Recovery of high-value green diamonds has the potential to rerate MED

Published 15-MAR-2017 09:42 A.M.

|

2 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Merlin Diamonds (ASX:MED) announced on Tuesday that it had recovered five green diamonds from the Kaye pit, amongst them ‘intense greens’. The largest green diamond recovered as seen below was 1.4 carats.

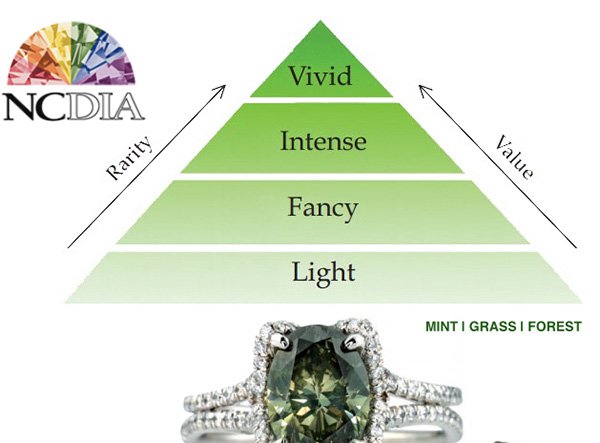

Pure green diamonds are extremely rare and highly valued, ranging from light mint green to vivid grass greens. These can contain a yellowish, bluish or greyish modifying colour.

Only a handful of natural green diamonds are introduced into the market each year, making them some of the most sought-after of all natural coloured diamonds. Green diamonds are predominantly found in regions of Africa and South America.

Consequently, for MED to have discovered green diamonds at its Merlin mine is not only significant in terms of the standalone value of the stones, but also the profile of the mine as its potential to yield green diamonds (and blue) is taken into account in terms of asset valuation and investor attraction.

However, it should be noted that MED is a speculative mining stock, and investors considering this stock for their portfolio should seek professional financial advice before making an investment decision.

Strength of colour an important price determinant

MED’s reference to an ‘intense green’ colour is particularly encouraging as this places it near the top of the value chain in terms of overall green diamonds. This is demonstrated below.

Management said yesterday that more green diamonds have been recovered from the ongoing operations at Merlin, and are being validated by independent experts. The results of these valuations could represent a potential share price catalyst.

As mentioned the recovery of these green diamonds comes on the back of the previous discovery of a rare blue diamond in December 2016, demonstrating the mine’s potential for producing valuable coloured diamonds.

MED also announced that it is currently raising $5.5 million via an entitlement issue which is fully underwritten by Triple C stockbrokers.

Merlin boasts a stellar history

Merlin Diamonds is the owner of the Merlin diamond mine in the Northern Territory, Australia, which is famous for producing large, high clarity, super white and high value diamonds.

Australia’s largest diamond, a 104.73 carats stone, was discovered at Merlin. MED also holds extensive exploration ground in and around the Merlin diamond mine, and the group is actively working to extending exploration for additional sources of diamonds.

Ashton Mining and Rio Tinto completed five years of mining at Merlin diamond mine between 1999 and 2003, processing over 2.2 million tonnes of ore to produce more than 500,000 carats.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.