Raiden Resources pens US$31.5M deal with Rio Tinto

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

This product is classified as ‘very high risk’ in nature due to its location and geopolitical situation of the region. FinFeed advises that extra caution should be taken when deciding whether to engage in this product, however if you are not sure whether it is suitable for you we suggest you seek independent financial advice.

2018 has been a busy year for Raiden Resources Limited (ASX:RDN). The company completed a successful capital raising if $5 million under a public offer before being re-instated on the ASX in February.

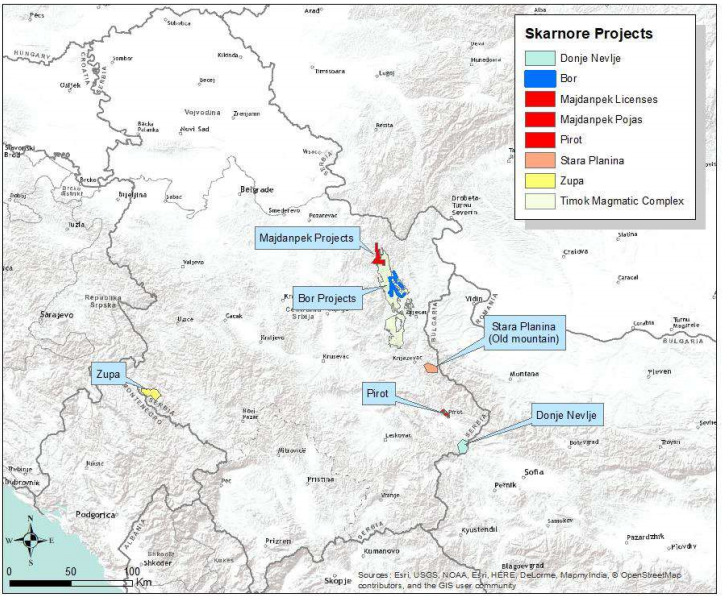

The relisting came after the company’s acquisition of a number of highly prospective copper-gold licences located in the world class Tethyan Belt in Serbia, via the acquisition of Timok Resources Pty Ltd. RDN has since established an in-country Serbian operational team and support infrastructure in preparation for exploration activities.

Here is its newly-acquired portfolio of Serbian projects:

To support its exploration in Serbia, $1.2 million-capped RDN has entered into an JV agreement with Rio Tinto (ASX:RIO), one of the world’s largest and most respected exploration and mining companies, regarding three of RDN’s Serbian copper-gold exploration licences.

Of course, as with all minerals exploration, success is not guaranteed — consider your own personal circumstances before investing, and seek professional financial advice.

The licences are located within the prolific Western Tethyan metallogenic belt and the exploration targets are for copper-gold porphyry and related mineralisation. The Majdanpek West and Majdanpek Pojas licenses are located within the northern section of the Timok Magmatic Complex, in the Serbian section of the East European Carpathian-Balkan Arc. The Timok Magmatic Complex is one of the most copper endowed districts in the entire belt.

The mineralisation is hosted within a porphyry and epithermal geological setting, which intruded into Cretaceous volcanic and volcanoclastic units.

Historical exploration at the site was promising. Geological mapping and exploration by the Serbian Geologial Survey in the 1960’s confirmed the compatibility of the stratigraphy and lithologies, primarily andesite volcanics and pyroclastics of Upper Cretaceous age, with those of the Timok Magmatic Complex.

The permit includes copper mineralisation and hydrothermal rock alteration that could be related to a porphyry copper system. Previous explorers have defined geochemical and geophysical anomalies which to date remain untested.

Rio Tinto Earn-In and JV

On March 13, RDN, together with its wholly owned subsidiaries (Kingstown Resources D.O.O. Beograd and Skarnore Resources D.O.O. Beograd), entered into an Earn-in and Joint Venture Agreement with the RIO’s Rio Tinto Mining and Exploration Limited.

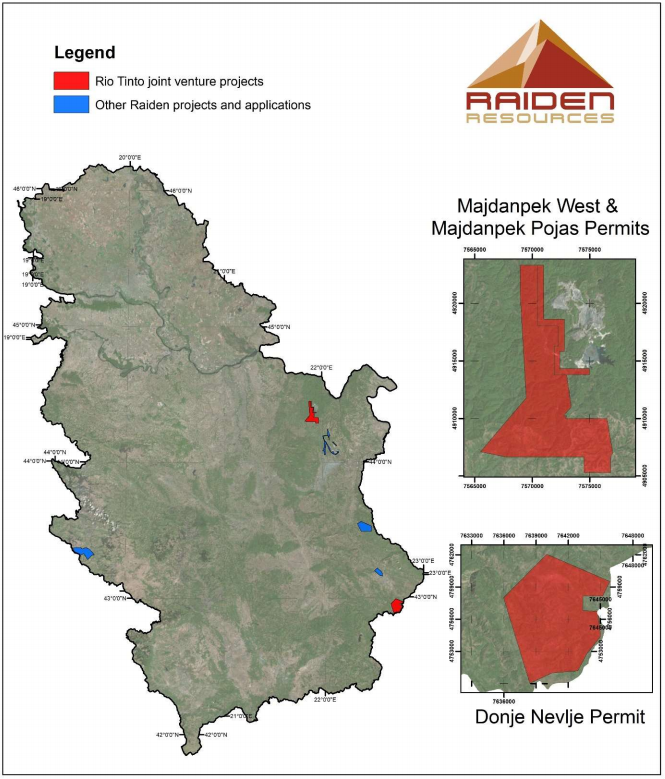

The Agreement covers the RDN’s Zapadni Majdanpek, Majdanpek Pojas and Donje Nevlje exploration licences in Serbia. The JV Licenses are located within the Western Tethyan Metallogenic Belt in Eastern Europe, which hosts numerous tier-one copper-gold porphyry and associated mineral deposits, including recent discoveries.

Here are RDN’s JV projects with Rio Tinto mapped out, along with its other Serbian projects and applications:

Dusko Ljubojevic, RDN Executive Director said, “We welcome Rio Tinto as a partner through this Earn-in and Joint Venture agreement on our selected licences. Rio Tinto delivers a tremendous depth of experience in these styles of mineralisation and a commitment to the Western Tethyan belt, together with funding capacity to unlock the potential of world class projects.

“In our opinion, this validates the prospectivity of our licences and we look forward to working closely with the Rio team and realising the potential of the JV properties. It also enables us to focus on exploration in our retained licences to rapidly deploy our planned exploration program.”

The Agreement is conditional on Rio Tinto being satisfied with its due diligence investigations within 60 days of the execution of the Agreement. If satisfied, the JV will then be formed.

Rio Tinto has the option to sole fund a three stage earn-in totalling US$31.5 million (~A$40M) in three stages, as follows:

- Stage 1: US$2.5 million (~A$3.1M)

within three years of the Effective Date to earn a 51% participating interest,

with a minimum of US$500,000 (~A$635,000), committed in the first 12 months.

- Stage 2: US$9 million (~A$11.4M)

in the three year period after Stage 1 to earn an additional 14% interest (for

a total participating interest of 65%).

- Stage 3: US$20 million

(~A$25.4M) in the three year period after Stage 2 to earn an additional 10%

interest (for a total participating interest of 75%).

This JV will provide RDN with a significant source of funding for exploration of the JV Licences and will enable it to devote further resources to exploration and development of its other assets, as well as evaluating new opportunities in line with its growth strategy.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.