Quantum strengthens financial position and releases promising exploration results

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

After completing mapping and assay work, Quantum Resources (ASX: QUR) has confirmed the existence of lithium mineralisation at Thompson #5 in a distinct parallel structure, which management said underlines the potential to significantly increase the scale of lithium mineralisation at the Thompson Brothers Lithium Project.

In conjunction with the release of exploration results QUR announced that it had successfully completed the placement of a shortfall from a recent rights issue leaving it well funded to undertake its planned exploration program on its advanced lithium project in Manitoba, Canada.

However, potential investors should note that QUR is an early stage exploration company and independent financial advice should be sought if considering this stock as an investment.

Quantum quick to make progress at Manitoba

These exploration results come just shy of three months after QUR completed the acquisition of Manitoba Minerals, a private company that holds the right to earn up to a 95% ownership interest in the Thompson Brothers Lithium Property in Wekusko Lake, Manitoba, Canada.

The project is located 20 kilometres east of the mining community of Snow Lake Manitoba which is well serviced by road and rail transport infrastructure, as well as being in close proximity to the sea port of Churchill.

Thompson Brothers Project location

Management noted at the time of the Manitoba acquisition that the region was consistently ranked as one of the top mining jurisdictions in the world which not only benefited from excellent transport infrastructure, but had access to low-cost electricity.

QUR also has the benefit of previous exploration data which identified lithium mineralisation in a spodumene rich pegmatite dyke over a strike length of more than 800 metres.

While a mineral resource estimate was announced in 1998, it isn’t JORC compliant, but the 4.3 million tonnes grading 1.3% lithium dioxide is still useful as a guide, as is information indicating that the deposit is open at depth and along strike.

Results demonstrate robust grades across multiple locations

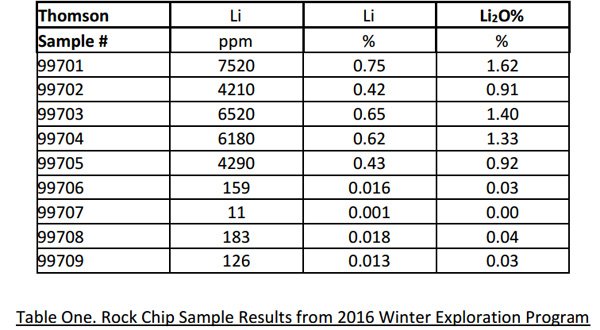

One of the key features of the results released on Wednesday revolved around information gleaned from nine samples that were taken, five of which returned 4000 ppm lithium, with three other samples boasting more than 6000 ppm lithium. A summary of the nine samples is outlined below.

While a large area of the property remains unsampled, highly mineralised areas remain open at depth and along strike, leaving the potential for the delineation of further mineralisation.

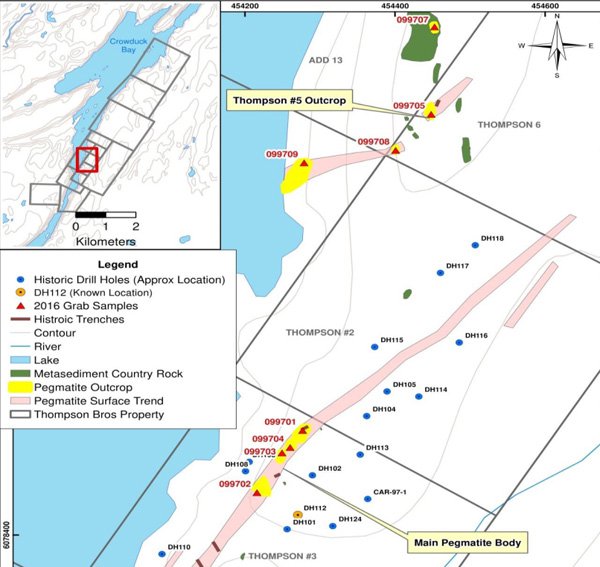

Importantly, the latest program identified and confirmed the existence of Thompson #5 as a separate, parallel structure which returned 4290 ppm lithium (0.92% lithium dioxide) in spodumene bearing pegmatite.

The following map demonstrates the proximity of Thompson #5 to the main pegmatite body previously delineated.

Proximity of Thompson #5 to the main pegmatite body.

Further exploration work is now being prepared which could lead to significantly increased overall lithium tonnages from the project.

QUR also collected discontinuous rock chip samples in order to test the extent and mineralised horizon of the main spodumene bearing pegmatite dyke, noting high-grade lithium values of up to 7520 ppm lithium (1.62% lithium dioxide).

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.