RTR’s option deal to acquire historic Nemesis gold project

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Rumble Resources Ltd (ASX:RTR) today announced it has signed a binding option agreement to acquire the Nemesis high-grade gold project, which comprises 141.6 hectares of tenements 40 kilometres north of Cue in the Murchison Goldfields of Western Australia.

The company recently added the Earaheedy high-grade zinc project and the Munarra Gully high-grade copper gold project, and is now adding the Nemesis project to its portfolio.

All of the projects will be drilled tested this calendar year, along with the RTR’s Fraser Range projects (being drilled by the company’s JV partner IGO). With so much exploration happening at once, RTR’s shareholders could see multiple near-term share price catalysts should any of the programs make high-grade discoveries.

Historic high-grade gold production at Nemesis

Nemesis was mined for gold from 1900-1910, and produced 7157 ounces of gold from 2276 ton of ore — 98 g/t gold grade.

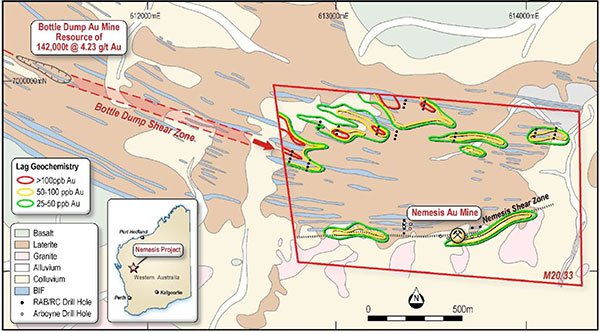

The Nemesis Shear Zone that hosts the Nemesis gold mine is prospective for mineralised strike and depth extensions with potential to host high-grade shoots similar to the Nemesis ore body. Previous drilling campaigns focused on defining shallow oxide mineralization, and as a result no drilling has tested the depth extension of the Nemesis deposit below 40 metres.

The Nemesis Shear Zone also contains near-surface laterite/saprolite mineralization, and the northern portion of the tenement contains a series of high-order gold in soil anomalies.

The below map shows the Nemesis Project’s location, surrounding geology and previous drill holes:

Most of the project covers land over a prominent lateritic plateau, which rises some 35 metres above the general topography. An east-west trending mineralised shear zone forms the boundary between the north sequence of mafic volcanics/BIFs and granites to the south.

Of course, as with all minerals exploration, success is not guaranteed — consider your own personal circumstances before investing, and seek professional financial advice.

RTR’s plans for exploration

During the option period RTR plans to undertake several drilling programs, circa April 2018, which will target high-grade gold lodes at the Nemesis mine area.

Having inspected the Nemesis u mine and the nearby Bottle Dump mine, RTR has identified that the high-grade gold mineralisation is associated with steep east-plunging shoots within steep north-dipping shear zones. Previous prospectors targeted the shallow strike gold mineralisation along the shears as opposed to the high-grade dip length extensive shoots.

RTR intends to map out the plunge extent of the known mineralisation to generate drill targets in the near-term, and subsequently fast-track RC drilling of identified targets.

Terms of the option agreement

RTR has signed a binding 12-month option agreement with Stonevale Enterprises Pty Ltd to acquire an 80% interest in the Nemesis project with the following terms:

– RTR to expend a minimum $60,000 before it can withdraw from the option agreement

– RTR to pay 1-year of rent and rates for the initial option period

– Rumble can extend the option for a further 6 months for $25,000 in cash payment to Vendor

– Rumble can exercise the option to acquire 80% of the project by paying A$250,000 in cash or RTR shares at any time during the 12-month option period

– Vendor is free carried to BFS

– Following the completion of a BFS and decision to mine, Vendor can either elect to contribute to ongoing project development or dilute to a 1% NSR

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.