Victory Mines identifies multiple mineralised structures

Published 27-JUL-2018 12:40 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Victory Mines (ASX:VIC) has provided a highly encouraging overview of its progress at its two Western Australia projects.

Preliminary desktop study interpretation of Aeromagnetic imagery has highlighted multiple prospective primary mineralisation-bearing structures for cobalt, nickel and copper across the Galah Well and Peperill Hill projects.

VIC non-executive chairman Dr James Ellingford commented on the update, “The Board is delighted the desktop study confirms the two West Australian projects are highly prospective for cobalt, nickel and copper mineralisation.

“In due course, a team will be sent to site to follow on key target areas.”

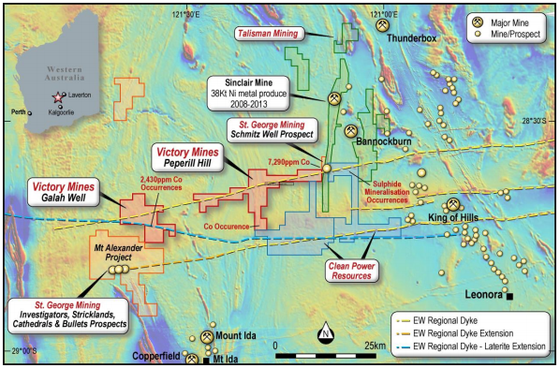

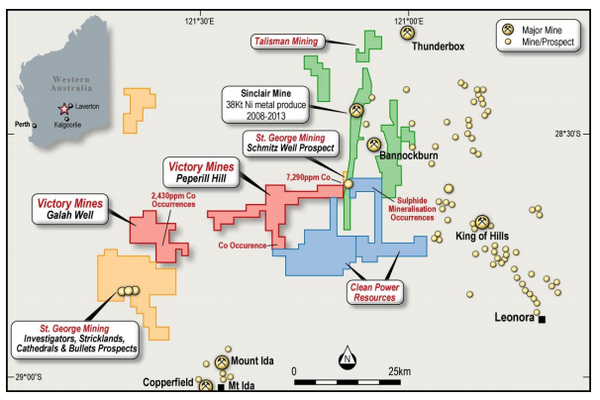

The projects are in close proximity to where two (potentially three) differing mineralised systems intersect (as seen below). VIC notes that this phenomenon largely explains why both projects are highly prospective for cobalt, nickel and copper mineralisation hosted within sulphides and laterites.

North-south shear zone

As seen above, there is a north-south trending shear zone/magnetic anomaly that runs between Talisman Mining’s (ASX:TLM) Sinclair Nickel Mine and St George Mining’s (ASX:SGQ) Schmitz Well prospect.

VIC’s Peperill Hill prospect is believed to feature several north-south trending structures which are similar in nature to the one connecting TLM’s and SGQ’s ground.

These structures are prospective for cobalt mineralisation, with verified occurrences within the Peperill Hill tenement.

The company noted that historic air-core drilling results suggested near-surface ultramafic units with elevated cobalt mineralisation, which confirms the project’s lateritic cobalt potential.

It should be noted that this is an early stage company, so investors should seek professional financial advice for further information if considering this stock for their portfolio.

East-west mineral province

The Galah Well and Peperill Hill projects are located within the Murchison Province of the Yilgarn Craton – a geological province traditionally recognised as a greenstone mineral province, with north-south trending shears controlling mineralisation.

However, several east-west structures (Widgiemooltha dykes) that cut across the terrain are gaining increasing interest for their mineralisation potential.

These structures are prospective for cobalt, nickel and copper sulphide mineralisation, with a preliminary desktop study detailing historic intercepts across VIC’s, SGQ’s and TLM’s ground suggesting a significant yet to be confirmed polymetallic mineral province.

Via aeromagnetic imagery, Galah Well and Peperill Hill are believed to be intruded by these dykes, which span their entire circa 60km length and are located within the newly claimed mineral province.

Secondary laterite potential

The Western Australian government mapping system has distinguished between the exposed and concealed dykes within the east-west trend.

VIC’s Galah Well project previously reported legacy assay results from an open borehole that featured 2m at 2,430ppm cobalt from the surface. The anomalous drillhole is located on a geophysical magnetic anomaly that trends approximately east-west across the project area.

The Widgiemooltha Ddykes were placed approximately 2,400-2,420Ma allowing sufficient time for the laterisation processes.

Because of this, the company believes the weathered near-surface features could present a lateritic profile that could open up free-dig mining operations.

In addition, the north-south trending shears that host the ultramafic lenses suggest lateritic potential within the region.

Most notably is the nearby Schmitz Well intercept, which had 2m at 7,290ppm cobalt from 34m, with the lithology recorded as saprolite.

Lateritic profiles are a key component of cobalt nickel from regolith, ultramafic bearing Greenstone belts within Western Australia.

Therefore, a potential economic lateritic development over the two mineralisations could be advantageous for VIC, leveraging early cashflow through low cost open-pit operations.

VIC concluded its update by reiterating that it will prioritise the finalisation of its inaugural drilling program at its NSW projects before progressing its WA assets.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.