RTR gears up for Fraser Range drilling, close to mining giant Vale

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Rumble Resources Limited (ASX:RTR) is gearing up for a diamond drilling campaign in the prolific Fraser Range.

The Fraser Range is presently one of the hottest exploration areas in Australia, following the massive nickel discoveries made by Sirius Resources there in the past few years.

A long list of circa 20 small explorers are vying for the next significant nickel discovery in the Fraser Range. But it’s not just smaller explorers drawn to the region. Such has been the attractiveness of the area that Brazilian mining giant and leading nickel producer, Vale, has entered the fray in the past two months.

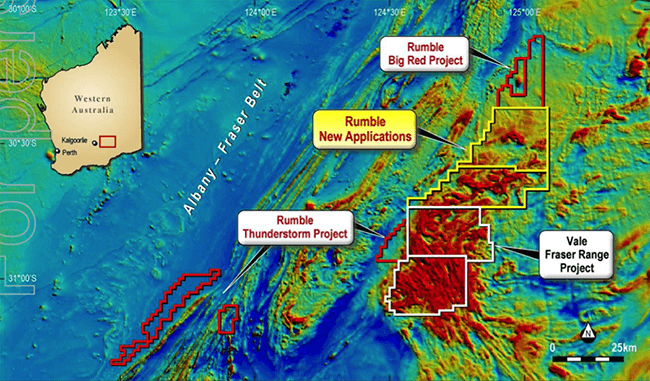

This is big news for RTR shareholders, as the ground Vale has taken up is adjacent to RTR’s Big Red Project in the Fraser Range.

RTR, with a current market cap of $5.5M AUD, has three projects in Western Australia’s Fraser Range – Zanthus, the Big Red and Thunderstorm – targeting nickel sulphide deposits.

With a small market cap and drilling activities in the coming weeks, any significant discovery in the Fraser Range could herald significant uplift to RTR. But like all exploration, luck will play a part.

This is exactly what happened to Sirius Resources. With a similar market cap a few years ago at $6M AUD, Sirius Resources’ discoveries of Nova, Bollinger and Polar Bear deposits catapulted their market cap to $1.3BN AUD.

Facilitating RTR’s chances are its recent promising exploration results. At the Zanthus Project, multiple bedrock conductors were discovered in September 2014 during ground-based electromagnetic (EM) surveys. Due to these discoveries, additional EM surveys have been planned beyond the original schedule.

Five conductors have been identified in the RTR ‘eye’ target from the EM surveys. The ground-based EM targeted priority areas in the Zanthus Project, one of which was the attractive ‘eye’ feature. An ‘eye’ feature is one that includes’ mafic intrusive complexes that have nickel, copper and platinum bodies. Sirius Resources’ Nova deposit was discovered by drilling into an ‘eye’ formation, and hence the ‘eye’ feature at Zanthus is a top priority.

RTR’s Big Red Project also has a key target of interest – a 2.2km feeder structure that exhibits high conductivity and magnetic properties. Diamond drilling is scheduled to commence in three to four weeks.

RTR has one of the largest footprints in the Fraser Range amongst ASX listed companies, with current acreage at approximately 3200km2, more than double Sirius Resources’ 1400km2. RTR’s large footprint can be attributed to the new exploration applications granted over the past few months, with the recent application for exploration licences increasing RTR’s Fraser Range presence by 71%.

Shane Sikora, CEO of RTR, said, ‘Our systematic exploration approach continues to generate compelling nickel sulphide targets at our Fraser Range projects providing our shareholders with the best chance of finding the next major nickel discovery. To identify significant bedrock conductors across an eye feature of similar size to the Nova “eye” has been an exciting development. Combine this with the interpreted Voisey’s Bay feeder system at our Big Red project and our low market cap, Rumble offers considerable leverage to exploration success.’

Zanthus electromagnetic surveys identify bedrock conductors

Zanthus is the southernmost project in RTR’s Fraser Range projects, covering 1363km2. Zanthus consists of three adjacent tenements located just 18km east of Sirius Resources’ massive Nova deposit.

