender.

ADT is one of the few independent near-term zinc development companies on the ASX and the first and only company on the ASX with exposure to Bosnia and Herzegovina — a first-mover advantage that could give it a distinct edge as an emerging polymetallic play.

The ASX has seen very few zinc listings over the past few years, with Australian newcomers mostly playing in the gold or battery metals space.

The bookbuild for ADT’s $10 million listing, one of the biggest mining floats on the ASX so far this year next to Jupiter Mines which opened a $240 million offer in late April, provides ample evidence for investor interest in this emerging Bosnian setting.

Although, ADT is an early stage play and investors should seek professional financial advice if considering this stock for their portfolio.

Importantly, ADT has the $1.2 billion capped Sandfire Resources as a cornerstone investor to help it mature its Bosnian assets. Sandfire spent $2 million for a 7.6% stake in Adriatic.

Sandfire and Adriatic have entered into a strategic partnership agreement which will enable Adriatic to access significant technical expertise to develop its Veovaca and Rupice Projects as well as strategic support as the company moves to unlock the potential from its first mover status and regional exploration portfolio.

“We welcome Sandfire as a strategic investor and partner of Adriatic as we transition to a publicly listed Company,” Adriatic’s Chief Executive Officer, Geraint Harris said. “Securing a high-quality partner with world leading expertise in the exploration and development of base metals projects is a strong endorsement to the quality and potential of Adriatic’s portfolio following an exhaustive period of due diligence. This also validates the prospectivity of our licence areas to host further discoveries as we commence our 2018 exploration program.

“Sandfire brings a tremendous depth of experience in these styles of mineralisation which will enable us to further understand this under-explored and emerging base metals province of central Europe.”

Well-funded, with a $10 million cash injection to fuel ongoing exploration and development of its key assets Rupice and Veovaca, ADT’s vitals are all very healthy.

The Sandfire investment would please Chairman, Peter Bilbe, who is something of an industry veteran. Bilbe is a mining engineer with 40 years’ Australian and international mining experience in gold, base metals and iron ore at operational, CEO and board levels.

Bilbe is also currently chair of Independence Group NL. Since 2009, he’s overseen IGO’s growth from a single mine to the $3 billion diversified gold and base metals mining company it is today.

With Bilbe steering the ADT ship at it looks to ramp up its exploration game post-listing, there’s every chance that this newly listed polymetallic junior will have similar success.

ADT is the second company to list on the ASX this year with a focus on the Balkans. The first was Raiden Resources (ASX:RDN), which is focused on Serbia, and recently penned a US$31.5 million (A$40 million) joint venture with mining powerhouse Rio Tinto — a deal that saw RDN’s share price surge by some 62%...

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

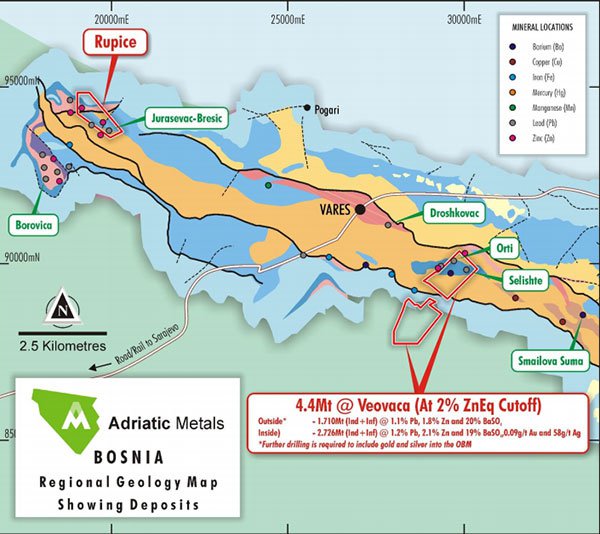

The map below shows you the location of ADT’s two key projects:

Rupice: one of the highest grade polymetallic deposits in the world

Rupice is an advanced exploration project that displays exceptionally high grades of base and precious metals. This deposit has an ample regional footprint and multiple untested targets.

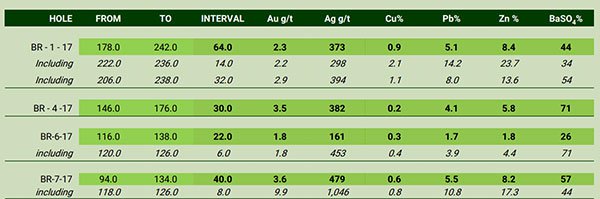

What we’re looking at here are near-surface sedimentary-style base metal deposits with very high grades of zinc, lead, silver, gold, barite and cobalt. In fact, 64m at 8.4% zinc, 5.1% lead, 373g/t silver, 2.3g/t gold, 1% cobalt and 44% barite — making Rupice one of the highest grade polymetallic deposits in the world.

An example of the high-grade ore encountered here:

The deposit sits some 17 kilometres north-west of the Veovaca pit and the historic processing facility.

