5 things you need to know about BKT’s latest acquisition

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

After much shareholder speculation, ASX-listed junior graphite player Black Rock Mining (ASX:BKT) has unveiled its plan to pick up more graphite tenements in Tanzania.

The seven contiguous tenements themselves, referred to collectively as the “Bagamoyo Project” are focused on coarse graphite flakes, with initial exploration firming up a “significant” coarse flake graphite zone of about 1km by 200m of outcrop.

They also cover a broad area of 1116sq.km, with four additional outcrops identified over a 7km area.

BKT has taken an option to acquire the tenements should early exploration work provide promising leads within a four month exploration window.

So what is BKT getting itself into?

Coarse graphite is good graphite

The defining characteristic of the new tenements is that it hosts coarse flake graphite, with flakes measuring 2mm to 7mm observed on average.

However, flakes of more than more than 10mm have also been observed.

In fact, this monster below has also been found in the area.

Mineralisation found at Bagamoyo

The rock above contains a 40mm graphite flake aggregate, which is the largest observed in Tanzania by BKT.

Based on its early exploration work, the graphite has a grade of about 7%, which is lower than its project at Mahenge, but BKT says it has the potential to be a premium product because of the very coarse flake size.

More exploration and analysis will be needed to prove up the hypothesis.

It’s close to infrastructure

While the rocks may be good in Africa, there’s always the threat of a lack of infrastructure to make projects unviable on the continent.

It’s an issue many companies have had to wrestle with before, especially juniors which don’t necessarily have the resources to build a lot of their own.

Luckily for BKT, the tenement area has excellent access to water and power.

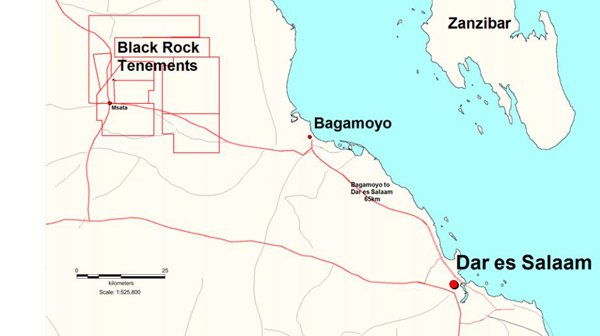

The location of the Bagamoyo Project

It’s just 125km north west of the Dar es Salaam Port, which gives BKT excellent access to market in the case of ultimate commercialisation.

The region itself has been producing graphite aggregates for a while now, so all the supply chains area already in place.

It will keep the exploration team busy

BKT’s other graphite project in the country centres around the Ulanzi prospect, which Finfeed has written about before on the back of promising exploration results.

It recently got back assays from 9 out of 17 holes it drilled into the prospect, including hits of:

- 92m @ 8.5% total graphitic carbon (TGC) including 12m @ 14% TGC

- 52m @ 10.4% TGC including 8m @ 13.81% TGC

- 32m @ 9.25% TGC including 10m @ 16.32% TGC

The assay results meant 1000m of the strike drill tested so far is consistently grading at about 10% TGC.

The results were enough to spur BKT onto a 30 hole infill drilling program.

However, with infill drilling taking place BKT has an exploration team sitting idle.

New exploration work means BKT will be getting more bang for its buck out of the exploration team.

It’s getting it for a song

One of the great things about the deal is that it’s back-loaded with most of the cash BKT putting forward to kick in once it gets close to commercialisation.

As part of a multi-step funding deal, BKT is putting in:

- $100,000 in exploration in the next four months

- $50,000 in a non-refundable deposit, plus 1 million shares

- $200,000 plus 4 million shares upon exercise of the option to acquire

Further payments kick in upon the declaration of a JORC resource and a net smelter royalty of 3%, but in terms of upfront costs BKT has managed to keep it low.

BKT will also be required to put $500,000 of exploration funds into the permit per year, meaning BKT will have plenty of exploration news to keep up with.

It positions BKT as a major graphite player in Tanzania

With this acquisition, BKT moves beyond being a one-project wonder and has added more to its plate.

It’s taken an early-stage position in another project, signalling a step-change from the company.

At the very least BKT’s managing director, Steve Tambanis, is excited by the potential.

“The acquisition of the Bagamoyo Graphite Project represents a significant strategic milestone and establishes the company as a major graphite explorer and developer in Tanzania,” Tambanis told shareholders this morning.

“Given the exciting nature of the mineralisation and the favourable location, the company has taken the opportunity to secure an extensive tenure position in the region.”

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.