Venus Metals adding highly prospective gold mining leases in WA

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

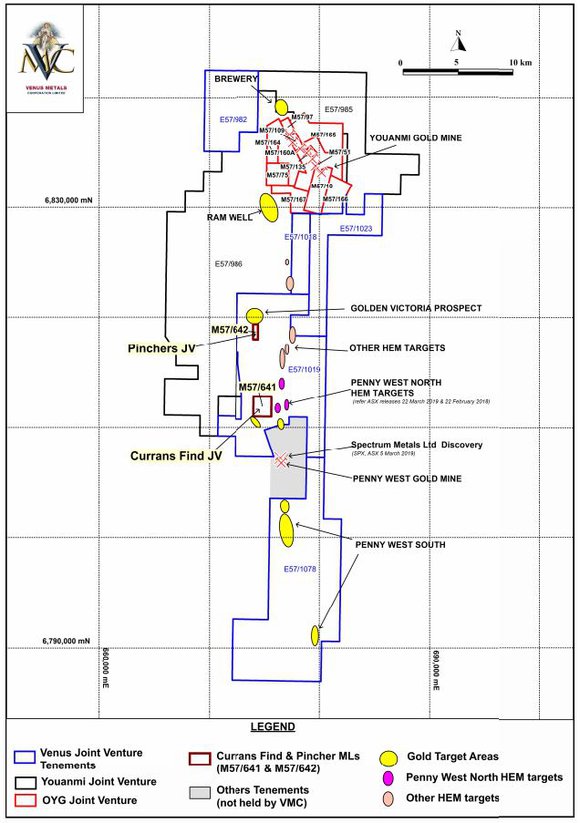

Venus Metals Ltd (ASX:VMC) have entered into a purchase agreement to acquire a combined 90% interest in two highly prospective tenements in Western Australia.

The tenements, owned by well-respected mining identity from Paynes Find, Mr Doug Taylor, and his wholly-owned company, Murchison Earthmoving and Rehabilitation Pty Ltd (MER), are the Currans Find (ML 57/641) and Pinchers (ML 57/642).

The deal comes about after Venus Metals built a strong working relationship with Taylor over the last five years.

VMC is purchasing a combined 90% interest in the tenements alongside joint venture partner Rox Resources Ltd (ASX:RXL), and will act as manager of the JV. Taylor will hold the remaining 10% stake.

VMC and RXL will pay for their equal shares in the tenements through a mix of cash and shares.

Having each paid a $5,000 deposit, VMC will issue 450,000 ordinary shares at $0.17 per share and pay $75,000 for its share of acquisition costs; and RXL will issue 7,500,000 ordinary shares at $0.01 per share and pay $75,000, to Taylor and MER, in equal shares at completion and settlement of the transaction.

Mr Taylor said, “I believe there are strong similarities with the geology at Currans Find and Penny West, so the discovery potential at Currans is, in my opinion, excellent. I have done the deal with Venus and Rox to become part of the bigger picture that Venus and Rox have now established at Youanmi with their excellent deal to jointly acquire the Youanmi Gold Mine with the aim of re‐establishing the gold mine.

“Venus has shown great tenacity and skill in assembling the Youanmi Gold Mine and its exploration tenement package, which Rox clearly recognized. It is now time to join that effort and bring the high‐grade Currans mine tenement into the bigger picture. The new Venus / Rox Currans Joint venture under Venus management can now get the drills going to test this potential.”

Mr Matt Hogan, MD of Venus Metals said on signing the deal “I wish to thank Mr Taylor for recognising our great efforts and his understanding of what is now transpiring at the historic Youanmi Gold Mine”.

Hogan confirmed that drilling will commence at Currans in about four weeks once approvals are in place.

Proximity to Penny’s West

The two tenements, Currans Find and Pinchers, are strategically important for VMC, located in the central part of the Youanmi Project within and surrounded by VMC-ROX joint venture tenements.

This is a highly prospective area as Currans Find lies along strike and only five kilometres from the high grade Penny West Deposit where a promising new discovery was made in early March, followed up by the release of outstanding early stage assay results, including 5.0 metres at 28.9 grams per tonne gold.

As indicated below, Pinchers lies five kilometres directly north of Currans Find.

Spectrum Metals Ltd (ASX:SPX) is operating that project, and the fact that its shares have increased seven-fold since the start of March speaks for itself.

Geology and gold mineralisation

Gold mineralisation at Currans Find is hosted in multiple ENE‐trending quartz veins within mafic and ultramafic rocks. These rocks are also host to the Penny West and Columbia –Magenta deposits south of Currans Find. It is a feature of the deposits hosted in the ultramafic rocks that they show significant high grades.

There are about 11 historically known quartz reefs associated with old workings and all are mineralised with a significant amount of gold. The auriferous quartz reefs are striking 040 degrees – 090 degrees and almost all of them are dipping to the south east. Many of these quartz reefs are either truncated or offset by sinistral faults or shears that could be also mineralized between offset reefs.

The information provided by Mr Taylor has identified new and important further auriferous quartz reefs, none of which have been tested.

Past Exploration

Surface rock chip sampling, underground sampling, and limited RAB and RC drilling has been conducted by previous tenement holders at Currans Find. VMC is now assembling this historical information prior to planning the first drilling campaign.

It is apparent from an early data review that nearly all drilling is shallow and that the considerable depth potential of the numerous reefs remains to be tested.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.