PSM Kicks Off Drilling Programme in South Korea

Published 27-SEP-2017 14:28 P.M.

|

2 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Finfeed presents this information for the use of readers in their decision to engage with this product. Please be aware that this is a very high risk product. We stress that this article should only be used as one part of this decision making process. You need to fully inform yourself of all factors and information relating to this product before engaging with it.

It’s crunch time for Peninsula Mines (ASX:PSM) in South Korea, as the ASX-listed metals junior commences its long-awaited drilling and sampling programme.

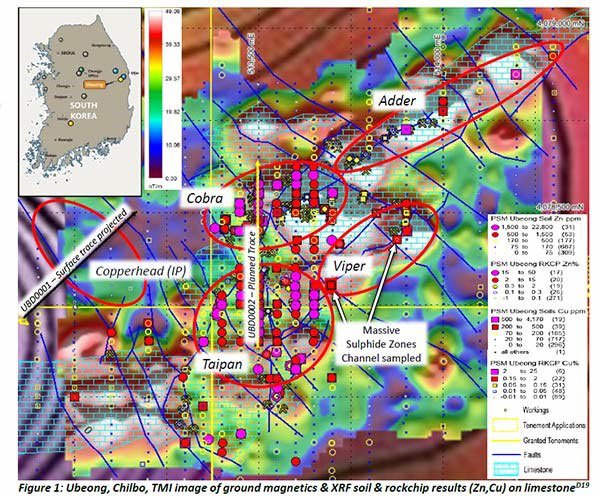

PSM has begun drilling as part of a programme aiming to define several high-grade zinc-lead-silver and copper-gold targets (Taipan & Cobra) at PSM’s Ubeong Project in South Korea.

PSM drilled the first of its two diamond drill holes on Monday, 25th September, and is expected to complete its second drill-hole within the coming days with results due shortly.

Of course it is early days for this junior explorer, so investors should seek professional financial advice if considering this stock for their portfolio.

As a precursor to this week’s drilling, PSM defined a 300m x 150m strongly anomalous zinc (up to 0.59% Zn), copper (up to 4,162 ppm Cu), lead (up to 1,023 ppm Pb) and silver (up to 24.7 g/t Ag) zone several months ago.

The first new diamond drill hole, which commenced yesterday, was drilled at a shallow angle under the Taipan soil anomaly.

The drilling programme will consist of three to four shallow-angle holes for approximately 1,200m to 1,600m of diamond drilling planned to test PSM’s local geology for “high-grade, porphyry-related zinc-lead-silver and copper-gold sulphide ore-bodies,” said PSM in a market update.

The next step for PSM is to finalise this round of drilling by adding a second drill hole later this week.

PSM’s second drill-hole will continue to test under the strongly anomalous Cobra soil anomaly, where hand-held XRF results, backed-up by laboratory analyses, have defined a northeast-southwest oriented zone of dimensions 300m x 100m characterised by strongly anomalous Zn (up to 1.4%), Cu (up to 1,281 ppm), Pb (up to 2,980 ppm) and Ag (up to 54.8 g/t).

In tandem with yesterday’s announcement, PSM Managing Director John Dugdale said, “The results of the geochemical and geophysical programmes to date indicate that we may be dealing with a major porphyry-skarn base and precious metals system and this drilling programme will go a long way towards testing that concept.”

PSM has sole rights to five granted tenements and multiple tenement applications over a strike length stretching above 10 kilometres and running parallel to the historical Chilbo mine workings. PSM’s tenements also adjoin the currently-operational Keumho Zinc-Lead-Silver Mine, belonging to Aurora Minerals (ASX:ARM).

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.