Vulcan releases maiden Indicated Resource at Insheim

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Vulcan Energy Resources Ltd (ASX:VUL) has announced the maiden Indicated Lithium-Brine Mineral Resource Estimate at the Insheim Licence in the Upper Rhine Valley of South-West Germany.

The Insheim Exploration Licence has been classified as an Indicated Resource because of the binding Memorandum of Understanding between Vulcan and Pfalzwerke geofuture GmbH, which permits access to the Permo-Triassic aquifer brine, and the enhanced understanding of the Insheim subsurface geology via seismic and well log data.

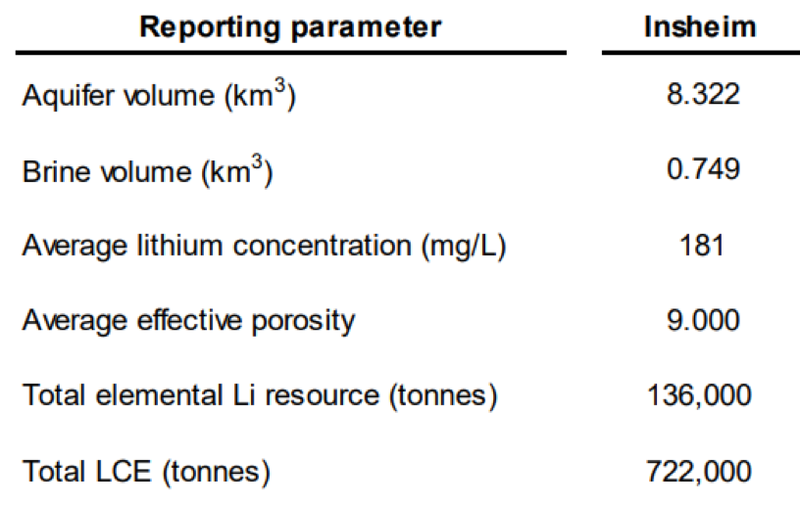

The maiden Indicated Vulcan Lithium-Brine Resource estimation for the Insheim Licence is estimated at 136,000 tonnes of elemental lithium as indicated below.

It should be noted that mineral resources are not mineral reserves and do not have demonstrated economic viability. There is no guarantee that all or any part of the mineral resource will be converted into a mineral reserve.

Vulcan has acquired direct access to lithium-enriched brine at the operating Insheim Geothermal Plant and Insheim Exploitation Licence via the MoU with Pfalzwerke geofuture GmbH.

The Insheim Geothermal Plant is currently pumping hot, high-flow, lithium-enriched brine from aquifer depths of nearly 3000 metres to the surface for power generation.

Pfalzwerke geofuture GmbH is not processing or extracting lithium as part of the power generation circuit before the reinjecting the brine into the reservoir.

The MoU grants Vulcan an initial collaboration period that allows access to the Insheim Licence brine and data, with a pathway to construct a lithium extraction demonstration plant at Insheim in the future.

The agreement marks a material milestone for Vulcan as the company has obtained access and a pathway to co-production lithium rights to lithium-enriched brine from within the deep aquifer underlying the Insheim Exploitation Licence.

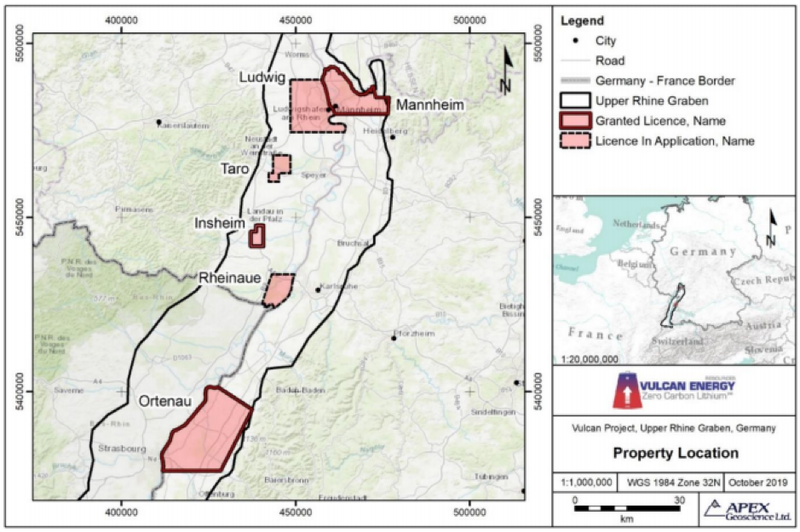

As indicated below, the Insheim Licence is 19 square kilometres and brings Vulcan’s total land position in the Upper Rhine Graben to 807.19 square kilometres.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.