Results in for Stonewall’s Theta Hill gold prospect

Published 24-JAN-2018 12:44 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

ASX gold junior, Stonewall Resources (ASX:SWJ) today updated the market with results from preliminary metallurgical testwork on reverse circulation (RC) drill samples from its Theta Hill prospect in South Africa.

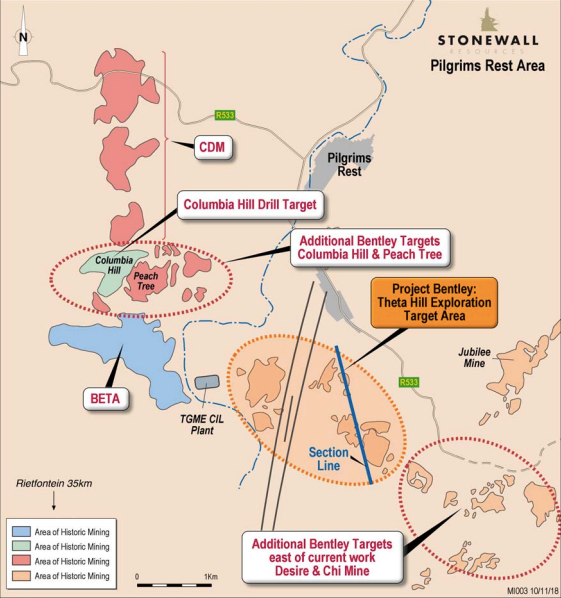

The Theta Hill prospect is part of SWJ’s TGME Gold Project, which is situated next to the historical gold mining town of Pilgrim’s Rest in Mpumalanga Province, some 370 kilometres east of Johannesburg by road or 95 kilometres north of Nelspruit (the capital city of Mpumalanga Province).

Location of Theta Hill exploration area (Source: Stonewall)

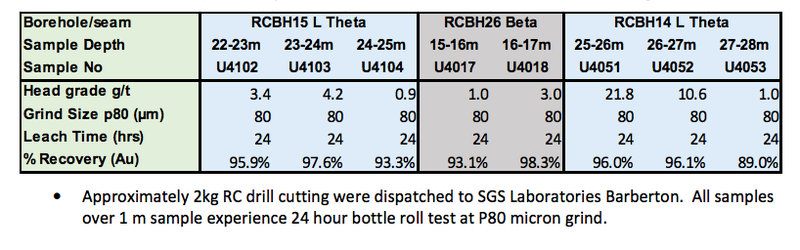

Tests show an average recovery from bottle‐roll cyanidation tests of 94.9 per cent from eight samples. Additionally, there was an average of 95.7 per cent recovery from Beta Reef (two samples) and 94.7 per cent recovery from Lower Theta Reef (six samples). These preliminary results, combined with the recent discovery of high-grade, potential open‐cut gold reef at both Theta Hill and Columbia Hill, supports the plan for near‐term gold production.

It should be noted though that SWJ remains a speculative stock and investors should seek professional financial advice if considering this stock for their portfolio.

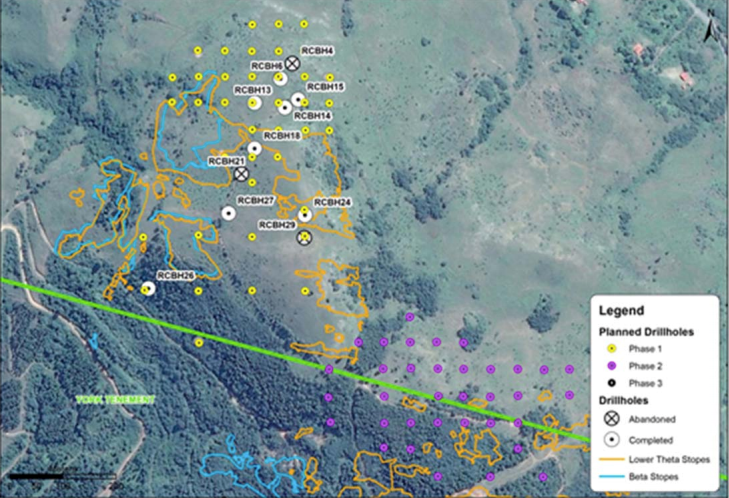

Plan view of Theta Hill Phase 1 drilling (Source: Stonewall)

Stonewall managing director, Rob Thomson said: “These preliminary metallurgical tests from the recent RC drilling campaign at Theta Hill show excellent recoveries for conventional milling with cyanide extraction, and fit with our plans to recommence gold production using the existing CIL plant fed with high grade, oxidised ore.

“We are very encouraged by both the high-grade drill results to date, and this early testwork, and look forward to continued drilling and establishment of reserves in 2018, along with expanding our resource base as new discoveries continue to be made,” Thomson said.

Theta Hill — metallurgical analysis

The direct cyanidation tests were carried out by the SGS laboratory at Barberton, South Africa, from samples collected in the drilling campaign conducted at Theta Hill in December last year.

These tests have been designed to test likely amenability of ores to gold extraction via a conventional cyanide leaching circuit, similar to that owned by SWJ at TGME.

Summary of bottle‐roll test results from Theta Hill RC drilling (Source: Stonewall)

As part of the exploration campaign planned (Phase 2) at Theta Hill and Columbia Hill, further drilling with RC and diamond methods will be undertaken, along with further metallurgical analysis as part of plans to declare maiden reserves in 2018.

SWJ’s current focus is to delineate a high-grade oxide resource, in close proximity to the existing CIL plant, for an early low‐capital start‐up option — with most of the capital expected to be invested into plant refurbishment.

SWJ announces placement under SPP shortfall offer

SWJ has also announced that it has received commitments for the placement of 119,963,682 shares (subject to rounding) at $0.019 per share and 119,963,682 free attaching listed options (subject to rounding) to raise A$2,279,310.

The options will be of the same class as the existing listed option, and will be exercisable at $0.03 each on or before 31 October 2020. This placement is being made under the shortfall offer pursuant to the share purchase plan prospectus, dated 2 November 2017.

Funds raised will be used to advance SWJ’s core gold project in South Africa, administration and corporate costs and working capital. The directors reserve the right to place the balance ($3.8 million) of the shortfall from the SPP offer by 6 March 2018 (within three months of the SPP closing date).

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.