Superior Lake delivers outstanding grades

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Superior Lake Resource Ltd (ASX:SUP) has released a Maiden JORC (2012) Resource for the Superior Lake Project of 2.15 million tonnes at 17.7% zinc, 0.9% copper, 0.4 g/t Au and 33.5 g/t Ag.

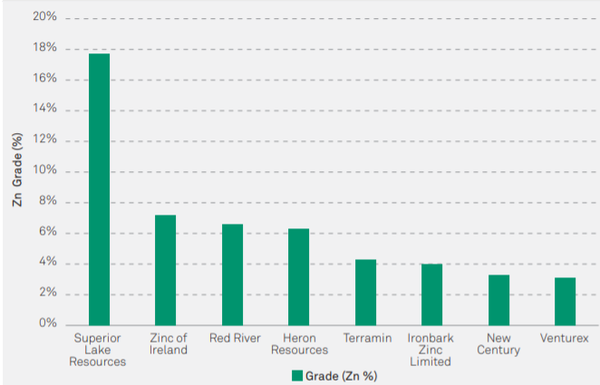

These metrics are outstanding by global standards, particularly in terms of the zinc grade of 17.7 per cent.

Grade of 17.7 per cent zinc blitzes global peers

Chief executive David Woodall is rightly upbeat regarding the resource definition saying, “This is an excellent achievement for the company as this resource has exceeded expectations on all accounts.

“Most notably with a zinc grade of 17.7 per cent, in addition to copper, gold and silver by-product credits, Superior Lake ranks as one of the highest-grade zinc projects in the world.

In addition, with the resource exceeding 2 million tonnes and over 90% within the indicated category, we believe this is sufficient to commence a re-start study immediately.”

It should be noted that SUP remains a speculative stock and investors should seek professional financial advice if considering this stock for their portfolio.

The outstanding grade is evident in the following ASX peer comparison of companies with established zinc and zinc equivalent grades.

The quality of the resource has been recognised by investors as the company’s shares spiked 37.5 per cent in the first 15 minutes of trading.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Region is well known for high grade ore

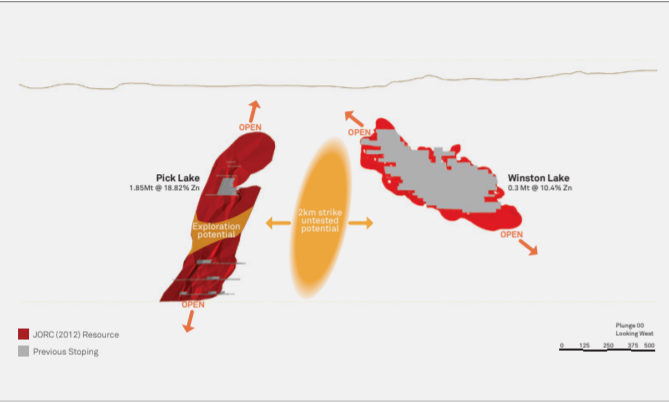

SUP is focused on the redevelopment of the Superior Lake Project which incorporates the Winston and Pick Lake mines.

The region generally ranks these deposits amongst the highest-grade zinc deposits globally.

Situated in Ontario, Canada the project benefits from being located in one of the best mining jurisdictions in the world.

Existing infrastructure to assist in expediting project

There is also significant infrastructure in place which includes underground mine development to the existing mineralisation, tailings dams, site power connected to the grid and an all-weather road.

The project historically produced over 3 million tonnes of ore up until 1999 when mining was suspended due to low commodity prices.

However, the decision to suspend mining was made when the zinc price was at US$0.42 per pound, well below the recent highs of more than US$1.60 per pound.

Even after the recent moderate retracement it is still trading at more than three times the level that it was when the mine was closed.

Importantly, more efficient mining methods and the ability to access ore at greater depths will provide scale and add further to the economic viability of the project.

Potential to add significantly to resource

There is also significant exploration upside to Superior Lake, another chapter in a highly promising story that has the potential to drive further share price momentum.

Superior Lake has completed a key milestone with the completion of the JORC 2012 Resource and a 3D model.

This 3D model is important given that there hasn’t been any follow-up on previously identified geophysical (EM) conductors.

This will assist the company in determining targets for the planned brownfield exploration programs.

Potential to access mineralisation below current depths

Other work will include structural mapping, modern geophysics and geochemical methods as part of the planned program.

Superior Lake will commence the planning and implementation strategy to test and understand the true potential of this highly prospective VMS deposit.

This will include downhole geophysical programs using existing surface holes to test up and down plunge extensions of both the Pick and Winston Lake deposits, and to test the 2.2 kilometres of prospective ground between these deposits as indicated below.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.