The systematic survey program was announced in May 2014, starting with an airborne survey of tenements in the Fraser Range. Using an airborne aeromagnetic survey, the company also identified several additional areas to survey in within a structural corridor. This additional acreage occupies an area of 14km by 5km, exhibiting large intrusive features and high magnetic readings.

Once the airborne survey was completed, the more accurate ground-based EM survey began in August 2014 in the Zanthus tenement. The ground-based EM initially covered seven areas, as shown by the star symbols in the diagram above, with one area being identified as a high priority conductive ‘eye’ feature.

RTR ‘eye’ identifies five bedrock conductors

The ‘eye’ feature is of key interest as ‘eye’ targets typically indicate the presence of nickel, copper or platinum. The size of the RTR ‘eye’ feature is estimated to be 2km by 1km, which is of similar size to the massive Nova deposit ‘eye’ operated by Sirius Resources.

Five bedrock conductors have been identified from the ground-based EM on the RTR ‘eye’. Importantly, three of the five bedrock conductors exhibit significant conductance and are located at relatively shallow depths. Initial analysis shows that the depth of the three highly conductive zones – named ZC1, ZC2 and ZC3 – are approximately 100-200m below surface.

The three zones showing high conductivity and shallow depth will be prioritised in the next phase of drilling.

The remaining two conductive zones – named ZC4 and ZC5 – will undergo further ground EM surveys to determine the depth, conductivity, strike and dip.

Big Red 3D magnetic modelling shows potential drilling target, expands tenement

The Big Red, north of the Zanthus and Thunderstorm tenements, also has a potential drilling target in a feeder structure that exhibits both high conductivity and magnetic qualities. The target is a 2.2km feeder structure similar to Vale’s Voisey Bay deposit – one of the most significant nickel discoveries in the past few decades.

RTR is currently in final negotiations with contractors for drilling. Drilling is tipped to commence in approximately three weeks, with approvals being expedited to meet the drilling schedule.

RTR Resources has also increased its footprint in the Big Red project. The Bid Red project is now 1491km2, increased from 308km2 previously.

RTR applied for strategic exploration licences next to the existing Big Red acreage, increasing the Fraser Range acreage by 71%. The new areas are situated next to the new applications made by Vale in the past few months.

Vale’s entry into the Fraser Range is also notable due to the fact that the type of nickel mineralisation found at Sirius Resources’ Nova deposit has been likened to Vale’s Voisey Bay nickel mine in Canada. Moreover, the Voisey Bay-style nickel mineralisation was thought to not have existed in Australia prior to the Sirius Resources’ Nova deposit discovery.

Given Vale’s history of nickel production, RTR’s new Big Red tenements contiguous to Vale’s tenements can be viewed as being favourably located.

Nickel market’s positive long-term outlook

Like all commodities, the long-term outlook for nickel is reflective of demand and supply forces. A supply squeeze in recent times has created upward price pressure on the metal. In January 2014, Indonesia imposed an export ban on unprocessed ores. This combined with a supply squeeze caused by geopolitical tensions in Russia and increased demand in China points to a higher nickel price over the medium and long-term.

A higher long term nickel price suits RTR well – especially if they can make a significant discovery on one of their projects.

RTR’s next steps

RTR’s recent progress both at Zanthus and the Big Red have generated strong targets for the next phase of EM surveys and drilling. The systematic approach taken by RTR appears to help identify key bedrock conductors in the most attractive rock formations.

RTR’s profile of large ground holdings, a promising Zanthus ‘eye’ feature and an attractive Voisey Bay-style feeder structure combined with a low market cap provide significant upside potential. A positive long-term nickel forecast only adds an additional layer to RTR’s story.

RTR has flagged that it will continue to systematically survey the Fraser Range tenements prior to commencement of the first drill program. Drilling will involve air core drilling to help determine the geology of the area and identify key targets. Diamond drilling will be used on priority targets, once identified.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.