Historic small-scale mining of the outcrop produced some 20,000 tonnes, containing 88.9% barite and sent to USA. 49 historic holes were drilled for 5696 metres, but only 35% of the holes were sampled for gold and silver.

Exploration adits were used to mine 15,000 tonnes of high grade zinc/lead material that was processed at Veovaca.

Intriguingly, 2017 diamond drilling by ADT (8 holes for 1458 metres) offered up outstanding results and demonstrated high-grade gold, silver and barite, with high-grade base metals.

Selected 2017 intercepts showing thickness and consistency of a high-grade nature:

Recent drilling by ADT shows a clear relationship between base and precious metal grades, suggesting at potential to add gold and silver to a future JORC Resource.

Moreover, numerous IP anomalies indicate that these two projects form part of a broader polymetallic district, with immediate targets in the Rupice (which we’ll look at shortly) and Borovica corridor. These IP anomalies correlate with historical work, including trenching, exploration adits and limited drilling.

ADT has begun geophysics and geochemistry work to further define exploration drill targets. ADT’s plan in the short-term is to complete an infill drilling program at Rupice, which kicks off this week, so there’s bound to be plenty of news flow in the near future here. ADT will also be targeting a Resource for Rupice.

On top of these two key holdings, ADT also has in its grasp numerous regional prospects with exploration targets indicating attractive tonnages and grades — these are supported by historic geophysics, exploration and drilling.

These promising targets offer exploration upside — and for the Orti and Selishte targets, possible inclusion in a development scenario at Veovaca. Discussions are currently underway to expand existing concession boundaries.

Veovaca: World-class exploration potential

ADT also has on its hands significant brownfields assets with world-class exploration potential, and is now gearing up to launch itself head-first into a series of proactive exploration works.

Veovaca is an historic open-cut zinc/lead/silver/barite mine with a 25-year mining concession. The project was mined between 1983 and 1987, and produced saleable zinc, lead and barite concentrate, delivered into European smelters. Notably, this project already has a JORC-complaint Resource of 4.4Mt with 80% classified as Indicated.

Backtracking for a moment, a quick word on barite... Barite is the naturally occurring mineral of barium sulphate — it is non-toxic, has a high specific gravity and low solubility. Notably, the barite found at Rupice and Veovaca is high-quality drilling fluid grade (4.2SG), which fetches a premium price. Here’s barite found at Veovaca:

Bearing that in mind, a recent hole at Veovaca 76 metres from surface delivered 4.0% zinc, 2.5% lead, 118 grams per tonne silver, 0.23 grams per tonne gold and 36% barite.

Below, you can see the Veovaca pit looking south-east, with the ore exposed at surface:

51 historic holes were drilled for 8,022 metres with zinc, lead, gold, silver, cobalt and barite mineralisation from surface, open down-plunge to the east-north-east and for potential repeat lenses.

Confirmation drilling by ADT in 2017 (16 diamond holes for 1,381 metres), meanwhile, yielded outstanding results, showing verifiable mineralisation from surface down to depths up to 125 metres.

Encouragingly, Veovaca is well-serviced by sealed roads, rail and infrastructure, and low-cost power which bodes well in terms of a future mining operation, should ADT managed to dig up something substantial.

A metallurgical test work program is currently underway with UK-based Wardell Armstrong. Now that ADT’s IPO is done and dusted, the company is looking to take things to the next level here. ADT is looking to kick off a scoping study in the coming months, as well as a Resource update in the second half of the year.

All in all, this is a promising start for ADT in its Bosnian setting.

Bosnia: an establishing shot

When thinking about appealing investment destinations, Bosnia might not be the first location that springs to mind. However, the previously war-torn country is now looking to attract greater foreign investment and become part of the EU.

Since the end of the civil war in the early 1990s and the signing of the Dayton peace agreement in 1995, Bosnia has experienced a stable and peaceful democracy. Bosnia is a stable democracy, and comprises harmonious tri-religious communities, making for relatively low sovereign risk.

Bosnia is rapidly attracting attention as a pro-mining, business-friendly country with world-class geology yet limited modern exploration. The country saw limited foreign investment and modern exploration over the last 20 years, leaving a door open for major discoveries. Here’s a snapshot of Sarajevo today:

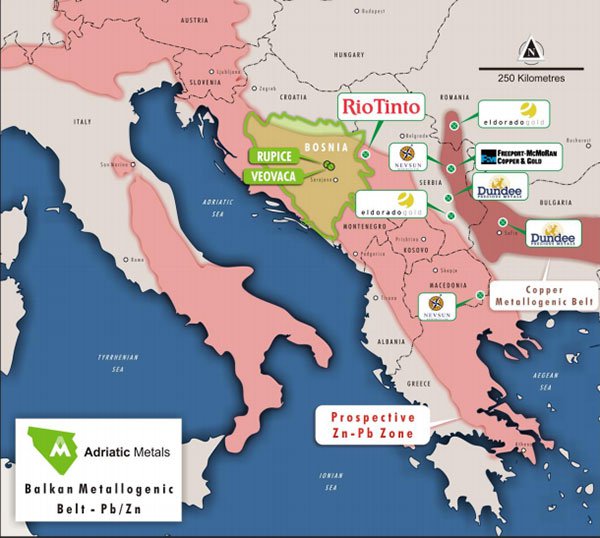

Bosnia displays similar prospectivity to Serbia, which is also opening up to foreign investment and has some of the world’s largest cobalt and silver deposits.

