Stonewall Resources announces new open-cut discovery

Published 09-MAR-2018 12:11 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Stonewall Resources (ASX:SWJ) has announced a third open-cut discovery at the historical Vaalhoek site, with a maiden high grade open-cut 17g/t gold resource (82% inferred, 18% indicated).

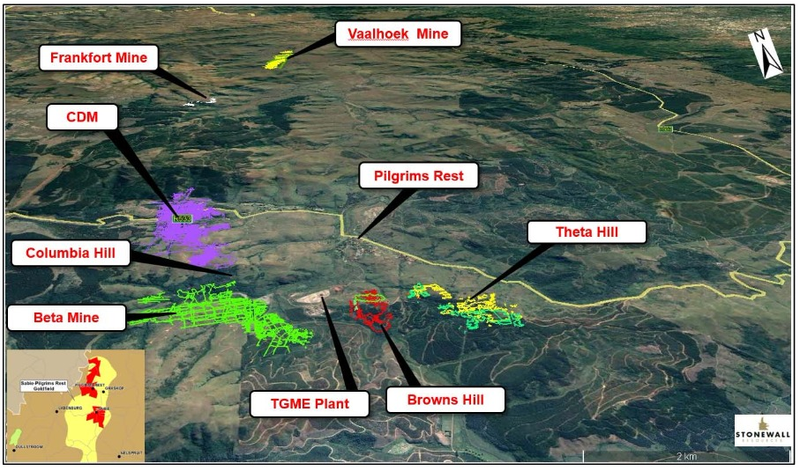

Vaalhoek (below) is SWJ’s third open-cut target after Theta Hill and Columbia Hill, with the resource upgrade forming part of an overall annual JORC review of the region which will be completed by the end of April this year.

The previous JORC (2004) resource was an underground prospect, coming in at 1.35Mt at 5.74g/t gold for 248Koz (100% inferred).

The updated JORC (2012) underground resource was calculated at 2.68Mt at 5.3g/t gold for 457Koz.

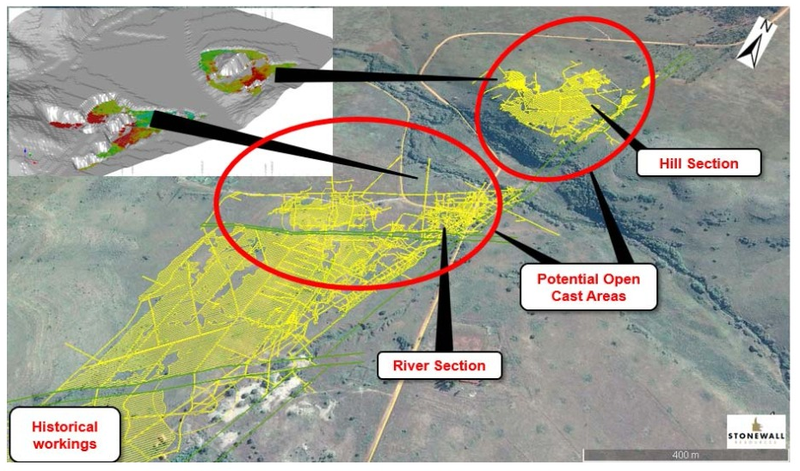

The 2018 upgrade comprised data collection, digitisation, modelling of 3D wireframes and eventual statistical estimation which led to the significant upgrade for the inferred and indicated Mineral Resource at the Vaalhoek Reef.

The maiden resource is an integral part of the successful Project Bentley to identify potential high grade open-cut opportunities with near term production potential.

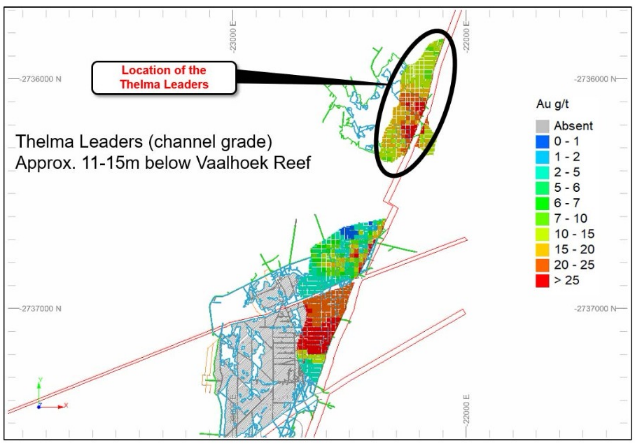

In addition, a maiden 134Koz open-cut resource at over 14g/t gold has been included from the high-grade Thelma Leaders Reef (below) which is located situated between 11m and 15m below the Vaalhoek Reef.

Now, at the same time, it should be noted that this company represents a speculative investment and those considering this stock for their portfolio should seek professional financial advice before making a decision.

SWJ believe these high gold grades could support an open-cut mine at the site, which would reduce overall development costs in comparison to an underground development in the same region.

As a result, the company will commence infill drilling which will facilitate an in depth examination of the project from an open-cut perspective. A preliminary mining schedule and scoping study breakdown will then follow.

SWJ Managing Director Rob Thomson commented on the highly promising development, “The investment by Stonewall into a complete re-assessment of the geological potential of the tenement area with a recent focus on open-cut targets, continues to uncover excellent opportunities.

“This maiden high-grade open-cut resource demonstrates the potential for multiple open cut mines in the area,” he said.

“With an additional open cut resource expected within the coming weeks from the Theta Hill drilling currently underway, the company is starting to build towards multiple high grade, low capital intensity open-cut deposits and we plant to be in a position to begin plant refurbishment and submit mine plans in 2018.”

Preliminary metallurgical sampling

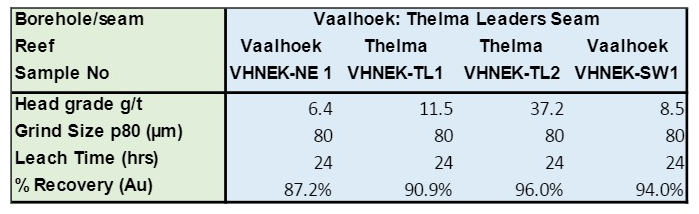

SWJ also provided an update on its metallurgical grab samples taken in February 2018.

The samples were recovered from old underground sections of the Vaalhoek project area, with two coming from the Vaalhoek Reef and the other two from Thelma Leaders Reef.

The samples were submitted to SGS Laboratories for gold recovery estimate in a simulated CIL environment.

Across the samples, head grade varied from 6.4g/t to 37g/t gold, yielding an average of 92% gold recovery (as seen below).

About the Vaalhoek Reef Project

The Vaalhoek Project is situated approximately 20km from SWJ’s fully permitted CIL plant.

Local residents across farms and the small townships of Pilgrim’s Rest, Sabie and Graskop are largely supportive of mining re-commencing in the area.

Prior underground mining took place between 1910-1956, with 1.3Mt extracted at an estimated head grade of 11.7g/t and production of 473Koz.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.