PSM announces highly promising zinc-silver results and $1.9M cap raise

Published 19-DEC-2017 14:03 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

ASX explorer Peninsula Mines (ASX:PSM) has today delivered a double dose of good news. The company has intersected two massive and disseminated sulphides at its Ubeong Zinc-Silver Project in South Korea.

On top of that, PSM has settled its recently completed, heavily oversubscribed placement, receiving funds to the tune of A$1.9 million. This places the company in an excellent cash position to continue its focused drilling program at Ubeong.

Massive disseminated sulphides intersected at Ubeong Project

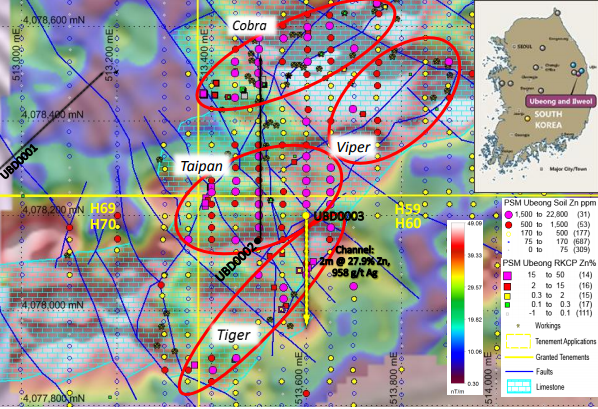

PSM has intersected two massive and blebby/disseminated zinc-silver and silver-lead-copper bearing sulphide zones in diamond drill-hole UBD0003 at its Tiger Target in the Chilbo historical workings area of the Ubeong Project. Results include:

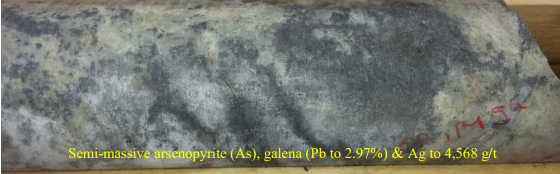

- A 10.65 metre intersection of blebby and semi-massive arsenopyrite, pyrrhotite, galena and chalcopyrite with high grade XRF results of up to 4,568 grams per tonne of silver, 2.97 percent lead and 0.7 percent copper and;

- A 2.22 metre intersection of massive and blebby/disseminated arsenopyrite and sphalerite with high-grade XRF results of up to 15.24 percent zinc and 949 grams per tonne silver.

The two sulphide intersections occur down dip of outcropping massive sulphide mineralisation that previously produced a channel sampling intersection of two metres at 27.9 percent zinc, 958 grams per tonne silver.

Key sulphide zones from UBD0003 and UBD0002D1 are now to be sampled and submitted for full interval analyses at ALS in Perth as soon as possible.

At the same time, it’s worth noting that this is an early stage play and investors should seek professional financial advice if considering this company for their portfolio.

PSM managing director Jon Dugdale said, “We have made great progress at our Ubeong Project over the last 12 months and the drilling is now intersecting the massive and disseminated sulphide mineralisation we have been targeting.

“Following assessment of the initial results the drilling will continue in Q1 2018, testing the interpreted core of this large-scale porphyry-skarn base and precious metals system.”

UBD0003 is now at >270 metres and continues to drill skarn/limestone with minor disseminated sulphides.

Selected sulphide bearing intervals in UBD0003 (and UBD0002) will be half-cored and submitted for multi-element analyses at ALS in Perth over the coming weeks.

UBD0003, 110.0 metres to 110.2 metres, semi-massive/blebby arsenopyrite and galena (lead) in skarn-limestone. Source: Peninsula Mines

The next hole, UBD0004, will commence after winter during the first quarter of 2018, and will test northwards under the most intense zinc and copper geochemistry at the eastern end of the Taipan Target.

PSM will target the magnetic ‘core’ of the porphyry-skarn system and under the six metre thick copper bearing massive sulphide outcrop at the Viper Prospect (shown below).

Ubeong Project – Chilbo area, drilling, rockchip and soil sample results on ground magnetics image Source: Peninsula Mines

PSM secures $1.9 million cash injection via oversubscribed placement

Equally positive news for the company is its announcement today that it has been settlement its recently completed share placement, with A$1.9 million received from the issue of 118.75 million ordinary shares to institutional and sophisticated investors.

Additionally, major shareholder Aurora Minerals Ltd (ASX:ARM) has committed to invest a further A$100,000 (subject to shareholder approval).

The company has also issued one free attaching option for every two shares subscribed in the placement, with an exercise price of 2.0 cents and an expiry date 18 months from the date of issue, resulting in the issue of 59,375,000 options to subscribers. PSM has also issued 21.6 million options to brokers who supported the placement.

“We are delighted by the overwhelming support of existing and new shareholders for this placement,” Dugdale said.

Funds raised will be used to continue the zinc-silver and copper-gold drilling program at Ubeong, to accelerate PSM’s graphite and lithium drill-targeting, and to complete graphite supply and offtake agreements.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.