Peninsula receives approval to access two sites prospective for high grade gold and silver

Published 26-JUL-2017 13:48 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Peninsula Mines (ASX: PSM) has received approval from the Korean Forest Service to access two separate drilling sites which will enable the company to test high-grade gold and silver targets at the company’s wholly-owned Osu Gold Project in South Korea.

As a backdrop, the Osu project consists of one granted tenement, Osu 23 and applications for 3 adjoining tenements. The Osu 23 tenement contains the historical Baegun and Pal Gong Mines. The Osu Project has high-grade, polymetallic veins that were discovered in the 1930’s and exploited intermittently until the early 1970’s.

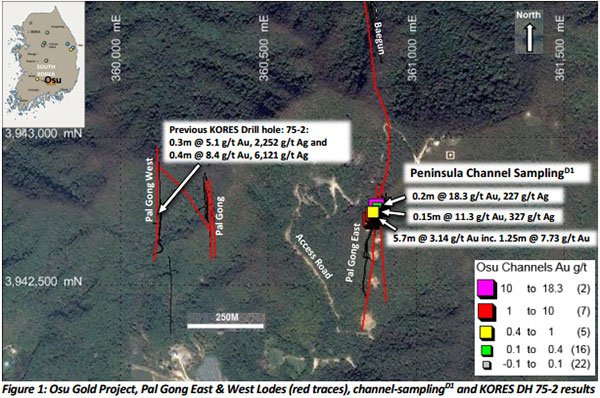

The first drilling site is located immediately to the west of the Pal Gong East Lode where rock-saw channel sampling by PSM was completed obliquely across a 30 metre wide zone of sulphidic sub-epithermal vein structures in and around the historical underground workings. Several high-grade, polymetallic results were produced across the veined zones.

These included relatively broad thicknesses of 5.7 metres grading 3.14 grams per tonne gold and narrower sections of 0.2 metres grading 18.3 grams per tonne gold. Strong silver mineralisation was also encountered.

Of course this is an early stage play and investors should seek professional financial advice if considering this stock for their portfolio.

Drilling to test down plunge extensions of high grade zones

The proposed drilling will test the down-plunge extensions of these high-grade zones within and below the area of previous historical stoping on the Pal Gong East structure.

The second drilling site is located to the east of the Pal Gong West lode where previous limited drilling in 1975 by the Korean Mineral Promotion Corporation, now the Korea Resource Corporation (KORES), intersected very high grade silver and gold mineralisation, including 0.3 metres grading 5.1 grams per tonne gold and 2,252 grams per tonne silver from 86.3 metres.

The proposed drilling from this site will include 1 to 3 diamond drill holes testing the immediate vicinity, along strike and down dip, of the previous drilling intersections below the area of historical stoping on the Pal Gong West structure.

The following graphic indicates the areas where sampling has been undertaken, and the subsequent results.

Commenting on these developments, PSM’s Managing Director Mr Jon Dugdale, said “We are very pleased to have gained access to drill the Osu high-grade gold-silver targets, which, alongside the polymetallic sulphide-porphyry targets on our Ubeong Project, will provide the Company with multiple drilling targets to test during this next exciting stage of the South Korean exploration programme”.

It is important to note that channel sampling was undertaken across narrow iron and manganese stained vein structures in and around the historic Pal Gong East mine workings. Previous drilling by KMPC (now KORES) has tested all three vein structures at shallow levels producing some very high-grade results.

Historical mining was confined to hand held mining methods resulting in very limited tonnage being recovered. Given that recent channel sampling has demonstrated evidence of steeply plunging shoot controls on the mineralization, PSM has an immediate target for the initial drilling program at Osu, and upcoming results could provide share price momentum.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.