Melbana Energy signs farmout agreement on Block 9

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Late on December 31, Melbana Energy Limited (ASX:MAY) signed a binding definitive farmout agreement with respect to its Block 9 Production Sharing Contract (Block 9 PSC) in Cuba.

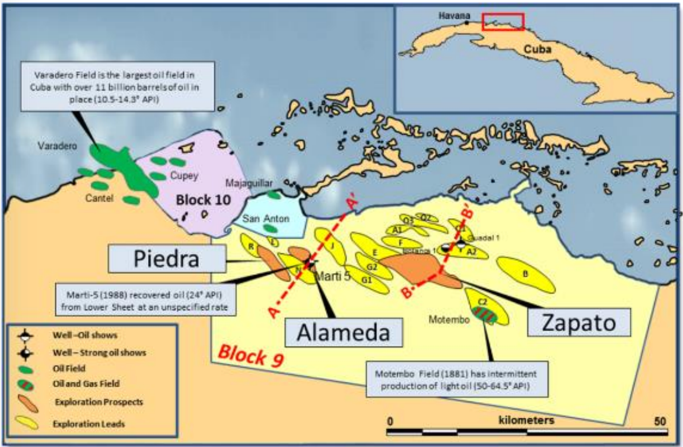

The deal will see the Alameda (140 million bbl target) and Zapato (95 million bbl target) prospects drilled by November 2019; a third well by July 2020, and it means MAY will be fully carried for 100% of all activities and costs for remainder of term of Block 9 PSC (20+ years).

The binding agreement is with Anhui Modestinner Energy Co., Ltd. (AMEC), a wholly owned and guaranteed subsidiary of Anhui Guangda Mining Investment Co. Ltd. (AGMI), and follows on from the Letter of Intent signed by Melbana and AGMI.

Under the terms of the deal, AMEC will fully fund all costs associated with the Block 9 PSC from 1 January 2019, including the drilling of at least three wells. The first two of these wells will be drilled by November 2019 on Melbana’s preferred exploration targets Alameda and Zapato.

In the event of a discovery, the third well may be either an appraisal well on Alameda or Zapato or, if no discovery, an exploration well on the Piedra prospect. In all cases, the third well will be drilled prior to July 2020. AMEC is also responsible for providing any required guarantees and will provide Melbana with 12.5% of any Profit Oil.

In the event of a development, Melbana will recoup its Block 9 back costs (approx. US$3.5M) over time from the Cost Oil in proportion to its relative spend versus AMEC.

The Alameda Prospect is currently the highest ranked exploration target in Block 9 PSC. Alameda is a large structure located in the western part of Block 9 and is in a similar structural position to the Varadero field, the largest oil field in Cuba, approximately 35km away. The proposed Alameda-1 well which will test a combined exploration potential of over 2.5 billion barrels Oil-in-Place and 140 million barrels of recoverable oil on a 100% unrisked, best estimate basis and 279 million recoverable barrels aggregate high side potential.

The primary objective at Alameda ranges in depth from approximately 3000 to 3700 metres. The presence of oil in the Alameda structure is supported by the Marti-5 well drilled within the prospect closure in a down flank position nearly 30 years ago and which recovered 24° API oil and had numerous oil shows extending over a 850 metre gross interval from the lower sheet section.

The proposed Zapato-1 well location is in the central portion of Block 9 and is designed to test a lower sheet closure in close proximity to the shallower Motembo oil field, which has historically produced a high quality light oil. The Zapato feature has a crest at approximately 2000 metres and is a robust structure with nearly 1000 metres of vertical relief.

Recently completed gravity and magnetic studies commissioned by Melbana and undertaken by Cuba’s specialist technical laboratory CEINPET over the Zapato prospect have indicated a strong gravity and magnetic alignment with the structural interpretation Melbana’s technical team derived from seismic and surface data. This result is supportive of Melbana’s assessment of the prospectivity of Zapato as a large carbonate duplex structure along strike from the Motembo discovery which produced light 56° API oil.

Melbana Energy’s CEO, Robert Zammit, said: “We are very pleased to end 2018 by finalising the binding farmout agreement and look forward with great anticipation to drilling our high impact oil prospects in 2019. Alameda and Zapato are significant multi-million barrel targets that will be drilled this year at zero cost to Melbana. Coupled with our recently announced Santa Cruz IOR project and our world class Beehive prospect in Australia, we see huge potential in our portfolio and look forward to an exciting year ahead.”

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.