Untapped mineralisation at Hardey’s Nelly Vanadium Mine

Published 07-AUG-2018 13:00 P.M.

|

4 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

As Hardey Resources Limited (ASX:HDY) fast-tracks due diligence at the Nelly Vanadium Mine ahead of its decision to acquire the mine’s owner, Nelly Vanadium Pty Ltd (NVPL), it has revealed even more potential at the highly prospective project than first thought.

Teams from SRK Consulting and Condor Prospecting have moved quickly to commence the inaugural site visit to Nelly Vanadium Mine in Argentina’s San Luis Province, mobilising their teams to progress preliminary due diligence.

HDY has now received a report from SRK Consulting and Condor Prospecting highlighting key initial findings from the field trip.

The teams from SRK Consulting and Condor Prospecting set an aggressive agenda for the initial phase of the site visit at Nelly Vanadium Mine, which was mostly achieved.

Of course it should be noted here that there is still a great deal of work to do and investors should seek professional financial advice if considering this stock for their portfolio.

They set out to take numerous photos of the historic workings/stockpiles, processing plant, mineralised veins and surface samples then augment these with detailed commentary.

The initial focus of the visit was performed on the region which extends south-west from the road that passes through the project area, as seen on the map below.

Pre-site checks comprised reviewing regional geology, verifying accessibility and availability of power/water to the project area.

Key initial findings, other than a comprehensive survey of the entire project area and taking numerous photos, included:

- Discovery of nine stockpiles around the main open pit which are readily accessible and can be easily processed as a potential direct shipping ore product, if bulk sampling and metallurgy results are positive.

- Portions of mineralised veins up to 1.5m wide left untouched from historic mining operations within the open pit and shafts.

- Possible extension to the main open pit vein evidenced by surface outcropping circa 250m to the south-west, with no visible legacy workings apparent, that exhibits the same mineralisation.

- Numerous examples from across the project area that highlight vanadium mineralisation prevalence at surface.

Over the balance of the site visit, the teams will focus on geologically mapping the project area, ascertaining the extent of unexploited mineralised veins and quantifying the cumulative size of ore within the legacy stockpiles.

Close up satellite image of Nelly

Initial observations highlighted there are four shafts within the open pit and at least nine adjacent stockpiles. The team took preliminary measurements of the workings and stockpiles, which can be utilised to determine the potential volume of ore available for a direct shipping ore product.

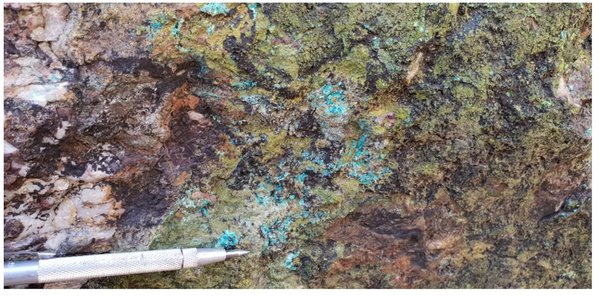

The mineralisation observed in the open pit vein and rocks in the stockpiles was consistent with hematite, pyrite, copper and black minerals.

There was a portion of the mineralised vein untouched by historic mining operations which is 1.5m wide and on the north wall of the main open pit. Notably, it extends for 30m and ranges in height from 1m to up to 2.5m.

About 200m to the south-west of the main open pit, a small dig (2m x 2m x 0.5m) was identified over an extension of the mineralised vein. Notably, there were clasts of quartz with veinings and breccia portions surrounding this small working area.

A closer look at the vein in the main open pit, shows yellow and greenish minerals which are probably vanadates. The blue minerals are from copper and oxidized veins probably hematite carrying copper and zinc minerals.

A further 50-70 to the south-west of this small working area, another vein outcropping (with no workings) was identified. It carried significant hematite and oxides, with the same style of mineralisation as the other veins within the project area.

The team also observed the ruins of the historic production plant including pits, furnace oven, ditches, living quarters and administrative offices. Interestingly, next to the plant was some oxidised material (2m x 4m x 0.5m) that requires analysis on the next field trip.

HDY Executive Chairman, Terence Clee commented, “Without question, SRK Consulting and Condor Prospecting have moved rapidly to mobilise their teams to Nelly Vanadium Mine to progress preliminary due diligence.

“Having reviewed the initial findings, the Board is highly encouraged to have confirmation the stockpiles are readily accessible and visible evidence of unexploited mineralisation. The Board looks forward to receiving further newsflow from site as it materialises.”

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.