Raiden Resources announces Joint Venture with Rio Tinto

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

This product is classified as ‘very high risk’ in nature due to its location and geopolitical situation of the region. Finfeed advises that extra caution should be taken when deciding whether to engage in this product, however if you are not sure whether it is suitable for you we suggest you seek independent financial advice.

Raiden Resources Limited (ASX:RDN) has announced a joint venture with Rio Tinto Mining and Exploration Limited (ASX:RIO). Exploration on this agreement, initially announced on 13 March 2018, will now commence, following Rio Tinto completing its due diligence.

Here are the highlights:

- The

Joint Venture has been formed following satisfaction of conditions set out

prior to the agreement.

- The agreement covers three of RDN’s exploration licences located in Serbia, including prospective for porphyry copper-gold and associated styles of mineralisation.

- RIO will soon start exploration on these licences with a staged earn-in to spend up to US$31.5 million (~AUD$40million), in order to earn up to a 75% project-level interest over three stages.

- The transaction validates RDN’s view of the prospectivity of these licences, and the potential to host world class mineral deposits.

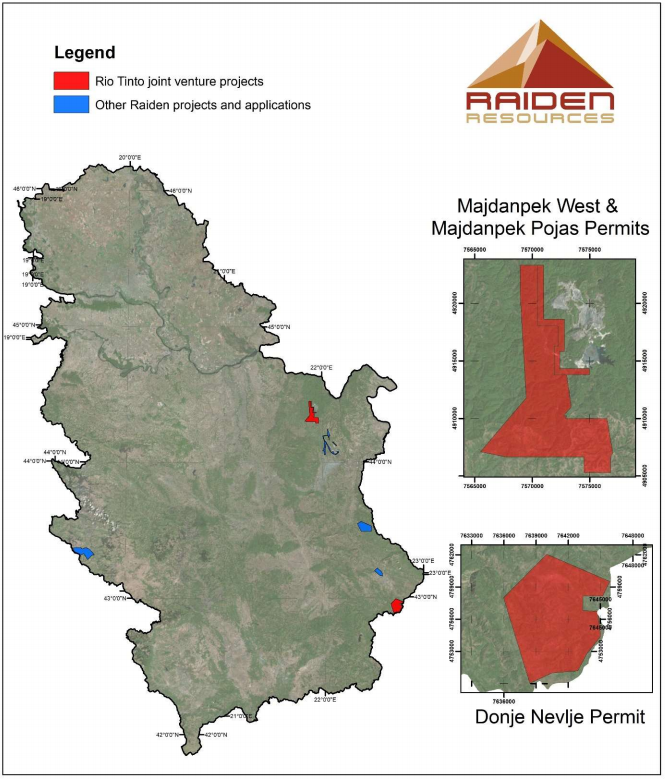

The Joint Agreement covers the company’s Zapadni Majdanpek, Majdanpek Pojas and Donje Nevlje exploration licences located in Serbia.

These licences are located within the Western Tethyan Metallogenic Belt in Eastern Europe, which hosts numerous tier one copper-gold porphyry and associated mineral deposits, including recent discoveries.

Following today’s announcement, Managing Director of RDN Dusko Ljubojevic said: “The commencement of the Joint venture is the first major step in the commencement of a modern systematic exploration campaign on these priority areas which have not been evaluated in detail in the past three decades.

“This is an exciting phase for Raiden and the broader Tethyan Belt, which has been demonstrated to be among the most highly endowed and under-explored copper-gold regions globally. Concurrent with the formation of the Joint Venture, Raiden will also commence exploration on its other assets in the coming month which will provide a parallel strategy to the JV properties.”

It should be noted that RDN is in the early stages pf exploration here and investors should seek professional financial advice if considering this stock for their portfolio.

About the Joint Venture Licences

The licences are located within the prolific Western Tethyan metallogenic belt and the exploration targets are for copper-gold porphyry and related mineralisation.

The Majdanpek West and Majdanpek Pojas licenses are located within the northern section of the Timok Magmatic Complex, one of the most copper endowed districts in the entire belt.

The Donje Nevlje project is located approximately 125km south of the Timok magmatic and hosts includes copper mineralisation and hydrothermal rock alteration that could be related to a porphyry copper system. Previous explorers have defined geochemical and geophysical anomalies which to date remain untested.

The location of RIO’s joint venture licenses and RDN’s other projects in Serbia:

RDN has provided more detailed information on the joint venture licences and the company’s other projects in the relisting Prospectus dated 13 December 2017. This includes an Independent Geologists Report on RDN’s Serbian projects.

The formation of the joint venture provides a significant source of funding for exploration and will enable RDN to devote further resources to exploration and development of its other assets. Funding also enables the company to evaluate new opportunities in line with the company’s growth strategy.

As highlighted in the Prospectus, RDN intends to reallocate its existing funds to its other licences on a pro-rata basis while Rio Tinto undertakes its sole funding period on the joint venture licences.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.