Red Mountain Mining: A$46 million of free cash flow from Batangas Gold Project

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

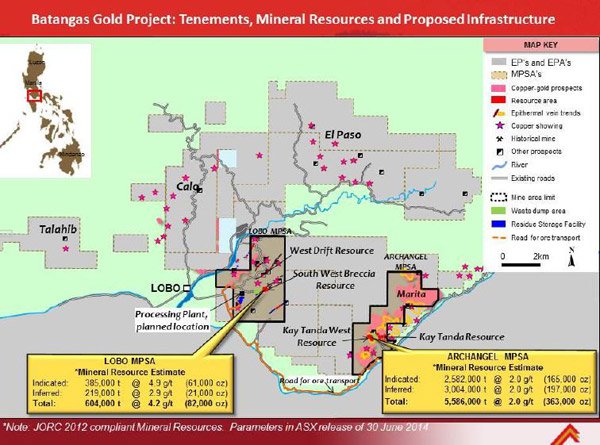

Western Australian based gold exploration company Red Mountain Mining (ASX:RMX) has released the results from their Pre-Feasibility Study of its Batangas Gold Project.

The findings of the study show that RMX’s flagship Batangas Gold Project will generate A$46 million in free cash flow during the first 7 years of production (after capital and pre corporate tax & admin. at gold price of A$1,700 oz).

With only $22 million of up-front investment required to get the project off the ground.

Located 120km south of Manila in the Philippines, the mine is expected to recover 116,000 oz of gold during the first 7 years of production, with an additional 26,000 oz of recoverable gold added in this latest PFS, which was not originally identified in the 2014 Scoping Study of the area.

The project is expected to generate A$190 million in revenue from gold sales, A$117 million of costs will be spent in the Philippines and A$13 million in royalties and taxes will be paid to the Philippines government and local communities during the initial 7 years of production.

RMX announced that their Maiden open pit ore reserve at Batangas contains 128,000 oz of gold including high-grade 100,000 oz at 4.2 g/t gold, including silver credits.

Due to the open pit nature of the mine, RMX is able to access the resource from the surface resulting in a relatively low cost per ounce of only A$999 per oz.

With these healthy margins, RMX will have a buffer built in should the gold price for any reason fall and is also positioned to leverage any upside moves in gold as well, gold trading today at A$1,740 per oz.

Cashflow generated could be used by RMX to further expand on the resource which is showing an additional 320,000 oz of gold inferred which was picked up in the study, including 14km of identified mineralised structures at Lobo.

Managing Director of RMX, Jon Dugdale had this to say with the release of the PFS:

“This is the culmination of the detailed work undertaken by both the Company and the team of high-quality Australian consultants during the last 18 months.

This Pre-Feasibility Study demonstrates the low operating costs, high margins and strong cashflow potential of the Batangas Gold Project.

The high initial ore reserve grades from surface, averaging over 6.6 grams per tonne gold for the South West Breccia pit, will allow this project to achieve strong early cash flows and a high rate of return on initial capital.

In addition, there is potential to expand ore reserves through drilling of the over 320,000 ounces of additional, mostly inferred, resources and upside potential remains to be tested within the 14 kilometres of identified epithermal gold structures at Lobo.

The JV partners are now aiming to complete the Definitive Feasibility Study on the Batangas Gold Project by this calendar year.

The JV partners very much look forward to developing the Batangas Gold Project, which will deliver major positive benefits to the people of Lobo and the Batangas region, as well as the Batangas Joint Venture partners.”

Based on the positive results of the PFS, the Batangas Joint Venture (BJV) partners, RMX and Bluebird Merchant Ventures have approved the study and move into the next step which is to complete a Definitive Feasibility Study on the site, followed by attaining financing to advance the project into production phase.

Final permits to allow development of the Batangas Gold Project are currently being progressed through the Philippines Government approval process.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.