Stonewall’s Theta Hill gold project progressing well

Published 23-APR-2018 12:00 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Stonewall Resources Limited (ASX:SWJ) has updated shareholders on its exploration progress at its Theta Hill project, which is part of the TGME gold project in South Africa.

SWJ is confident it can delineate high grade open‐cut oxide ore reserves at Theta Hill this year, and refurbish and upgrade the fully permitted TGME CIL plant, so it can rapidly re‐start gold production in 2019. Costings for plant refurbishment at the TGME processing plant are now being finalised.

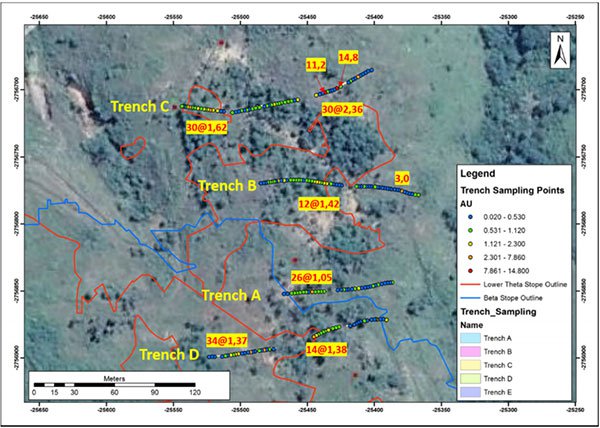

Theta Hill continues to develop open cut potential with RC drilling and trenching results on the adjacent DG4 section yielding positive results including:

- Trench C, 122m at 1.3g/t gold

on Bevett’s mineralisation, including

- 2m at 14.8 g/t gold and 2m at 11.2 g/t gold (lateral sampling)

- RC Drilling (RCBH DG4LT8) 4m at

4.3 g/t on Bevett’s mineralisation, including

- 1m at 12.4 g/t gold (vertical sampling)

- RC Drilling (RCBH DG4B6) 1m at

5.6 g/t on Beta mineralisation.

Trenching at the DG4 target, which is adjacent to Theta Hill, has yielded positive grades from the Bevett’s seam exposed at surface.

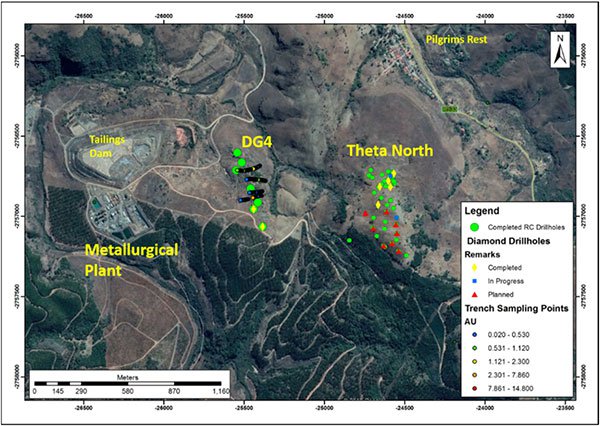

This DG4 area is part of the Project Bentley Theta Hill project and is only 700 metres from the TGME CIL process plant and tailings dam, as can be seen on the map below:

Of course, as with all minerals exploration, success is not guaranteed — consider your own personal circumstances before investing, and seek professional financial advice.

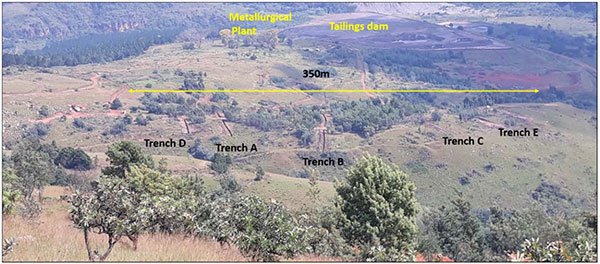

The below is a photo looking west, that shows DG4 trenches and TGME Metallurgical facility in background:

An RC drilling rig is also being mobilised for the first week of May to advance the evaluation of the depth extent of Bevett’s that has been exposed by five trenches, as well as to undertake infill drilling at the DG4 and the underlying Lower Theta and Beta Reef targets.

The target gold zone at the DG4 area has a low strip‐ratio, and represents the first possible mill‐feed target ahead of pre‐stripping activities being considered at Theta Hill.

A second diamond drill rig is on site to assist with Theta North drilling program, following which it will be relocated to the DG4 area to advance the resource drilling for this area. Diamond drilling meterage rates have been below expectations to date with slow progress due to the highly fractured and variable ground conditions including voids in the dolomite and broken ground. This second rig will improve on the daily drill meters achieved so that SWJ can complete the program on schedule.

Theta Hill DG4 trenches with gold grade distribution:

Planning is underway to commence drilling at Vaalhoek during the second quarter of 2018, where a maiden JORC (2012) Inferred Resource of 617Kt at 16.88 g/t gold (for 335koz) was confirmed on 24 March 2018.

SWJ is also reviewing the Columbia Hill area and continues to define new targets for planned drilling, hoping to define additional open cut reserves before open‐cut mining commences in 2019.

Stonewall MD Rob Thomson said: “Slower than expected drilling conditions at Theta Hill are part of the reason such large amounts of high grade gold reef were left behind by past underground miners who simply could not safely extract these near surface, oxidized, broken up reefs in these areas.

“We are confident with modern open‐cut mining techniques we will be able to recover much of this material left behind. We remain committed to rapid delineation of high grade gold reserves to underpin a re‐start of the TGME plant in the quickest time possible and thank shareholders for their ongoing patience and support of our strategy.”

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.