ABR’s Resource for Fort Cady Borate and Lithium Project sees significant upgrade

Published 01-FEB-2018 12:01 P.M.

|

2 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

American Pacific Borate and Lithium Limited (ASX:ABR) has delivered a significantly upgraded JORC Mineral Resource Estimate for its 100%-owned Fort Cady Borate and Lithium Project in Southern California, USA increasing both tonnes and grade.

Since ABR’s acquisition of Fort Cady in May 2017, it has completed 14 new drill holes in confirming and expanding the Mineral Resource Estimate at the project.

Fort Cady resides in a highly prospective area for borate and lithium mineralisation. It is a highly rare and large colemanite deposit with substantial lithium potential and is the largest known contained borate occurrence in the world not owned by the two major borate producers Rio Tinto and Eti Maden.

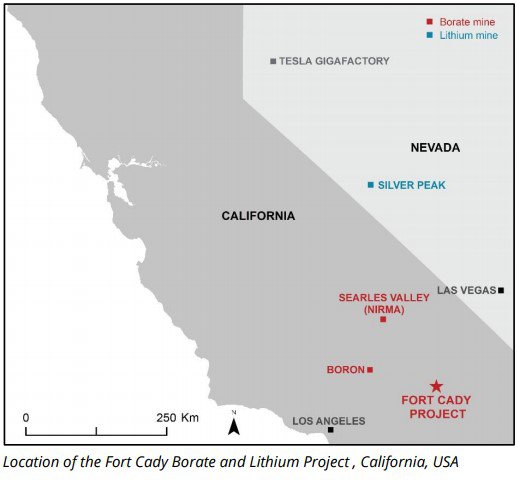

The project is located in the eastern part of the Mojave Desert region in San Bernardino County, California. It lies approximately 200 kilometres northeast of Los Angeles near the town of Newberry Springs.

The updated Total Resource now sits at 120.4 million tonnes at 6.5% B2O3 (11.6% boric acid equivalent [H3BO3]) and 340 ppm lithium (5% B2O3 cut-off) for 7.8 Mt contained B2O3 (13.9 Mt H3BO3).

It has a Total Indicated Resource of 58.59 Mt at 6.59% B2O3 (11.71% H3BO3) and 367 ppm lithium (5% B2O3 cut-off grade) for 3.86 Mt contained B2O3 (6.86 Mt H3BO3).

And a Total Inferred Resource of 61.85 Mt at 6.43% B2O3 (11.42% H3BO3) and 315 ppm lithium (5% B2O3 cut-off) for 3.98 Mt contained B2O3 (7.07 Mt H3BO3).

The Mineral Resource Estimate increased by 27.4 Mt from 93.0 Mt to 120.4 Mt and by 0.2% B2O3 from 6.3% to 6.5%. This represents a 30% increase in tonnes and a 3% increase in B2O3 grade. The contained boric acid increased to 13.9 Mt.

Yet it remains a speculative stock and investors and investors should take a cautious approach to any investment decision made with regard to this stock.

ABR Managing Director and CEO Michael Schlumpberger said:

“This is a large increase in contained boric acid to nearly 14 million tonnes and importantly there appears to be even more upside.

“This should support a substantial multi-generational operation, that will take advantage of elevated demand growth for a product that is favoured for energy efficiency applications like fibre glass insulation, energy generation technologies like solar PV modules and fertilisers that are used to enhance crop yields, water retention and disease resistance.”

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.