Province inks hydrogen development deal with Total Eren

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Province Resources Ltd (ASX:PRL) has entered into a binding memorandum of understanding (MoU) with Total Eren Australia Pty Ltd to develop a major green hydrogen project in the Gascoyne region of Western Australia.

Importantly, Total Eren is 30% owned by global energy giant Total SE (NYSE: TOT), which has a market capitalisation of approximately US$120 billion.

Total Eren is an emerging global renewables leader with over 3.3GW of renewable energy power plants worldwide either operating or under construction (mainly solar and wind).

The group has successfully developed, financed and constructed Victoria’s largest solar farm – the 256 MWp Kiamal Solar Farm located north of Ouyen with a team of 20 renewable energy professionals based in Australia

Province is in the early stages of planning the development of the HyEnergy ZERO CARBON HYDROGENTM Project in the Gascoyne region of Western Australia.

Since announcing its intention to develop the HyEnergy Project in mid-February, Province’s shares have increased by more than 400%.

While this is a substantial gain, it should be noted that the project represented a completely new venture and a potential game-changer for the group.

Two-stage development totalling eight gigawatts

The partners joined forces in a MoU to combine their expertise to co-operate and proceed with the development of the proposed HyEnergy Project to be located in the Shire of Carnarvon in the Gascoyne region in Western Australia.

It is proposed to develop the project in two stages, ramping up to 8 GW in installed renewable energy capacity.

Under the terms of the MoU, Province and Total Eren will have 50/50 ownership.

From an operational standpoint, a scoping study and the execution of definitive agreements should occur in the next four months.

Today’s news is the most material since the company announced the project as the introduction of a partner with high levels of expertise and robust financial backing is a major step in terms of moving the project from the planning phase to the all-important studies and preliminary operational initiatives that need to be taken to move to construction.

Consequently, this news could trigger a further significant share price rerating.

This is particularly the case given the investor appetite for green energy projects, and in particular the recent focus on the many benefits of hydrogen as a renewable source of power.

Andrew Forrest terms green hydrogen projects as nation-building

There is also substantial support from all levels of government and big business, and on this note managing director David Frances said, “Given the recent drive by state and federal governments to quickly develop and advance the green hydrogen industry in Australia, I am confident this project will be of strategic national importance.

"Management is excited to have a global renewable energy leader such as Total Eren as a partner with the technical and financial capability to help Province deliver this project as part of the backbone of the nation’s hydrogen strategy.”

Indeed, Frances’ reference to the project as being of strategic national importance may even be an understatement as one of the country’s most prominent entrepreneurs in Andrew Forrest described the development of zero carbon hydrogen power projects in Australia as nothing short of 'nation-building'.

Fabienne Demol, Executive Vice-President and Global Head of Business Development of Total Eren, highlighted the projects global significance in saying, "Total Eren is pleased to partner with Province on this ambitious green Hydrogen Project.

"This new step demonstrates our strong commitment to the Australian market towards the decarbonisation of the country and is also a concrete opportunity to kick-off our Hydrogen strategy worldwide.

"After solar, wind, and storage, we believe Hydrogen is the next step of growth of renewable energies.

"We are determined to leverage our development and technical skills to make our first of several Hydrogen Projects in Australia a success.”

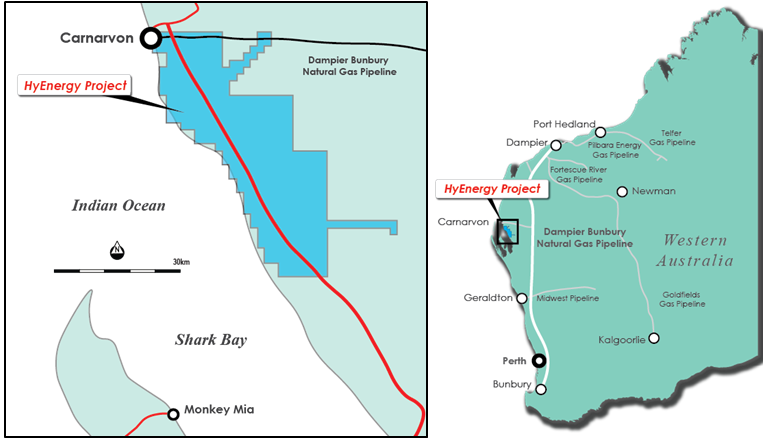

On the score of offtake agreements, it is worth noting that the project is situated in reasonable proximity to the existing Dampier Bunbury Natural Gas Pipeline (DBNGP), and this takes on even more significance given that the stated goal of Western Australia’s hydrogen strategy is to have a 10% mix of renewable hydrogen in the DBNGP by 2030.

Groundswell of support at government and corporate levels

The hydrogen industry is in its infancy in Western Australia, but there is substantial momentum behind the move into sustainable energy by both federal and state governments, as well as corporations in Australia and globally.

Part funding for various projects has already been provided at a government level through the Australian Government Advancing Hydrogen Fund ($300 million), the Australian Renewable Energy Agency ($70 million) and the Western Australian Renewable Hydrogen Strategy ($10 million).

On a global scale, $490 billion is estimated to have been sold in ESG bonds (investments pitched at ESG themes including renewable energy).

