White Rock releases maiden resource for Red Mountain project

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

White Rock Minerals (ASX:WRM) has released its maiden independent Mineral Resource estimate for the Red Mountain project located in a highly prospective region of Alaska, 320 kilometres north of Anchorage.

The Statement of Mineral Resources compiled by RPM Global Holdings (RPM), formerly RungePincockMinarco Limited, is reported in accordance with the requirements of the 2012 JORC Code.

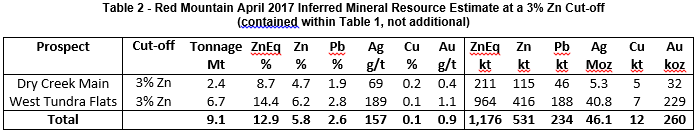

The mineral resource relates to WRM’s Dry Creek and West Tundra Flats deposits, part of the Red Mountain project. One of the most important takeaways was the sizeable high grade inferred mineral resource of 9.1 million tonnes grading 12.9% zinc equivalent for 1.2 million tonnes of contained zinc equivalent at a 3% zinc cut off.

RPM has provided some informal modelling based on potential open pit/underground mining strategies which FinFeed will examine after discussing the headline numbers.

While this does not constitute a scoping study, it provides some insight into options that may be open to WRM, as well as taking into account other variables such as different cut-off grades that could be deemed appropriate depending on management’s decision to opt for an open pit and/or underground mining strategy.

It should be noted here that WRM is an early stage play and investors should seek professional financial advice if considering this stock for their portfolio.

Headline numbers are impressive

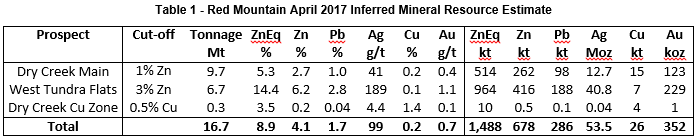

The total inferred mineral resource of 16.7 million tonnes grading 8.9% zinc equivalent for 1.5 million tonnes of contained zinc equivalent at a 1% zinc cut off for Dry Creek, 3% zinc cut off for West Tundra Flats and 0.5% copper cut-off for the Dry Creek copper zone highlights the fact that Red Mountain is a quality base and precious metal asset. It should also be noted that mineralisation commences at surface and is open down dip.

The Mineral Resource places the Red Mountain project in the top quartile of undeveloped high grade volcanogenic massive sulphide VMS (zinc, silver, lead, gold, copper) deposits globally.

Base and precious metal content includes 678,000 tonnes of zinc, 286,000 tonnes of lead, 53.5 million ounces of silver and 352,000 ounces of gold.

The cut-off grade was calculated to report the Mineral Resource contained and to demonstrate reasonable prospects for eventual economic extraction. A 1% Zn cut-off was used for Dry Creek in consideration that sufficient grades are obtained for the combined elements with a likely open pit mining method. A higher cut-off grade of 3% Zn as indicated below was used for West Tundra Flats in consideration of the likely underground mining scenario.

Commenting on the release of the maiden resource and reflecting on the implications for the broader project, WRM’s Chief Executive Matt Gill said, “Establishing a Mineral Resource estimate for the two deposits at Red Mountain underpins our belief that the Red Mountain project can be home to a new camp of high grade zinc-silver-gold VMS deposits”.

Gill highlighted the fact that the maiden Mineral Resource estimate validates WRM’s view on the potential for the district to yield further high-grade VMS deposits. On this note he said, “Our recent examination of the historical geochemical and geophysical databases using a combination of world experts in the fields of VMS mineralisation and electromagnetics has already identified 30 conductors that are associated with geochemical anomalism”.

WRM has only scratched the surface at Red Mountain

Indicating these recent results could just be the tip of the iceberg, Gill said, “We are highly encouraged by this initial Mineral Resource estimate, especially as it only encompasses a small portion of our total tenement holding, and we look forward to adding considerable additional discoveries in the near future.”

WRM is now preparing a program to advance the understanding of the project, focussing on the already defined geophysical targets that exhibit the same signatures as the two zones that have already been drilled.

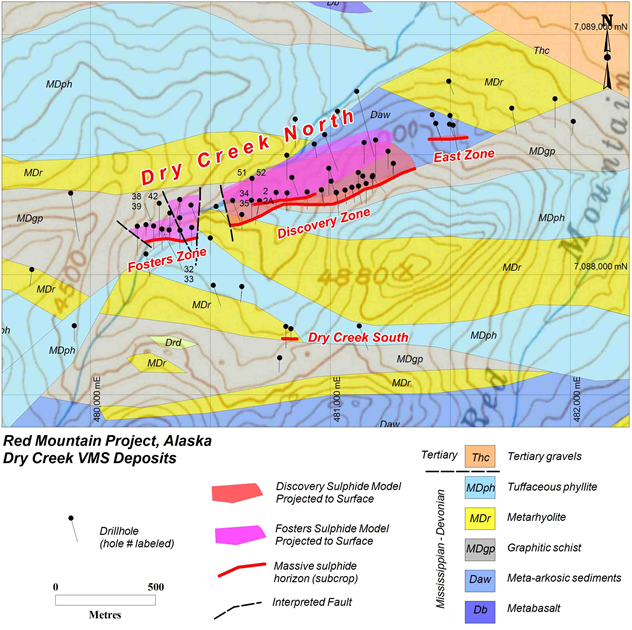

The high priority VMS targets are conductors located within zones of anomalous surface geochemistry that are indicative of proximal VMS mineralisation as illustrated below. The proposed field work will include surface geochemical sampling and ground geophysics to define drill targets for follow-up.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.