Trek Metals on track to start zinc drilling in June

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Finfeed presents this information for the use of readers in their decision to engage with this product. Please be aware that this is a very high risk product. We stress that this article should only be used as one part of this decision making process. You need to fully inform yourself of all factors and information relating to this product before engaging with it.

Following 12 months of exploration, Trek Metals (ASX:TKM) is now preparing to commence its maiden exploration drilling programme during June 2018 in Gabon.

The company has undergone a program of constant re‐interpretation and re‐examination of historic data and combined with its own exploration, has found excellent opportunities for an open pit zinc and lead discovery.

“It was obvious during my recent site visit to Kroussou that the guys have been working extremely hard in preparation for drilling, following unavoidable delays due to rain, and continue to unlock the historic data package to assist with our drill targeting,” Trek's Managing Director Bradley Drabsch said. “The Nzahou target is a prime example of where BRGM has left us a great opportunity to quickly piece together a significant zinc‐lead resource at Kroussou.”

Examples from drilling the Nzahou target have found the following:

- 8.2m @ 7.7% Zn + Pb from 13.6m in DK040 (Hist)

- 16.0m @ 4.3% Zn + Pb from 11.0m in DKDD001 (TKM)

- 12.5m @ 6.2% Zn + Pb from 3.9m in DK156 (Hist)

- 15.8m @ 3.3% Zn + Pb from 19.1m in DKDD008 (TKM)

This target remains open down-dip and along strike towards TKM’s Mgene target to the west and the Mbome target to the east.

Each target is considered to have excellent potential.

It should be noted that TKM is an early stage play and anything can happen, so seek professional financial advice if considering this stock for your portfolio.

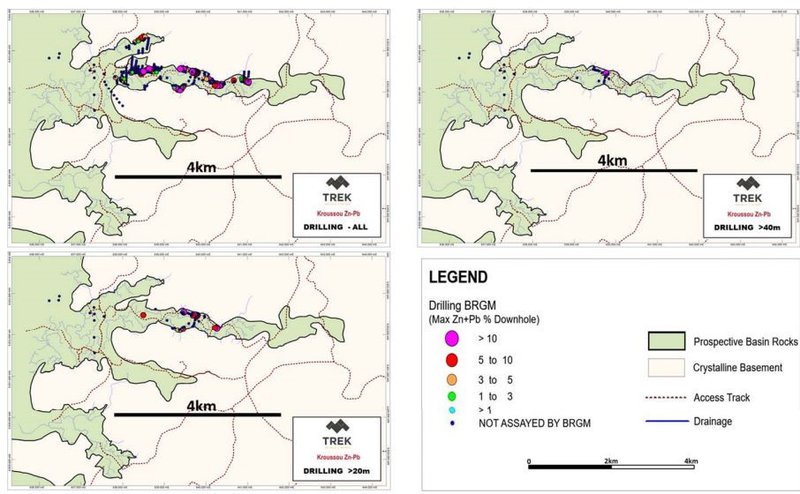

TKM will build on BRGM’s past exploration in the knowledge that historical drilling only targeted the delineation of lead deposits within the top 20 metres of surface and gave little attention to the zinc potential, nor the depth potential of the numerous significant zones of mineralisation that were discovered.

The figure below shows historic drilling conducted by BRGM was limited to very shallow holes and their interest in lead mineralisation.

The down‐dip potential of the mineralisation at Nzahou was not investigated or was not encountered due to the shallowness of the drilling. A more in-depth analysis of Kroussou can be found in the Next Mining Boom (a related entity of S3 Consortium) article Trek Metals Nabs Potential Zinc-Lead Behemoth: Drilling in Weeks.

Trek has shown that with complete hole assaying, the metal content is far greater than that indicated by the BRGM work. This is evidenced by TKM’s drillhole, DKDD001, indicating a much broader zone of mineralisation than suggested by the historic drilling.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.