Turner River results to support production at Wingina

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

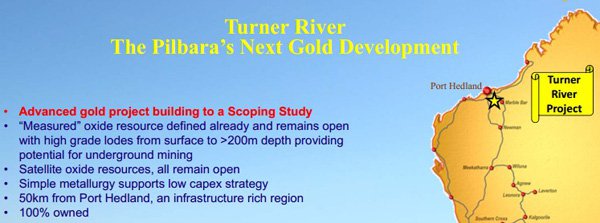

With the overall Wingina drilling program now finalised, De Grey Mining (ASX: DEG) has released further drilling results confirming shallow high grade gold lodes at Turner River located 50 kilometres south of Port Hedland in the Pilbara region of Western Australia.

DEG is currently assessing the most advanced prospects within the Turner River project that are considered likely to provide further additional open-pittable gold resources which will support the proposed Wingina development.

Consequently, the encouraging drilling results released in relation to Turner River on Tuesday are significant in terms of the company’s progression from explorer to producer.

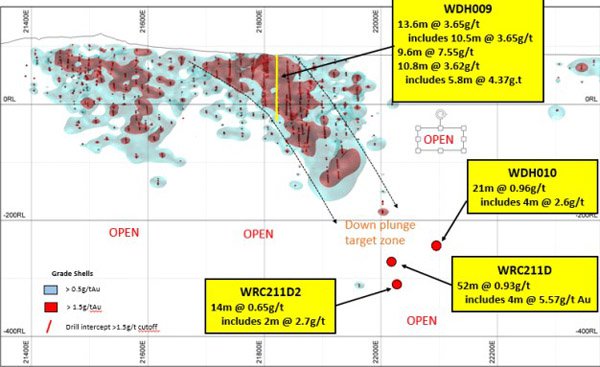

The results included 13.6 metres grading 3.6 grams per tonne including 10.5 metres grading 4.4 grams per tonne. There was a particularly strong return delineated from 70.5 metres which featured 9.6 metres grading 7.6 grams per tonne.

Management also highlighted that deeper drill holes confirmed extensions to the East and at depth, demonstrating an envelope of lower grade gold mineralisation hosted in a thick shear zone, now termed the Wingina Shear Zone which shows internal high-grade extensions to a depth of 350 metres.

There is a significant share price catalyst on the horizon for DEG with the company expecting to provide a resource update on Wingina in October. This will focus on high-grade lodes identified in recent months.

However, it should be noted that exploration results are not an indication of a company’s prospects of moving to commercially viable production, and as such shouldn’t be used as a basis for an investment decision. Seek professional financial advice for further information about the company.

Given DEG is a relatively small company in the early stages of exploration it can be prone to commodity price volatility and should be considered a speculative investment.

That said, the following outline of exploration success to date holds promise for the future.

In terms of the recent drilling campaign it is worth noting that high-grade lodes were continuous over the entire 600 metres strike length, an important factor in terms of assessing future mining optimisation options.

Management highlighted that structural information underlying today’s results was limited due to the oxide material and highly variable recoveries achieved while drilling. This resulted in the second planned hole being deferred until additional equipment can be used to improve recoveries.

The upside to this development is that due to core losses the drill results can be viewed as the minimum gold intercept for that interval as the missing core is classed as a zero gold grade when calculating the combined intercepts.

It is reasonable to assume that this is probably not the case and therefore the grade would increase if the missing core was mineralised.

The Wingina gold deposit currently has a Total Mineral Resource Estimate of 268,000 ounces of gold, including 156,000 ounces in the measured category and 48,000 ounces in the indicated category.

Based on exploration results to date DEG considers the Wingina deposit will most likely be developed as an open pit and underground mining operation with additional ore sourced from satellite open pits within economic trucking distance.

The Mount Berghaus (43,000 ounces) and the Amanda (35,000 ounces) gold deposits, both located within 10 kilometres of Wingina, are expected to provide additional ore feed.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.