Zinc of Ireland releases game changing exploration results at Kildare

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

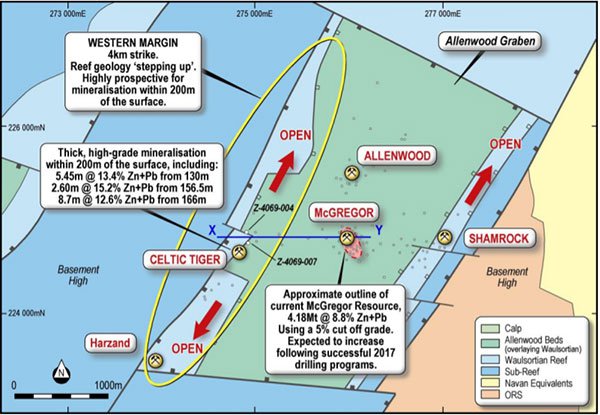

European base metals explorer Zinc of Ireland (ASX:ZMI) informed the market on Wednesday that recent diamond drilling at its Kildare MVT Zinc Project in Ireland had confirmed multiple zones of exceptionally high-grade zinc mineralisation in the shallower regions of the McGregor and newly discovered Celtic Tiger prospects.

This news prompted a 20 per cent share price rerating. However, this was off an arguably oversold base and with the prospect of further positive exploration news and sustained momentum in the zinc price there could be more upside to come.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Management pointed to the highly significant assay results from recently completed diamond drill holes Z_4069_006 (006), Z_4069_007 (007) and Z_4069_008 (008), which it believes clearly demonstrate the potential for shallower mineralisation at Kildare, transforming the outlook for the project and significantly upgrading its discovery and growth potential.

The reported drill holes each intersected multiple zones of mineralisation relating to faulting, brecciation and veining, including zones of massive sulphide development.

The results at Celtic Tiger, which is located approximately 1 kilometre to the west of the main Resource at McGregor, comprise multiple zones of mineralisation between 81.5 metres and 200 metres below surface, including 5.45 metres grading 13.4 per cent zinc and lead from 130.2 metres, 2.6 metres grading 15.2 per cent zinc and lead from 156.5 metres, and 8.7 metres grading 12.6 per cent zinc and lead from 166 metres.

The discovery of thick, high grade zinc mineralisation in close proximity to the surface at both the McGregor and Celtic Tiger deposits is highly promising in terms of ZMI expanding the resource and establishing an economically viable mining strategy.

Shallow mineralisation translates into low operating costs and the fact that the deposits are adjacent to each other is a positive in terms of upfront operating costs and the potential to establish a larger scale plant which can accommodate high volumes of ore.

ZMI’s Managing Director, Peter van der Borgh touched on these points in saying, “From an exploration perspective, this means cheaper and quicker drilling for shallower targets, while the presence of shallower, more accessible mineralisation will obviously translate into improved economics when we undertake future financial modelling of the project.”

Of course any data is speculative at this stage and investors should seek professional financial advice for further information if considering this stock for their portfolio.

He also highlighted the fact that these recent exploration results bring into play more than 4 kilometres of similar geology along the western margin of the Graben as illustrated below.

Looking at the bigger picture, van der Borgh said, “The style of mineralisation at Celtic Tiger has many similarities to the Base of Reef mineralisation at McGregor, and as a consequence, I believe we can be thinking of a substantial Exploration Target at Celtic Tiger which will complement our existing Inferred Mineral Resource at McGregor and Shamrock.”

He also noted that the extensions to the Base of Reef mineralisation at McGregor clearly point to the likelihood of an increase in the maiden Inferred Resource.

Extending the Base of Reef mineralisation at McGregor

Phase 3 of ZMI’s diamond drilling is a multi-pronged program designed to extend the Base of Reef mineralisation at McGregor, and follow up on the company’s previous intercepts of shallow mineralisation at McGregor and Celtic Tiger.

