Sovereign Gold surges 25% as it flags the start of drilling at Halls Peak

Published 03-NOV-2016 14:10 P.M.

|

2 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

There is the potential for market moving news to emerge over the next days and weeks as Sovereign Gold (ASX: SOC) commences drilling at the company’s highly prospective Halls Peak-Gibson project located in New South Wales.

The company’s initial drill program is planned for more than 1000 metres of diamond core and if results are positive the program will be expanded.

SOC is targeting potential Direct Shipping Ore (DSO) high grade zinc and silver. This is founded on the company’s progress to date which has included the delineation of zinc grading up to 32.8% and silver grading 48.2 grams per tonne.

Halls Peak is the inferred volcanic centre for extensive small but high-grade volcanic massive sulphide (VMS) deposits rich in copper, lead, zinc and silver.

SOC is reasonably confident that surveying has potentially located sulphide deposition, but economic grades and tonnage are yet to be proven.

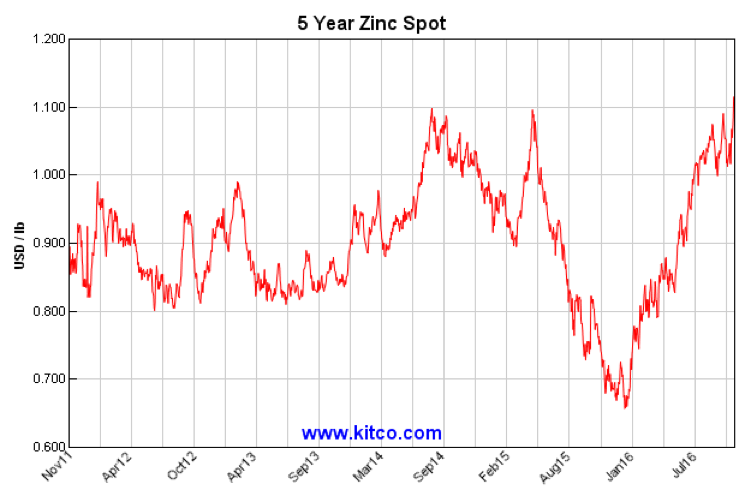

Zinc dynamics looking strong

As can be seen in the chart below, the zinc price has surged in 2016, hitting a five-year high in the last week. With the likelihood of a sustained rally driven by improving supply/demand dynamics over the next three years, the prospects of identifying commercially viable zinc projects have improved significantly.

Furthermore, should evident start to emerge regarding the possibility of developing a high grade project with strong margins, SOC’s share price could undergo a significant rerating.

However, investors should not make assumptions regarding exploration activities, and independent financial advice should be sought if considering this stock.

SOC’s managing Director, Rocco Tassone, said he expects the drilling program to be completed in four weeks, after which drilling will commence at the group’s Mt Adrah gold project, also located in New South Wales.

Mt Adrah gold project offers further upside potential

The drilling program has been designed to follow 3D modelling of gold bearing structures. Management is of the view that there is the potential for a high margin mining operation focusing on gold mineralised quartz reefs.

The drill program is intended to establish an inferred resource with a focus of moving towards early cash flow by developing a near surface/high-grade operation.

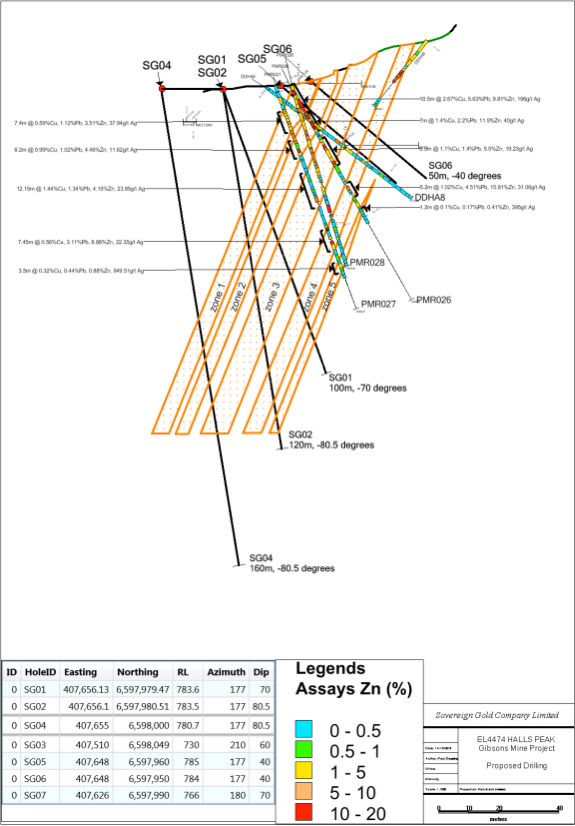

While there is the potential for promising news to stem from the Mt Adrah project, the near term focus is on Halls Peak. A schematic of the target is outlined below.

It would appear that the market is preparing for promising newsflow in relation to this drilling campaign with SOC’s share price rallying 25% in early morning trading.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.