Bosnia is also eminently miner-friendly, with favourable regulatory terms, including low corporate tax rates of 10% — among the lowest in Europe — with foreign investors having the same rights as locals. There’s no government participation right or free carry, and the local currency (BAM) is pegged to the Euro.

Furthermore, ADT has at its disposal access to a highly skilled workforce, and low labour, transport and electricity costs. Promisingly, there is an extensive rail network linking European smelters and seaborne markets through the port in Montenegro (Bar) and Croatia (Ploče), as you can see below:

As we’ve mentioned, the Balkans is rapidly attracting a host of attention from a cluster of mining heavyweights, including the likes of Rio Tinto, Nevsun, Dundee, First Quantum, Eldorado Gold and Freeport-McMoRan. You can see these major players plotted out in the map below alongside ADT’s Veovaca and Rupice projects, spanning the highly coveted Balkan Metallogenic Belt:

A peer comparison

Below, you can see how ADT is tracking against its ASX peers in terms of market cap and contained zinc:

As you can see, the average market cap here is $72 million.

Bearing in mind the fact that ADT has in its hands some of the world’s highest grade polymetallic deposits, this ASX newcomer has a post-listing market cap of $26.2 million — making it significantly under-valued when taking into account these peers.

Although it does remain a speculative stock and investors should seek professional financial advice if considering this stock for their portfolio.

Given its highly prospective holdings, this modest sized stock could be a judicious entry point into a rapidly expanding investment corridor — the emerging Balkans region.

The zinc story

In 2017, zinc prices jumped almost 30% on the back of supply concerns, scheduled mine closures, strategic supply cuts by major supplier Glencore, declining warehouse stocks, a weakened US dollar, and a positive Chinese demand outlook.

Into 2018, these supply issues continue to grow. Worldwide stockpiles of zinc are sitting at near-decade lows, translating to the near-decade high price of US$3400/t:

The London Metals Exchange’s (LME) zinc price has more than doubled since falling below $1500/t in late 2015:

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Global zinc demand continues to grow at 2-4% per year.

Pundits don’t see this high-powered zinc story changing any time soon, looking to a significantly tightening zinc market over the coming years.

Zinc is most commonly used in steel galvanisation, which accounts for some 60% of global usage. The end-use zinc market is dominated by construction companies, followed closely by the transport industry. On top of this, however, zinc is also emerging as a compelling commodity in the energy storage story.

Despite the fact that it’s the largest zinc producer in the world, China has become a net importer of zinc.

Also contributing to this supply/demand imbalance has been the dwindling output of some of the world’s major zinc mines, with leading producers having closed down historic zinc mines in Australia and Ireland in recent times.

Given these kinds of dynamics, it seems like ADT has impeccable timing, and is looking for this high-performing commodity in a low-cost Balkans region that’s rapidly emerging as a key investment destination.

Moving forward

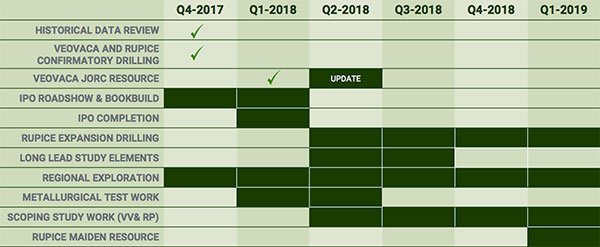

Freshly listed and in a solid cash position, ADT is looking to move fast as it ramps up its game in Bosnia. In the weeks and months to come, ADT will aggressively drill Rupice and Veovaca, with a 15,000 metre program currently being tendered.

Development work at both Veovaca and Rupice will continue with metallurgical work, flowsheet and preliminary mine design.

Regional exploration on surrounding prospects will also further define drill targets for the remaining months of 2018. ADT is also looking to evaluate new project opportunities with a view to build its already impressive portfolio.

As you can see in the timeline below, ADT has plenty to keep it busy in the days ahead:

ADT is one of the few independent near-term zinc development companies on the ASX, and it’s capitalising on one of the world’s most prolific and underexplored regions.

It does still have a lot of work to do so investors should still take a cautious approach to their investment decision when considering this stock for their portfolio.

With high-grade targets and potential for new discoveries, ADT has assembled a team with proven experience in a low-cost operating environment close to existing markets. All of this makes for a rather tasty recipe for success, and we have no doubt we’ll be tracking this ASX newcomer closely in the months to come.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.