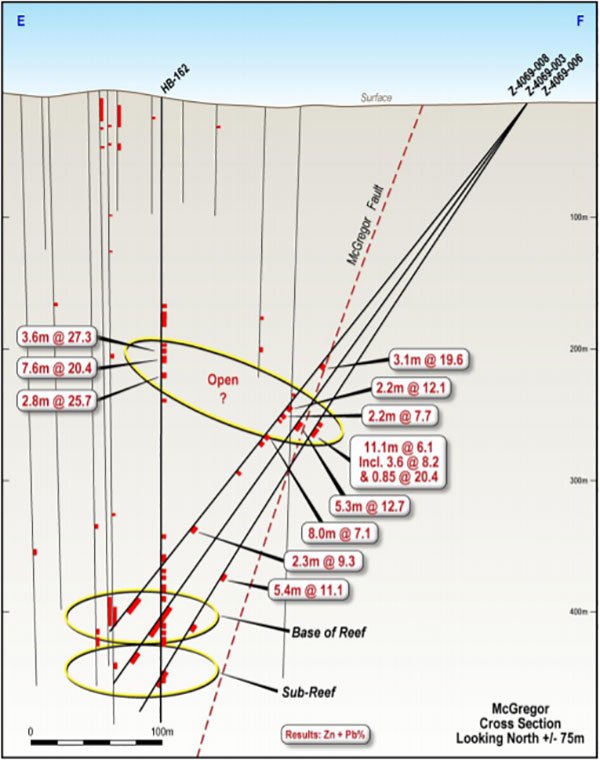

Two holes, Z_4069_006 and _008, were drilled at McGregor. The results from the Base of Reef intercept in Hole 008, comprising 11.19 metres grading 10.3 per cent zinc and lead from 423 metres, were reported on October 16 and the remaining assays from hole 008, and those from hole 006, were released today.

Of particular significance are the shallower results that appear to be spatially related to the recently discovered McGregor Fault, including 3.1 metres grading 19.6 per cent zinc and lead from 205 metres below surface.

Several other zones were intersected within 250 metres of surface in both drill holes. Three contiguous holes have now intersected this mineralisation which as indicated below may correlate with high grade mineralisation in historical hole HB162, approximately 100 metres to the south.

As, can be seen above 006 also intersected mineralisation comprising 5.36 metres grading 11.1 per cent zinc and lead from 366 metres towards the Base of Reef. ZMI said the Base of Reef contact was faulted in this hole, and a portion of mineralisation is likely to have been displaced.

Drill hole Z_4069_007 at the Celtic Tiger prospect was drilled approximately 100 metres south of hole Z_4069_004 reported in July, which intersected several zones of mineralisation including 2.85 metres grading 20.9 per cent zinc and lead from 194 metres.

As indicated above, the latest results are highly encouraging and confirm that the Kildare Project hosts significant zinc-lead mineralisation within 200 metres of the surface. In terms of geological characteristics, the Celtic Tiger mineralisation comprises zones of white matrix breccia (WMB) and calcite veining with abundant tan sphalerite (ZnS), marcasite (FeS2), and occasional galena (PbS) towards the base and at the base of the Waulsortian Reef.

This is significant in terms of ZMI’s prospects for future exploration success as the replacement of breccia clasts is common in many of the more mineralised horizons. Consequently, the mineralisation in Z_4069_007 resembles the mineralisation observed towards and at the Base of Reef horizon at McGregor, which hosts a significant component of the 5.2 million tonne Kildare Inferred Resource.

If the geometry of the mineralisation is also similar in terms of being sub-horizontal, it can be assumed that the intercepts in this vertical hole are close to true thickness, although management noted that this has yet to be confirmed.

Upcoming catalysts could drive share price higher

Drilling will continue at Celtic Tiger with up to three holes to be completed in the next six weeks. ZMI expects to complete an updated Mineral Resource estimate for the Kildare Project plus a maiden exploration target for the Celtic Tiger prospect by the first quarter of 2018.

As further exploration results come to hand analysts and investors alike will be crunching the numbers on the likely quantum of the mineral resource update which could result in sustained share price momentum leading up to the release of this data.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.