Top notch team assembled ahead of Vulcan Zero Carbon Lithium Project PFS

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Vulcan Energy Resources Ltd (ASX:VUL | FRA: 6KO) today announced the appointment of an international team of experts to support its Pre-Feasibility Study (PFS) at the Vulcan Zero Carbon LithiumTM Project in Germany.

Vulcan has defined one of the largest lithium resources in the world at its lithium-rich geothermal brine project in the Upper Rhine Valley of Germany, where it plans to produce a world-first Zero Carbon LithiumTM hydroxide product to supply the growing local market for batteries and electric vehicles manufacture.

The appointments for the PFS are as follows:

Global engineering and consulting (gec-co) GmbH for engineering studies for geothermal plant. The German geothermal engineering company has extensive geothermal surface power plant design experience in Germany and worldwide, including in the Upper Rhine Valley where the Vulcan Project is located.

GeoThermal Engineering (GeoT) GmbH for geology and hydrogeology, geothermal sub-surface well design and production study. GeoT GmbH is a German geothermal geology consultancy, based near the Vulcan Project in the Upper Rhine Valley. It has broad and successful experience in development of the sub-surface part of geothermal projects.

IBZ Salzchemie GmbH & Co for chemical engineering. This German chemical engineering consultancy has expertise in handling of geothermal brines and in chemical engineering for brine pre-treatment processes.

Hatch Ltd. for the design and engineering studies for lithium plant. Hatch is a tier-one, international engineering consultancy with unique experience in geothermal lithium brine developments. It is an industry leader and has a recent track record of successful lithium plant engineering, procurement and construction (EPC).

APEX Geoscience Ltd. for resource modelling and estimation. APEX Geoscience is a consultancy with over 25 years of diverse geological consulting experience, including modelling of deep, confined aquifers with lithium-rich geothermal brine. It conducts 3D geological modelling, resource estimation and National Instrument 43-101, JORC and SAMREC compliant Technical Reporting.

Optiro Pty. Ltd., a resources consulting and advisory group, for financial modelling. Optiro has extensive expertise in commercial advising of clients throughout the resources cycle with emphasis on geological, engineering, and financial operations.

The PFS will be further supported by Vulcan Executive Director Dr Horst Kreuter, a geothermal expert and German geothermal industry veteran; newly appointed Director Dr Katharina Gerber, a geothermal lithium and battery chemistry expert; and VUL CTO Direct Lithium Extraction (DLE) Alex Grant, co-founder of DLE company, Lilac Solutions that was recently backed by Bill Gates’ Breakthrough Energy Ventures fund.

Vulcan Managing Director, Dr Francis Wedin, commented:

“We have assembled a highly credentialed technical team for our Vulcan Zero Carbon LithiumTM Project PFS. The team combines world-class expertise and a proven record of success in lithium plant engineering, direct lithium extraction, geothermal surface and sub-surface engineering, brine chemistry treatment and geological modelling.

“Securing highly respected German consultants and team members to lead this study provides a breadth of knowledge in the local conditions, which is critical to achieving our goal of supplying the EU battery market with Zero Carbon LithiumTM products from 2023. We look forward to providing further updates on the PFS work shortly.”

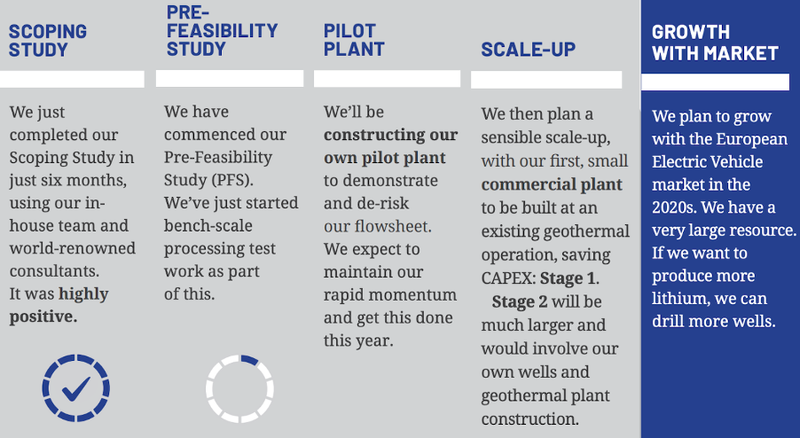

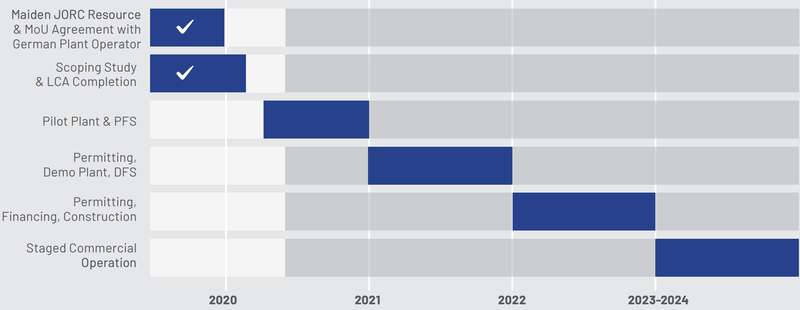

The upcoming PFS and planned pilot plant follows a positive Scoping Study and Life Cycle assessment (LCA) that was successfully completed in February and sees the project remain on track for first commercial scale production in 2023.

Lithium test work for the PFS has already commenced and the company has signed an agreement to acquire a 3D seismic package to accelerate project development. Vulcan has also secured EU backing for the Vulcan Zero Carbon LithiumTM Project via its partnership with EIT InnoEnergy to help to unlock funding, including that from EU and national grant schemes.

VUL has been a standout performer of late, up 70% in just the past two weeks. The stock has now gained 190% since 1 January, making it the world’s best performing lithium stock YTD.

Further updates on the progress of the PFS are expected soon as bench-scale lithium extraction test work and pilot plant engineering is ongoing.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.