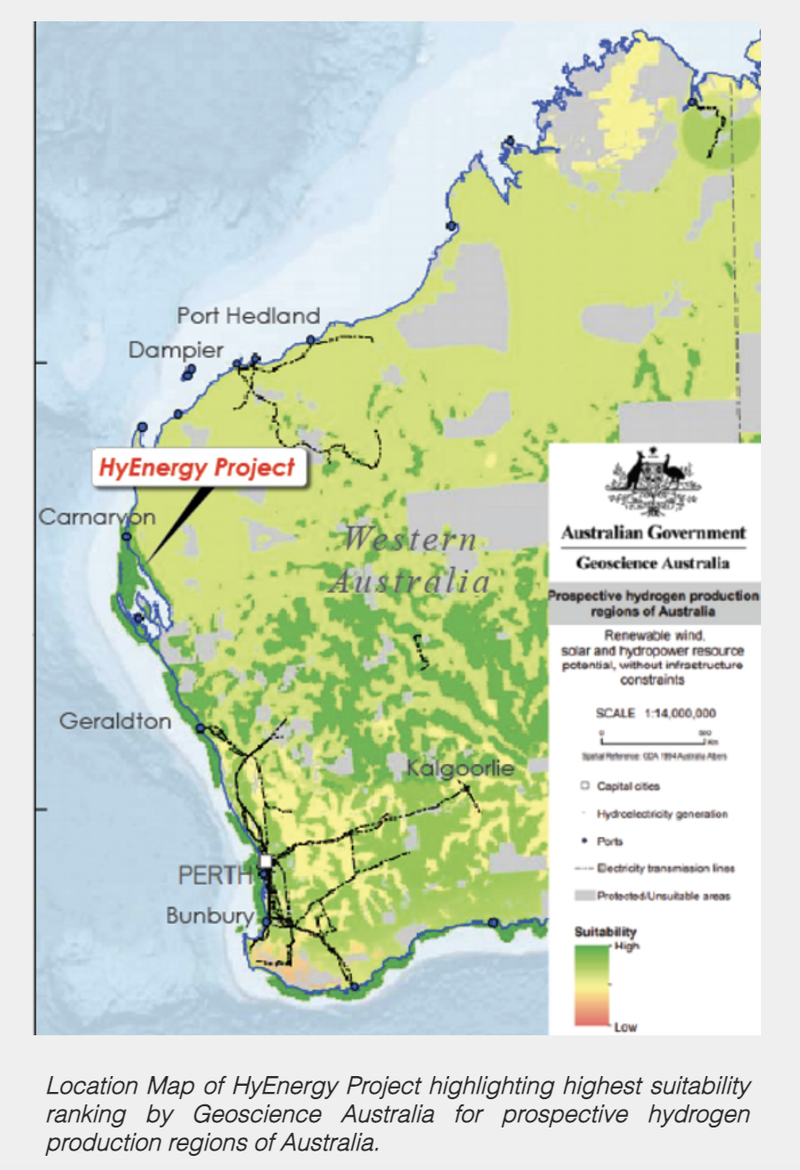

The Gascoyne region is ideally suited for the generation of solar and wind power, as well as having ample space for the required hydrogen production infrastructure.

The area is renowned for its consistently strong wind speeds and optimum sunny weather patterns, making it ideal for the establishment of wind and solar energy plants that would feed a hydrogen generation facility.

Province’s tenements have ready access to saltwater (as shown above) which is used in the electrolysis procedure, and this is an obvious benefit.

Some of the key highlights of the HyEnergy Project are listed below:

- Infrastructure: existing Dampier Bunbury gas pipeline within close proximity to potentially install a spur line and provide Hydrogen Feedstock in DBNGP for domestic or export use.

- Infrastructure: room for offshore Ship Loading Facility in the future for export market.

- Wind: ranked 4th in Western Australia for mean wind speeds recorded per annum12.

- Wind: located along coastal region with the greatest wind potential.

- Solar: identified flat arid area with minimal competing land uses for large solar array network.

- Solar: Carnarvon has a very rich solar resource averaging 211 sunny days per year, with an average solar exposure of 22 MJ/m2 /day (or 6.24 kWh/m2 /day)13.

- Water: potential site to extract sea water for electrolyser plant.

- Water: covers least saline and highest potential area of the world class Birdrong Aquifer if used as alternate water source.

- Geothermal: high geothermal potential in the Carnarvon Basin if geothermal power options are explored to generate renewable electricity.

- Supportive Government: The Regional Centres Development Plan (RCDP) is about attracting business, investment and people to support the growth of WA's Regional Centres and SuperTowns. This means a stronger economy and a better quality of life for the people in regional WA – and for the benefit of all Western Australians.

MoU substantially de-risks project development

This partnership has the ability to significantly de-risk the project, and Total Eren’s decision to commit to all aspects of the project is a strong endorsement of the assets on offer and their development potential

The de-risking factor is indeed a highly valuable benefit of this agreement, particularly given that this is a large scale project being undertaken by a company with a relatively modest market capitalisation.

A collaboration with Total Eren will provide regulatory bodies, potential corporate backers and financiers with a great deal of confidence when assessing the likes of permit applications, validation of studies, offtake agreements and funding arrangements.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.