Raven Energy provides promising Tulainyo update

Published 08-JAN-2018 11:27 A.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Energy junior, Raven Energy (ASX:REL), previously Magnum Gas & Power (ASX:MPE), has today provided the market with a pleasing update on its progress at the Tulainyo 2-7 gas appraisal well in northern California’s Sacramento Basin.

Post-well evaluation indicates multiple potential gas pay zones. The project operator, Gasfields LLC, interprets up to 56 metres (183 feet) of potential gas pay in sandstones.

Planning for a critical flow test program is also now advanced.

This serves as a considerable milestone for the $9.69 million-capped REL, which has a 20 per cent stake in the project.

Although, it should be noted that this is still an early stage project and investors should seek professional financial advice if considering this stock for their portfolio.

Recent progress in the Sacramento Basin

After drilling as planned to a total measured depth of 5,710 feet (1,740.4 metres), the Ensign Rig 587 was demobilised from site, the well cased and suspended, and preparations are currently underway to return to site with a gas production testing unit.

Detailed analysis of the well data has been conducted for the primary section of interest within the Early Cretaceous Lodogo Formation. This analysis indicates multiple stacked sandstone units, varying as expected in thickness and quality, and are all gas saturated. The well encountered gross sandstone reservoir thicknesses of up to 118 metres (386 feet), with estimated, net gas pay of 56 metres (183 feet). Higher quality reservoir units exhibit porosities ranging from 15-20 per cent.

The Tulainyo Project and California’s hungry gas market

The Tulainyo Project is situated in the prolific Sacramento Basin, around 120 kilometres northeast of Sacramento. It is held under leases covering some 40,000 net acres (152 square kilometres), and is positioned just eight kilometres from a major gas transport trunkline that supplies gas from Canada into the enormous Californian domestic market.

Notably, California only produces a sixth of its annual gas demand, and is expected to import 98 per cent of its natural gas requirements by 2025.

The state consumes on average some seven billion cubic feet of gas per day (that’s 2.6 trillion cubic feet of gas per year), and up to 11 billion cubic feet of gas per day during peak periods. Gas prices also attract a premium to the USA benchmark Henry Hub pricing.

The joint venture

The Tulainyo JV includes the project operator, California Resources Production Corporation (NYSE:CRC), one of California’s largest oil and gas producers, as well as Cirque Resources LP, a private company based in Denver, Colorado.

REL’s interest is held by its own 60 per cent owned subsidiary, Gasfields LLC. At completion of the farm-in earning program, it will have an effective 20 per cent interest across the project.

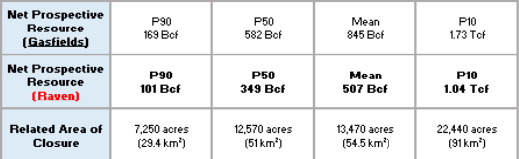

Estimated recoverable gas resource potential (Source: Raven Energy)

Gasfields representative John Begg said: “We made an initial release of the well results when total depth had been reached and the zones of interest cased off and preserved for testing. Since then, evaluation of the well data, in particular the wireline logs, has progressed.

“We are now more confident that the entire section of interest is gas saturated and sandstone reservoirs of sufficient quality to support commercial scale flows of natural gas are present. We still need to prove this via flow testing and will have more to say about the test program once finalised.

“From the outset, we have viewed this as a potential play opening well. If we are successful with the test program, we have a real shot at proving up at Tulainyo what Gasfields believes has potential to be the largest new, conventional gas project in California in many years,” said Begg.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.